In The Know: Medicaid Reimbursement Rates

Medicaid is the largest public insurance provider in the nation, and as such its reimbursement rates are critically important to the quality of care its recipients receive and compensation for those who provide that care.

Medicaid provides people with low incomes necessary health care, including home and community-based care. It is both federally- and state-funded, and while subject to federal requirements, is fully administered by the state. The government contracts with private entities that then provide services and are reimbursed by the state, making Medicaid a primary way in which health care workers are paid.

A sufficient Medicaid reimbursement rate is important to ensure the costs of quality care are covered, and provide for a fair wage to health care workers. Reimbursement rates are intended to cover services provided, administrative costs, overhead, and wages and benefits for service providers.

Determining the Medicaid Reimbursement Rates:

In Colorado, the Department of Health Care Policy & Financing (HCPF) is responsible for calculating and recommending the Medicaid reimbursement rates. The legislature is responsible for approving and setting the reimbursement rates for each health service. Rate setting methodology varies by state, but it must be approved by the Centers for Medicare & Medicaid Services.

- Inputs: First, HCPF identifies the main drivers of costs for each service provided. This typically includes salaries, facility overhead costs (rent and utilities), administrative costs (computers, technology, office supplies), and capital equipment expenses.

- Rate calculation: With an estimated total cost for providing care, the department uses their rate calculation formula, which is not available to the public, to determine how much should be reimbursed to adequately cover costs.

- Budget neutrality: After HCPF has calculated the amount needed to cover costs, the rate will be reduced to ensure reimbursement is within the constraints of the state budget. The percentage by which it is reduced is known as the budget neutrality factor.

- Reviewed for sufficiency: Reimbursement rates are periodically reviewed for sufficiency. In Colorado, since 2023, rates are reviewed every three years. However, reimbursement rates are often cited as insufficient by providers and recipients of care. For example, for nursing home care, it was found that Medicaid reimbursement rates only cover 70 to 80 percent of the actual cost of care

Why do reimbursement rates fall short and how can we increase them?

Medicaid rates are inadequate in covering the actual costs of care because they are subject to state budget constraints. To compensate for budget constraints, the rates are lowered accordingly as explained by the budget neutrality factor. As a result, this burden is often shouldered by those providing care. Medicaid reimbursement rates can be increased, though it requires additional funding and is at the mercy of strained budgets.

Key Context:

- Medicaid is the primary funder and covers 50 percent of costs for all long-term care services. Therefore, many care workers’ wages and benefits are dependent upon Medicaid reimbursement rates. The inadequacy of these rates is a main driver of the low wages paid to Colorado’s direct care workers.

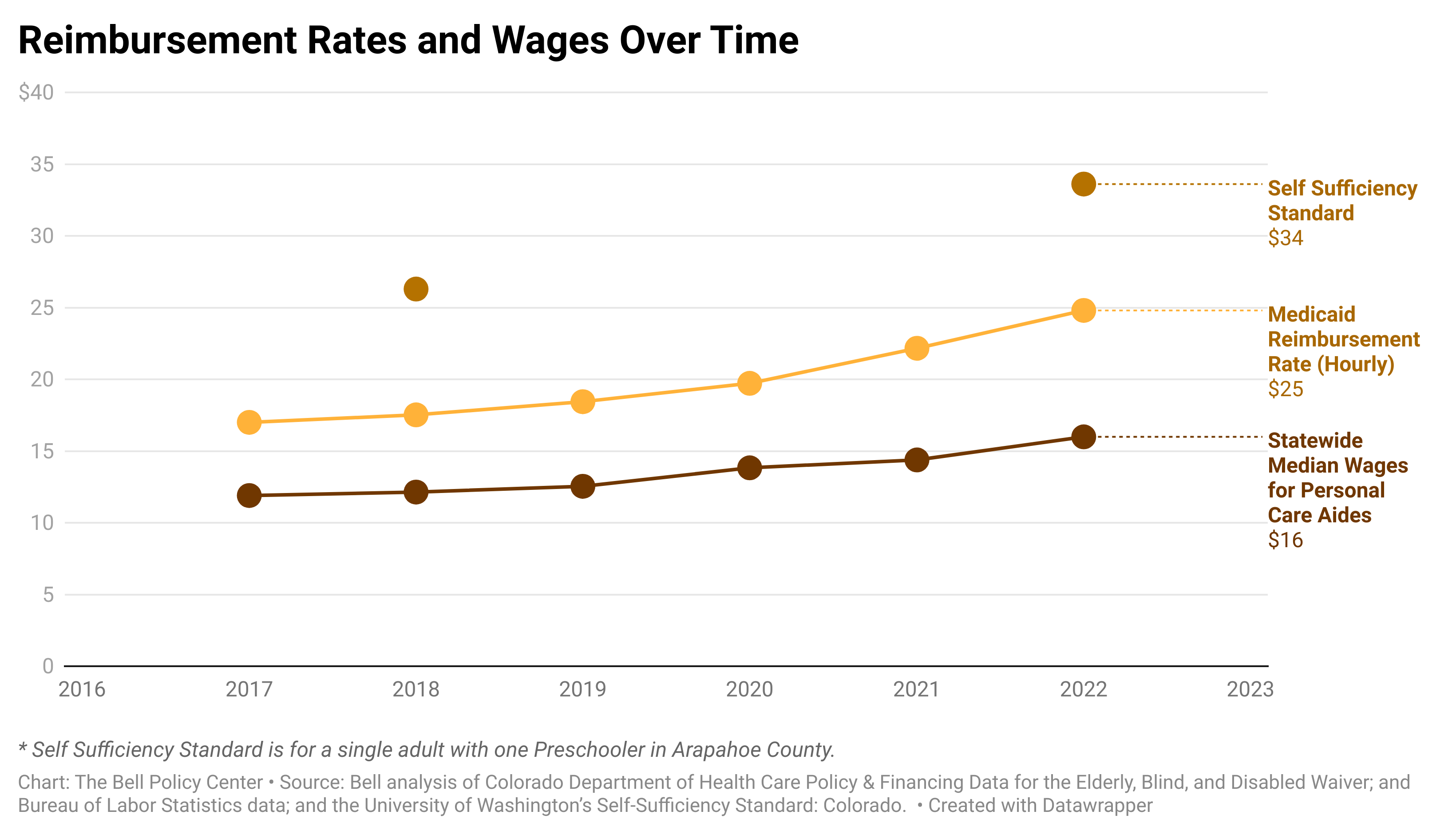

- As shown in the chart above, despite some small increases in Medicaid reimbursement rates and wages, they remain far below Colorado’s Self Sufficiency Standard. In fact, 42 percent of Colorado’s direct care workers rely on public assistance to make ends meet.

- Low compensation leads to a high turnover of direct care workers. In combination with a growing need for care workers in Colorado, a critical gap between the need and availability of workers has emerged. One key way to address this worker shortage and meet the needs of our communities is to increase the Medicaid reimbursement rates, and subsequently care workers’ wages.

- To ensure that the respective rate increases go toward paying fairer wages to care workers, mechanisms such as wage pass-throughs (meaning the increase is for the express purpose of going to wages) or statutory changes (requiring a certain percentage or all the rate increase go to workers’ wages) are necessary.