The Consumer Financial Protection Bureau: A Champion for Consumers is Under Attack

Since its creation in 2010, the Consumer Financial Protection Bureau (CFPB, or “the bureau”) has played a critical role in protecting the interests of hard-working Americans from the often harmful and sometimes predatory practices of large financial institutions, including banks, mortgage lenders, credit card companies, student loan servicers, debt collectors, and credit reporting agencies. By establishing regulations to curb predatory practices and enforcing the law on behalf of consumers when financial institutions impose illegal fees or use deceptive practices, the bureau has returned more than $21 billion to over 205 million consumers across the United States and has prevented a potentially greater sum from being improperly charged to consumers in the first place.

These robust consumer protections are currently being undermined by the federal administration and Congress, and rhetoric from administration officials suggests an intent to fully dismantle the bureau. While states, including Colorado, have enacted various consumer protections, they have not had the resources to effectively replace the role of the CFPB. If this corporate watchdog is eliminated or defunded, consumers will be exposed to new exploitative and deceptive practices and there may be risks of larger impacts on the economy from widespread practices that encumber consumers with unsustainable amounts of debt.

The CFPB’s Work and Impact

The CFPB was established by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 as a response to the subprime mortgage crisis that led to the Great Recession. While much of the legislation sought to address the financial health of “too big to fail” Wall Street banks and the broader US financial system, consumer groups argued for an independent advocate dedicated to preventing illegal practices and products. It was intended to stand up to large corporations to demand recourse for consumers harmed by use of financial products and ensure we never again see a financial crisis like the one that hit our economy in 2008.

The bureau’s work has involved numerous strategies to elevate the interests of consumers relative to financial services corporations and ensure recourse for consumers who have been harmed by illegal practices.

What is subprime lending?

Subprime loans are those offered to consumers with credit scores that are too low to qualify for “prime” interest rates. While not illegal or inappropriate in most instances, many lenders downplay the financial risk that consumers incur and take advantage of borrowers with financial challenges to offer higher-cost loans with exploitive terms. The widespread use of high-cost subprime mortgage loans was a primary driver of the 2008 financial crisis because high rates of defaults led to much broader repercussions for the economy.

While subprime mortgage loans are still available, they are subject to new regulations from the CFPB. However, subprime loans are offered in other markets as well, including the auto loan market where delinquency rates are rising.

Rules and Policy

The CFPB has rulemaking authority comparable to other federal agencies, which means it can establish rules within its statutory authority that detail how financial services companies must comply with the law. The bureau also issues broader guidance to establish clear and consistent expectations in order to improve transparency and induce responsible behavior.

CFPB rules have proposed capping overdraft fees and credit card late fees, established that financial products like “earned wage access” and “buy now, pay later” are loans subject to the Truth in Lending Act, clarified existing prohibitions on charging copays and deductibles to the one in eight older adults defined as Qualified Medical Beneficiaries. It also addressed practices such as sloppy name matching by credit reporting companies and tenant and employment screening companies that have disproportionately impacted members of Hispanic, Black, and Asian communities.

Medical Debt and Credit Reports

Medical debt can have very serious impacts on a family’s well-being. A 2022 CFPB report explored the various impacts of medical debt, and in 2023, Colorado became the first state in the nation to prohibit medical debt from being included in credit reports. In June 2024, the CFPB proposed a rule that would remove medical bills from most credit reports. The nationwide rule’s implementation was delayed by a judge until June 2025, and its future remains uncertain.

Compliance

Within its supervisory authority, the CFPB works directly with companies through examinations, data analysis, and ongoing communication. This more proactive form of regulation catches problems before they grow out of control and creates opportunities for companies to alter their practices before enforcement is necessary. This work is documented in 38 supervisory highlights, and has saved consumers millions of dollars including $140 million in refunds to consumers over the illegal charging of junk fees.

Enforcement

The CFPB has the authority to order companies to compensate consumers who have been wronged and to assess civil penalties for broader violations of laws and rules.

One of the CFPB’s most notable enforcement actions was to order Wells Fargo to pay $2 billion directly to 16 million consumers plus $1.7 billion in civil penalties for various violations including improper denial of loan modifications that led to numerous losses of vehicles and homes.

Other enforcement actions have resulted in restitution from companies that double-dipped on fees, provided consumers with misleading cost comparisons, opened fake accounts in consumers’ names or real accounts without a consumer’s consent, and discriminated against communities of color. The CFPB has banned certain companies from continuing to operate, including Navient, a student loan servicer, for steering borrowers toward costly repayment options, and BrightSpeed Solutions for purporting to offer technical assistance to older adults while in fact misleading them into purchasing unnecessary antivirus software packages.

Advocating for Consumers

Consumers may struggle to get responses from large financial companies when they submit complaints, but by transmitting an average of 25,000 consumer complaints per month about financial products and services to companies,the CFPB has been able to get answers and recourse for these consumers.

Data, Research, Market Monitoring, and Consumer Education

In addition to analyzing market trends and their impacts on consumers, the CFPB has provided numerous materials to help consumers advocate for themselves. Over 63 million consumers have accessed answers to hundreds of common financial questions, translated into eight different languages.

The CFPB’s research has uncovered numerous problematic trends, including school district payment processing companies quietly charging fees on student lunch accounts, comparison shopping tools taking kickbacks to steer consumers to sponsored products, certain lenders withholding student transcripts as a debt collection practice, and nursing homes pressuring friend and family caregivers to personally guarantee payments for a resident’s bills.

The CFPB’s Impact by the Numbers

- $21 billion-plus: Amount of monetary compensation, principal reductions, canceled debts, and other consumer relief resulting from CFPB enforcement ($19.7 billion) and supervisory ($1.45 billion) work.

- 205 million-plus: Estimated number of consumers or consumer accounts eligible to receive relief from the CFPB’s enforcement and supervisory work.

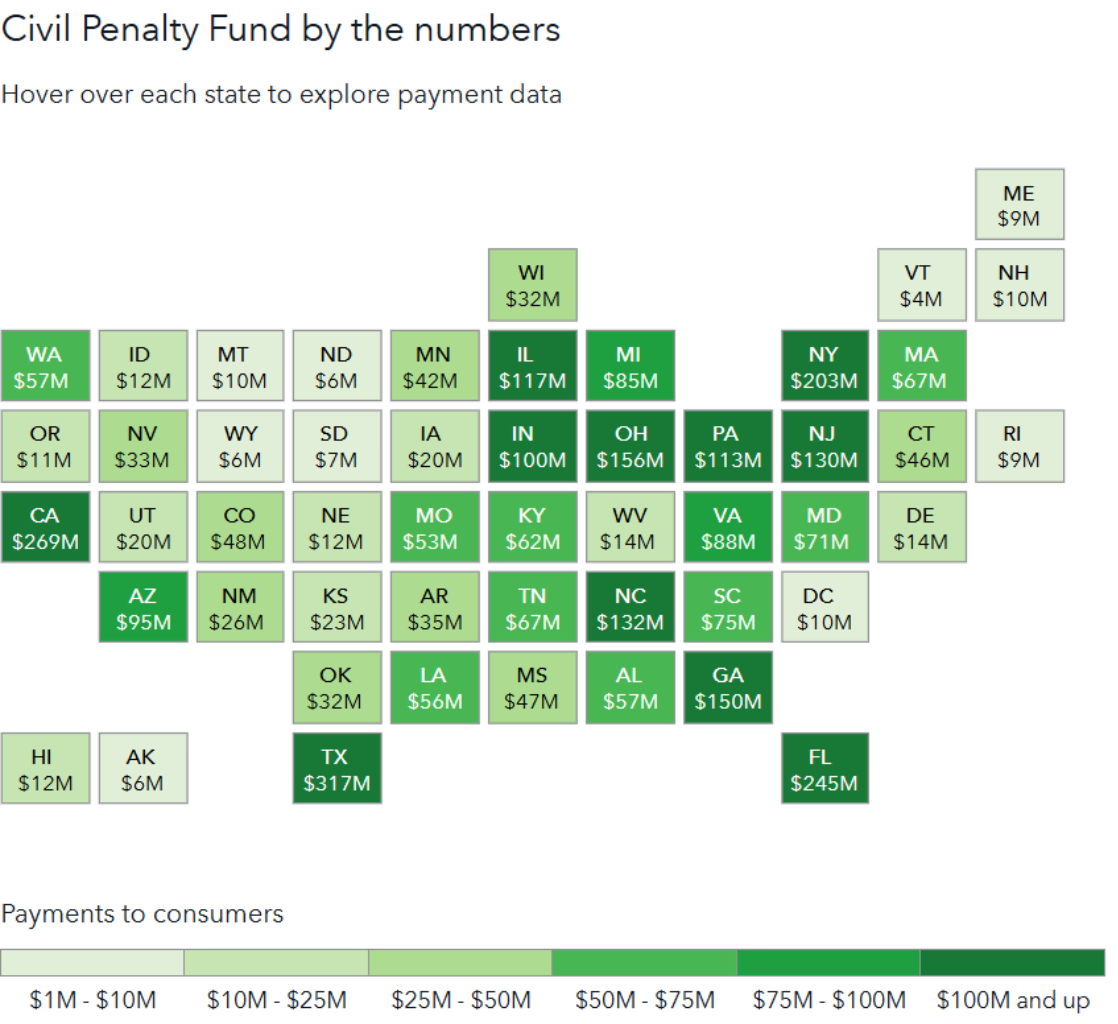

- $5 billion-plus: Civil monetary penalties imposed by the CFPB on companies and individuals that violate the law. These penalties are deposited into the CFPB’s victims relief fund, also known as the civil penalty fund, which provides compensation to consumers who have been harmed by violations of federal consumer financial protection law.

- $11 billion: Estimated amount consumers will save every year thanks to the CFPB’s action to close the overdraft loan loophole and recent changes in banks’ overdraft and non-sufficient funds (NSF) fee policies, including nearly $2 billion in annual savings resulting from most large banks deciding to eliminate NSF fees entirely.

- Note: The cap on overdraft fees, which accounts for $5 billion of these projected savings, was repealed by Congress on April 9, 2025.

- $363 million: Monetary relief resulting from 45 public enforcement actions that involved harm to military service members and veterans, including six enforcement actions for violations of the Military Lending Act. A particularly egregious action by some companies was the misleading of veterans and other consumers into selling their pension and disability payments.

- 37.8 million: The estimated number of people who will have had at least one medical collection removed from their credit reports after the CFPB finalized a rule to remove them, and the industry’s voluntary removals in advance of the rule being finalized.

Source: CFPB, December 2024

While the bulk of the data is only available at the nationwide level, there are state-level data for complaints and civil penalties.

Complaints

In Colorado, the CFPB has responded to 66,587 complaints from consumers including 3,667 from older adults, 6,209 from military service members, and 2,967 from rural consumers. The CFPB successfully yielded relief for 17,763 of these complaints. It’s possible that the proportion of complaints resolved in favor of consumers would increase substantially if such work were to be adequately funded at the state level.

Civil Penalties

The Civil Penalty Fund was established to collect fines levied on companies that break the law in order to compensate victims who wouldn’t otherwise benefit from CFPB enforcement actions. In Colorado, the fund has paid out nearly $48 million to 101,583 consumers.

The Interaction of Federal, State, and Civil Enforcement of Consumer Finance

State and federal governments have both had authority over consumer financial issues since 1914, when President Woodrow Wilson signed the Federal Trade Commission Act to prohibit unfair or deceptive practices of competition. Prior to that time, only the states had taken action to establish legal standards for fair behavior in the market. Both federal and state law have commonly allowed for private rights of action–civil lawsuits filed by harmed consumers–to complement the more direct enforcement by public agencies.

While states do have the legal authority to fill many of the gaps that would exist if the CFPB were to disappear, states cannot replicate the supervision authority which catches emerging problems before they fester and grow, and there are certain federal preemptions that limit a state’s authority. But the more significant barrier to state-level enforcement is simply the question of resources. States will have to significantly increase investments in consumer protection work to keep up with the ever-changing market. Many states, including Colorado, already struggle to pay for services they’ve traditionally offered. And with the federal government poised to cut a wide range of services, states will be hard-pressed to fill gaps, including the loss of CFPB enforcement. In Colorado, TABOR’s harsh revenue restrictions leave the state at a severe disadvantage and funding for new or enhanced services is improbable at best.

Additional consumer protections were added to federal law many times since 1914, including a new prohibition against unfair, deceptive, and abusive acts in the 2010 Dodd-Frank legislation, but the CFPB was largely established to strengthen the enforcement of existing consumer protection laws by consolidating previously-fragmented authorities in one agency with dedicated funding and a focused mission. Modernized federal enforcement provided critical support for states in the $18.04 trillion consumer debt market amid the rapid growth of technology among large financial companies who operated nationwide or internationally.

The creation of the CFPB did not reduce the role of state and civil enforcement, but rather gave states a new partner in their work. States continued to hold the authority for enforcement of state laws and were often best positioned to handle issues that arose at the state level, in part because even the CFPB’s own limited resources meant they needed to focus on the largest, nationwide issues.

Civil enforcement, having been authorized in numerous federal and state laws, allowed consumers who had been harmed to pursue remedies in the courts. The impact of civil litigation helped public enforcement at both state and federal levels decide how to prioritize their resources, and conversely, robust public enforcement enabled local attorneys to narrow their focus. According to consumer protection attorneys in Colorado, the CFPB works on a larger scale by setting rules, supervising certain financial institutions, and demonstrating that there will be robust enforcement. They additionally provide educational resources that answer questions for consumers who would otherwise need to file complaints or inquiries.

The most significant state-level enforcement authority is enshrined in state laws concerning Unfair or Deceptive Acts and Practices (UDAPs). Colorado, like most states, enforces UDAPs through the Attorney General’s office (AG). Prior to 2019, Colorado’s UDAP laws were among the weakest in the country, meaning that state and civil enforcement had to overcome various unnecessary barriers that biased the system in favor of corporate interests in order to prevail in court on behalf of consumers.

State legislation has passed to improve our consumer protection laws. HB19-1289 added a catch-all provision to a list of specifically enumerated consumer protections and allowed enforcement of “reckless” in addition to “knowing” violations of the law. And for enforcement by the attorney general or district attorneys, the legislation eliminated a requirement that a “significant public impact” be proved – a significant hurdle that prevented remedies for individuals who had been harmed unless they could demonstrate a larger pattern of public harm. Since the passage of HB19-1289, the Colorado Attorney General has utilized this expanded authority to file lawsuits against a corporate landlord for deceptive advertising and charging hidden fees and against multiple marijuana companies for falsely marketing intoxicating products as industrial hemp. Additionally, the AG has successfully won or settled lawsuits with a for-profit college for saddling students with debt after fraudulent promises of lucrative job placements, a property management company charging illegal fees, and a business selling fraudulent documents.

The Colorado General Assembly has additionally passed legislation over the last several years to cap interest rates on payday loans, allow class-action lawsuits for consumer protection law violations, crack down on price gouging during a disaster emergency, expand state oversight of nonbank mortgage servicers and student-loan servicers, and curb algorithmic redlining in auto insurance markets.

This year, the legislature is considering expanded enforcement of price gouging, prohibiting junk fees in rental agreements and other product pricing, and prohibiting landlords from using algorithms to collude in order to set higher rents than the market would otherwise bear. Bills were also debated in committee to prohibit surveillance-based wage and price setting practices and to eliminate the “significant public impact” standard from private rights of action in addition to public enforcement, but both failed to pass.

What's a junk fee?

A junk fee is an added cost that is not disclosed in advance. These have become common in rental agreements and various other contexts. When a renter shops around for a place to live, they may attempt to compare prices and choose the most affordable unit, only to find additional costs that were not disclosed. This phenomenon also hurts smaller businesses, such as mom-and-pop landlords, who operate honestly but are undercut by larger corporations who use shady practices like junk fees.

Colorado’s legislation, HB25-1090, was signed into law by Governor Polis in mid April.

The cumulative effect of all of this legislation should be to make Colorado one of the most consumer-friendly states in the country, if the state had sufficient resources for robust enforcement of these laws. There are only a few instances where the state is preempted by federal law from enforcing consumer protection laws, most notably with regard to regulation of certain bank practices that are governed by the National Banking Act. Another debatable preemption is a federal law that ostensibly blocks states from capping interest rates for certain out-of-state lenders, but Colorado took advantage of an opt-out provision in the federal law in order to bring these lenders under the interest rate caps that apply to in-state lenders. That state law is now being challenged in court.

A larger impediment to state-level enforcement is the limitation on funding caused by the unique constraints of Colorado’s TABOR amendment, added to the state constitution by voters in 1992. Without voter approval for new tax revenue or exemptions for the state spending limit, funding for consumer protection cannot be increased without first cutting funding elsewhere in the budget. Those cuts would inevitably fall on the two largest budget items — education and healthcare — which are already underfunded. And even with the CFPB in place, there are simply too many consumer issues for both public and private enforcement to handle in Colorado, especially with the increasing number of financial technology products entering the market and finding new ways to evade existing regulations.

The dismantling of the CFPB will not necessarily eliminate all consumer protections from federal law, but these protections will carry much less weight without the threat of enforcement actions from a consumer-focused regulator. And state and civil enforcement, already unable to take every claim of wrongdoing to court, will fall even further behind.

Recent Efforts to Dismantle the CFPB

While the CFPB has long been a target for those who seek a deregulated financial environment, no efforts have come close to the threats now facing the CFPB under the new federal administration and congress.

Changes to CFPB leadership happened within weeks of President Trump’s inauguration when Rohit Chopra, who led the bureau since 2021, was fired before the end of his term.Treasury Secretary Scott Bessent was first tapped to serve as acting director, but after a week, Director of the Office of Management and Budget Russell Vought was named to replace Bessent as acting director. Shortly thereafter, President Trump nominated his longer-term pick to lead the bureau, Jonathan McKernan, an attorney who was nominated by President Joe Biden to serve on the board of directors of the Federal Deposit Insurance Corporation. McKernan’s nomination cleared the Senate Committee on Banking, Housing, and Urban Affairs in early March on a party-line vote, but has not yet been scheduled for a vote before the full Senate.

Under the interim leadership of Bessent and Vought, nearly all CFPB activities have been halted and 88 percent of the staff have been threatened with layoffs. Immediately upon assuming control of the bureau, Bessent directed staff to suspend work on rulemaking proceedings, enforcement actions, and research publications. Vought went a step further, directing staff to suspend examinations and supervision activities and sending them home for a week. Vought was reportedly “hours away from terminating 1,200 workers” in February before a federal judge issued an injunction. The same week, staff for the so-called Department of Government Efficiency took control of the CFPB data systems, sparking fears of misuse of sensitive data and locking out career employees.

The judicial order required reinstatement of staff, contracts, and data based on the fact that the bureau was created by an act of Congress and therefore major changes to its mission and functions could only be achieved through another act of Congress. The order also condemned the “highly misleading, if not intentionally false” statements made by Vought at an evidentiary hearing. Nonetheless, Vought proceeded to send “reduction-in-force” notices to all but 207 of the 1,690 CFPB employees. This mass layoff was also enjoined by a federal district judge, but an appeals court partially stayed the injunction, allowing the current CFPB leadership to fire staff deemed unnecessary to the statutory functions of the CFPB while continuing to block mass layoffs and ensuring work can continue. This temporary order will be reconsidered in May based on the merits of the larger argument about executive authority.

While the courts may ultimately rule that the Trump administration cannot dismantle the CFPB on its own, there is no question that Congress has the authority to change the CFPB’s scope, reduce or eliminate its funding, or eliminate the bureau entirely. Congress additionally has authority under the Congressional Review Act to revisit regulations adopted by the CFPB and used this authority in early April to nullify two such regulations. The first was a rule capping overdraft fees at $5 for the largest financial institutions, which was projected to save consumers $5 billion every year. The second was a rule extending the CFPB’s supervision authority to cover certain digital consumer payment apps.

The larger debate about the future of the CFPB will likely be part of the budget reconciliation legislation. The recently-adopted budget resolution includes direction to the Committee on Financial Service to find $1 billion in cuts from agencies under its jurisdiction, which include the CFPB, other financial regulatory bodies, and the Department of Housing and Urban Development. The CFPB’s projected budget for FY2025 is $823 million, so it’s possible that the committee may recommend eliminating a significant portion of this funding. However, because the CFPB’s funding comes from the Federal Reserve System rather than general appropriations, it is unclear how cuts to the CFPB will impact the overall budget.

It’s also worth noting that the budget reconciliation process, in which the Senate can pass legislation with a simple majority, limits the scope of legislation to setting funding levels. This means that the legislation can remove funding from the CFPB, but cannot strip its statutory authorities or transfer them to other agencies.

The Future of Consumer Finance

The work of the CFPB over since 2010 has been incredibly impactful, putting enforceable guardrails on financial industry practices and returning dollars to consumers’ pockets. This work has been particularly important for lower-income families and older adults who are more likely to be targeted by predatory products and subprime loans, communities of color who have suffered from redlining and algorithmic discrimination, caregivers and other lower-income families who so often lack access to traditional banking, and students who often have no choice but to take on debt in order to pursue higher education.

And the CFPB’s watchful eye has stabilized a financial system that has, in times of deregulation, led to significant economic shocks from the Savings and Loan crisis of the 1980s to the subprime mortgage crisis of 2008.

Across Colorado and the U.S., new financial products like Earned Wage Access loans and other financial technologies enter the market every year and create new risks for consumers who are struggling to afford the high costs of housing, healthcare, childcare, higher education, and basic goods like gas and groceries. And zealous lenders continue to lure consumers with lower credit scores into taking on more and more debt, which creates real risks for anyone who loses their job or faces unexpected costs such as health emergencies or hail or fire damage to their home. And this consumer debt, which is growing steadily every year, could lead to larger impacts if the state’s economy moves into a recession, which state budget forecasters say is an elevated risk due to chaotic US trade policy.

At a time when a middle-class life feels out of reach for many and wealth inequality continues to reach new heights, hard-working Coloradans depend on a well-regulated financial sector to make investments and plan their families’ futures. Rolling back the progress made by the Consumer Financial Protection Bureau will leave a hole that cannot easily be filled by states, especially those with spending limitations like TABOR, and will only expose consumers to greater risks while increasing profits for large corporations.

CFPB Takes Action Against Bank of America for Illegally Charging Junk Fees, Withholding Credit Card Rewards, and Opening Fake Accounts

In July 2023, the CFPB ordered Bank of America to pay more than $100 million to customers for systematically double-dipping on fees imposed on customers with insufficient funds in their account, withholding reward bonuses explicitly promised to credit card customers, and misappropriating sensitive personal information to open accounts without customer knowledge or authorization.