In The Know: 2025 State Budget

The Colorado General Assembly has two bills it must pass every year: a bill to fund public schools in Colorado and a bill that funds the government for the following year. This year, the task of passing a balanced budget will be an extreme challenge. Non-partisan Legislative Council Staff estimate that around $1.2 billion will need to be cut from the budget for fiscal year 2025-26 that starts on July 1, 2025. The cuts needed to balance the budget will be felt by Coloradans across the state. Furthermore, non-partisan staff have made it clear that this is not a one-time problem, but a problem that will require structural reforms – or else we will have to continue cutting core services like healthcare and education in future years.

The context of this year’s budget is vital, as solutions are difficult without understanding the underlying problem.

TABOR

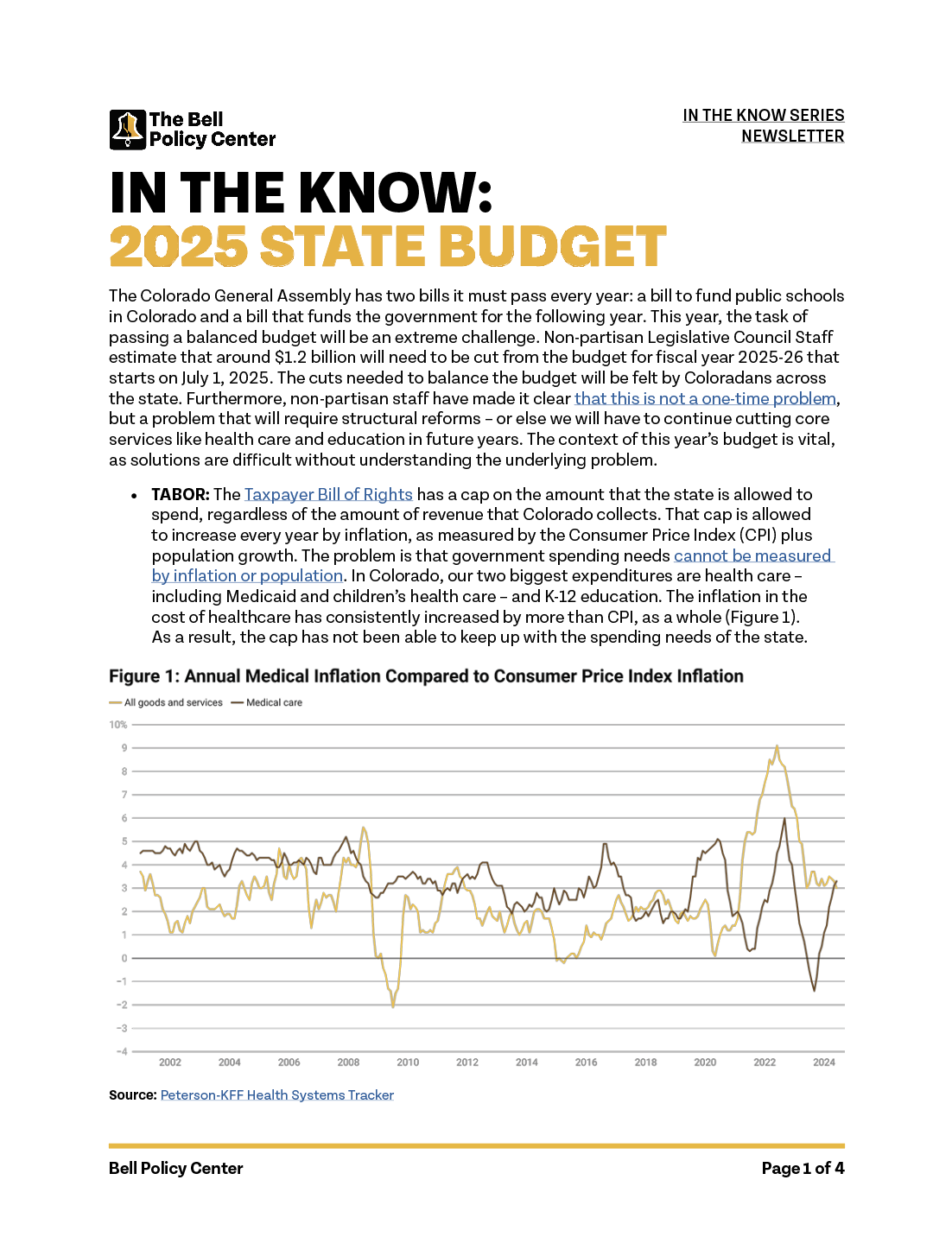

The Taxpayer Bill of Rights has a cap on the amount that the state is allowed to spend, regardless of the amount of revenue that Colorado collects. That cap is allowed to increase every year by inflation, as measured by the Consumer Price Index (CPI) plus population growth. The problem is that government spending needs cannot be measured by inflation or population. In Colorado, our two biggest expenditures are healthcare – including Medicaid and children’s healthcare – and K-12 education. The inflation in the cost of healthcare has consistently increased by more than CPI, as a whole (Figure 1). While CPI outpaced medical inflation during the high inflation era in the early 2020s, the broader trend has already impacted our budget and will continue to do so going forward, putting significant strain on the state’s ability to fund important programs. As a result, the cap has not been able to keep up with the spending needs of the state.

In terms of population, younger Coloradans and older Coloradans have more need for government services, which impacts spending. Whether that is child care and schools for younger children or more healthcare and long-term care needs as the number of older adults increases proportionally. Given that Colorado, as a state, is aging more rapidly than most other states, population as a whole is a poor marker for spending necessary to accommodate the programmatic needs for older Coloradans.

The result is that the state’s spending cap does not allow lawmakers to keep up with the needs of Coloradans. This becomes pretty clear when one sees the relatively flat spending in our state since 2000, when adjusted for population and inflation (Figure 2).

Medicaid

Medicaid is one of the largest expenditures in Colorado’s state budget. But the amount being spent on this program is rising – and rising quickly. Much of that is due to Colorado’s rapidly aging population – a demographic that is growing three times faster than the population as a whole. Older Coloradans are more likely to need long-term services and supports (LTSS) – a classification of services that includes in-home support to care in a nursing or assisted living facility. As it relates to our state’s fiscal situation, these services are both expensive and are most often accessed through Medicaid. Over the past several years, the number of older adults using Medicaid-provided LTSS has grown, increasing by 20 percent between FY2014-15 and FY2022-23. As expected, higher enrollment, due in part to a greater number of older adults living in the state, has led to increased costs. Some of these increases were masked over the past several years by federal Medicaid spending, which increased to allow management of the COVID public health emergency. But that money is no longer available, and now the state is on the hook for more spending, further constraining our budget.

Tax Cuts

The state has cut income and property taxes multiple times over the last several years. Income tax cuts do not increase the gap between available revenue and the cost of needed services. They lower the amount over the spending cap and reduce the rebates that must be sent to taxpayers. However, the lack of a “surplus” limits policymakers’ ability to respond to economic conditions by reducing their ability to put forward policies like targeted tax credits that can help Coloradans weather economic uncertainty or to make up for decreased spending in important programs.

Property tax cuts are a more direct hit to our state budget. That’s because public schools are jointly funded by the state and local property taxes. When property tax revenue decreases locally, the state has to put more of its tax revenue into schools to make up the difference. In trying to deal with the rapid increase in property taxes since the beginning of the COVID pandemic, lawmakers temporarily cut property taxes in 2020, 2021, 2022, and 2023. In 2024, lawmakers came together for a bipartisan bill that stemmed the increase in property taxes and protected school funding. However, with property tax cuts looming at the ballot that would have devastated funding for many state services, the legislature came into a special session in August 2024 to further cut property taxes. Now, the state has to contribute hundreds of millions of dollars more to schools to cover for the lost revenue at the local level. That is putting further strain on the state budget.

Some of these problems are not new, and in fact have caused inadequate funding in a variety of areas, like healthcare, education, and child care, over many years. But what makes this year different is that instead of not doing enough to fund certain programs, we are cutting already inadequate funding in order to balance the budget.

End of Federal Money for Pandemic Relief

At the beginning of the COVID pandemic, the federal government sent billions of dollars to states and local governments to help weather the economic distress caused by the pandemic. That money had to be obligated by the end of 2024 and is now gone. The vast majority of these dollars were used for discrete purposes with a clear end date, but there was some money that was used to plug holes and increase reserves. While state legislators were aware of the coming expiration of these dollars, the availability of the money masked some of the structural problems that are now plain to see. The roll-off of federal money is a compounding factor that is making it more difficult to close the current budget deficit.

The Looming Federal Cuts

Going forward, we cannot expect our budget situation to improve. There are still significant structural reasons for our budget woes – as described above – that are not immediately going away. And on top of that, there is an expectation that the federal government will drastically cut funding coming to states. If the federal government were to cut 10 percent of spending across the board, that would cost Colorado $2.4 billion. That is money that cannot be made up by increased state spending because we are already at our allowable spending limit under the TABOR cap. Given that the cuts would likely be concentrated in healthcare, education spending, and transportation funding, this will harm the most vulnerable Coloradans and the state will have very limited options to backfill lost services.

What's Next?

There is no easy answer to our budget woes. Given that TABOR has been in place since 1992, and our current spending limits have been in place since the end of the Referendum C timeout in 2010, this is a long-term problem that requires long-term solutions. Whether that is a change to TABOR to allow for more spending with current revenue, a new stream of sustainable money to help reduce the gaps in our budget, or something else, it is clear that Colorado will need to make some changes to the current fiscal system so that legislators do not have to make significant budget cuts year after year. Having adequately funded programs across our state is crucial to economic mobility.