SB24-233: Responsible Property Tax Reduction and Reform in Colorado

Based largely on recommendations from the state’s Commission on Property Tax, Colorado lawmakers passed SB24-233 at the end of the 2024 legislative session. This bipartisan bill balances multiple, important interests in order to simultaneously provide responsible rate reductions to property owners, ensure more predictability for homeowners and businesses, protect K-12 funding, and avoid deep cuts to the local governments that provide essential community services.

Below, we provide details about what’s in SB24-233 and examine the delicate balance it achieved.

Permanently Lowers Residential Colorado Property Tax Rates

Lawmakers have taken several emergency actions over the past few years to address the spike in property taxes caused by a global pandemic and the repeal of the Gallagher Amendment. Without SB24-233, these emergency measures – including a flat exemption for homeowners of $55,000, and a lowered assessment rate of 6.7 percent – would have expired. If this were to have happened the assessment rate would have returned to a flat 7.15 percent and the previously mentioned exemption would have gone away.

Under SB24-233, there will be a transition to new, permanently lower property tax rates.

- The emergency relief provided during the 2023 special legislative session (a $55,000 exemption and a lowered assessment rate of 6.7 percent) will be extended through property tax year 2024. Importantly, continuing this relief comes at a cost of nearly $400 million from the State Education Fund to backfill school districts. Backfill previously provided to other local districts will not be made available to districts other than those, like those in rural areas, that would see actual net-negative revenue reductions in revenue.

- To ease into long-term reform, the $55,000 exemption will go away in property tax year 2025, but all assessment rates will be lowered to 6.4 percent

- Finally, in property tax year 2026 and beyond, permanent changes will begin, and include:

- Creating a new, permanent exemption in which homeowners will see the taxable value of their home reduced by 10 percent of up to the first $700,000. This amount will be adjusted to account for inflation between assessment cycles. Notably, this formula provides relatively more value to owners of low- and moderately-priced homes while also ensuring fair treatment to homeowners in different parts of the state.

- Reducing assessment rates for all non-school district mills to 6.95. To protect K-12 funding, the assessment rate for all school finance district mills will remain at 7.15 percent

The table lays out the effective assessment rate – which accounts for the cumulative impact of the stated assessment rate and exemptions – of the permanent changes that will occur in 2026. As seen below, the new exemption adds a degree of progressivity to our property tax system and ensures lower effective assessment rates for homes at or below $700,000.

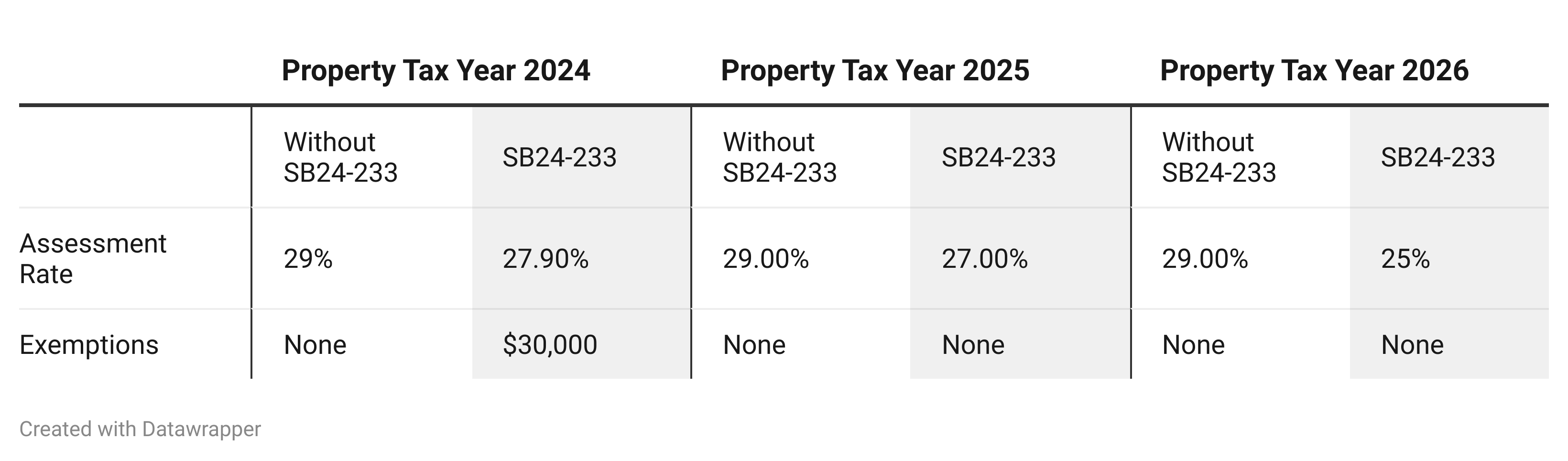

The table below summarizes how residential assessment rates and exemptions will change over time as a result of SB24-233. These changes are compared to what would have occurred without SB24-233.

Permanently Lowers Commercial Property Tax Rates

The Gallagher Amendment led to significantly higher assessment tax rates for commercial as opposed to residential properties. In tax year 2019-2020, residential assessment rates were 7.15 percent, compared to 29 percent for commercial properties. Similar to the emergency relief provided to homeowners, lawmakers temporarily reduced the commercial assessment rate and provided a property tax exemption in prior years.

SB24-233 provides a permanent change to the commercial assessment rate. The previously mentioned emergency relief will be extended through property tax year 2024. Afterward, a step down in rates will occur through property tax year 2026, as seen below:

Caps Future Property Tax Increases

The most recent spike in home values is uncommon, and another increase of that magnitude is not projected for the next few years. However, if home values were to rapidly increase, SB24-233 creates protections to limit year-over-year property tax increases. These include:

- Starting in 2025, capping yearly non-school district property tax revenue growth for non-home rule jurisdictions at 5.5 percent. To avoid the harsh rigidities of previous revenue caps, like TABOR, the cap does exempt tax increment financing and bond revenue, as well as any new voter approved mill increases.

- To prevent sharp increases in property taxes allocated for school districts, the bill also creates a trigger that would temporarily reduce the K-12 assessment rate if property taxes account for 60 percent of statewide school funding.

The Takeaways

SB24-233 balances a multitude of important, but often competing interests. When taken together, we see that the bill:

Permanently reduces property taxes, particularly for homeowners with low- and middle-value homes:

If SB24-233 did not pass, property taxes would increase in the coming years. This is clearly shown in the chart below, which compares a homeowner’s property tax bill through 2026 with and without SB24-233.

Paired with the previously mentioned caps, SB24-233 simultaneously provides meaningful property tax reductions in the near-term while also preventing spikes in the long-term.

Protects K-12 funding:

The role of property tax in adequately funding K-12 has been a perpetual sticking point in tax reform conversations. The recent elimination of the Budget Stabilization (BS) Factor – which has largely been attributed to an increase in property tax revenues – spotlights this reality.

SB24-233 protects K-12 funding and guards against the return of the BS Factor by separating the assessment rates for local governments and K-12. By doing so, SB24-233 ensures funding for this constitutionally-required priority will be safeguarded.

Creates predictability for homeowners and local governments:

For several years, Colorado has regularly adjusted effective property tax rates. These steps were taken to meet Coloradans’ immediate needs. However, because they were temporary, both homeowners and local governments were often left unsure of what may happen in the coming years, making it difficult to plan for the future.

SB24-233 addresses this problem by creating long-term solutions that provide predictability and stability for both homeowners and local governments. Moving forward, both parties won’t have to wonder about legislative action or what will happen if the state experiences another spike in assessed value.

Coloradans have been debating property tax reform for years – well before the pandemic and the recent spike in home values and property taxes. The one-size-fits all solution that was the Gallagher Amendment was distortionary and had tremendously uneven consequences for the state. SB24-233 provides a flexible, long-term replacement to the Gallagher Amendment. In balancing the multitude of interests of homeowners, businesses, local governments, and public schools, this bill offers the permanent path forward that our state has been seeking for years.