Setting the Record Straight on “Special Interests”

Colorado’s income tax has been permanently reduced many times over the past three decades. Each time it’s lowered, it makes our tax code more regressive and jeopardizes future state budgets. Alarmingly, new proposals to lower the income tax continue at the state’s Title Board and inside the Capitol. All too often, the arguments for reducing our income tax rely on generalities and misleading assertions that obscure the true picture of who these cuts benefit and who they hurt. A recent report from the anti-tax Independence Institute is the latest attempt in Colorado to misconstrue this issue.

Special Interest Tax Breaks?

The report continually refers to tax expenditures as “special interest tax benefits” and it is important to explain what those are. Tax expenditures describe the ways in which the government spends money through the tax code. As Colorado’s Department of Revenue explains, “A ‘tax expenditure’ is a tax provision that provides a gross or taxable income definition, deduction, exemption, credit, or rate for certain persons, types of income, transactions, or property that results in reduced tax revenue.”

Tax expenditures are extremely common in federal and state government, and they benefit many different types of groups. Some of the more common tax expenditures in the state are: Deductions for donations to qualifying charities, deductions for pension and annuities, tax credit for taxes paid to other states, and the Colorado Earned Income Tax Credit. These credits incentivize economic behavior that is beneficial to Colorado, ensure that taxes are not paid twice, or support and incentivize work for lower-income Coloradans.

In Colorado, there has been a significant increase in the use of tax expenditures over the last several years as a way to target help to people and businesses needing help. For example, the Colorado legislature has increased the state’s Earned Income Tax Credit and the Child Tax Credit twice since 2021. These tax credits go to families and individuals making less than $85,000 annually to help with the cost of living, and raising children. Colorado has also put in place tax credits for businesses and individuals that support efforts to reduce their carbon footprints and start on the path towards decarbonization. One could claim – as the far-right Independence Institute has – that children and clean air are “special interests,” but that’s not where most Coloradans land on these issues.

To lump all tax expenditures – adding those that help working families make ends meet with those that allow large corporations to deduct bad investments from their taxes – together as “special interest tax benefits” is not meant to educate readers about fiscal policy, but to turn them against tax credits that have significant support and have been shown by studies to be extremely economically beneficial to families, and the economy as a whole.

Who’s an Average Tax Payer?

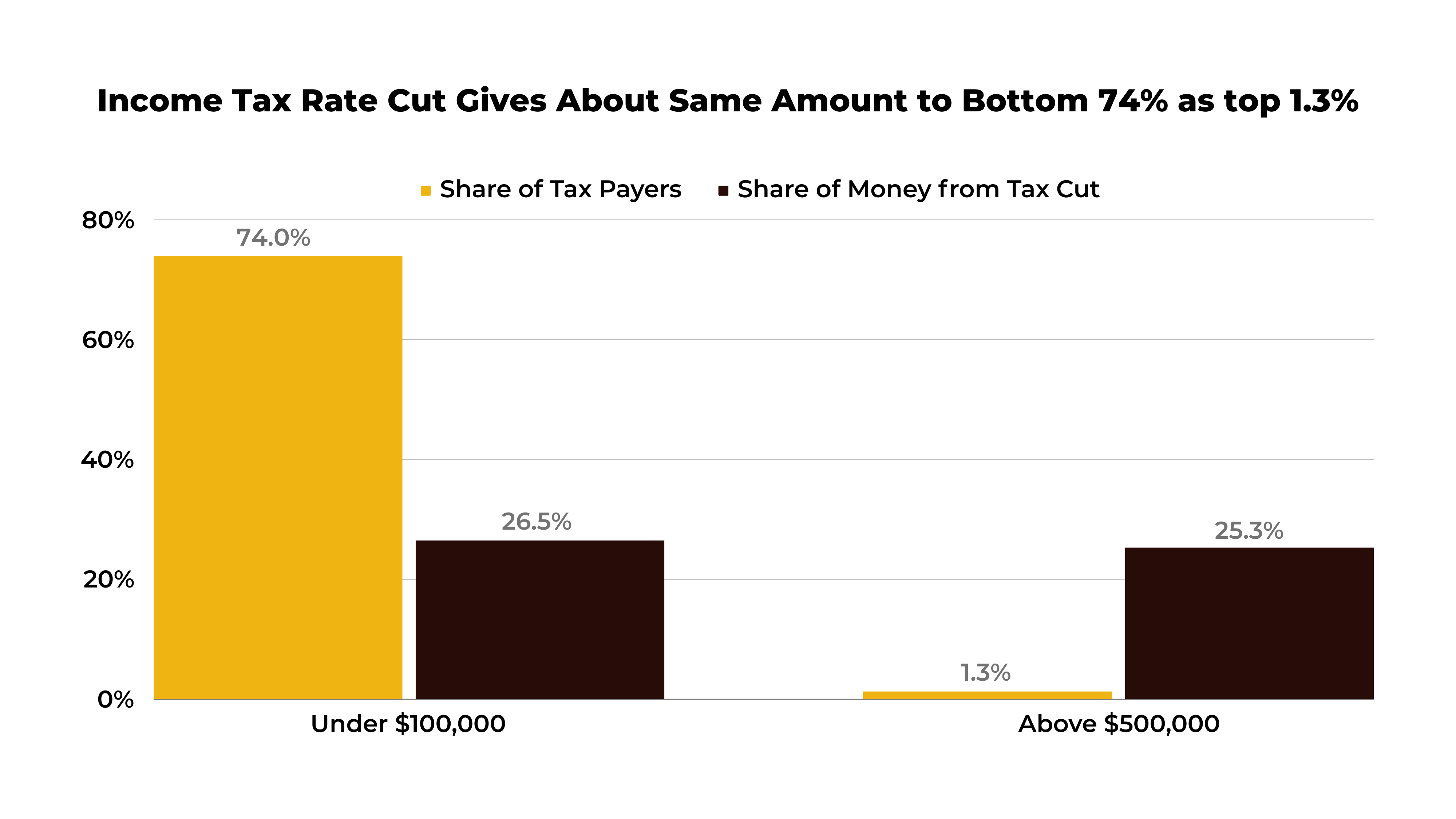

Another sleight of hand the report attempts is explaining how income tax rate cuts give average benefits to all taxpayers. Their claim that the tax cut would result in “an average tax saving of $510 per tax filer” might be factually correct, but it leaves so much information out as to be completely meaningless.

If someone gets $1,000 and someone else gets $1, then every person gets an average of $500. Of course, that fact is not helpful to the person who gets a single dollar. Using a real life example, HB24-1065 would reduce the income tax rate from 4.4 percent to 4 percent. Under that bill, Colorado millionaires would get an average of $11,000 in tax savings, but someone making $75,000 would get an average of only $171. In fact, the top 1 percent of taxpayers – those making more than $500,000 annually – get the same amount of tax savings as everyone making below $100,000, which is a full 74 percent of Colorado taxpayers. That is regressive, unfair, and inequitable.

Coloradans Do Not Support Tax Cuts for the Wealthy

Finally, it’s important to note that Coloradans think that the wealthy do not pay enough in income taxes as it is. A recent poll from Global Strategy Group found that a whopping 72 percent of Coloradans think that income taxes on the wealthy are too low. Since TABOR prohibits graduated income tax rates, the only way to cut the income tax rate in Colorado is to do it across the board. Therefore, the report not only advocates for economic policy guaranteed to benefit the already wealthy, it does so with a position that is unpopular among voters.

Using misleading numbers and obscuring the actual policies, this report is nothing more than a tax cut advocacy document. But this is what the anti-tax side has. Because everyone knows that across-the-board tax cuts overwhelmingly benefit the wealthy, the only way to convince people that they are good policy is to deflect and mask the real consequences. Those advocating for fair tax policy and a tax code that promotes economic mobility must remain vigilant in explaining what tax rate cuts actually mean for everyday Coloradans.