Referred Ballot Measure: Prop II

During the 2022-2023 legislative session, legislators referred a question to the November 2023 ballot that will ask voters if they want to direct more funding to public preschool. Prop II will ask whether the state can keep the additional revenue generated from Proposition EE, the increased nicotine and tobacco tax passed by voters in 2020, which funds the Universal Preschool Program (UPK). We explore the nuance of this forthcoming ballot measure in more depth below.

Background on Proposition EE

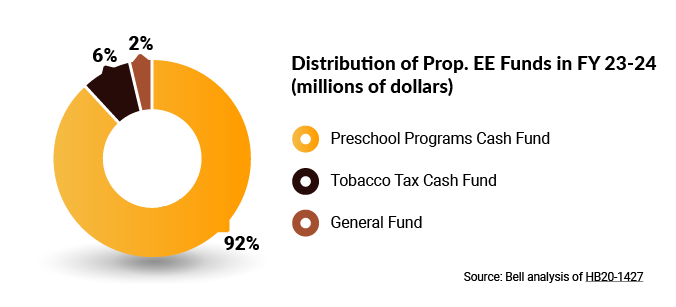

In 2020 voters passed Proposition EE, which taxed nicotine products to fund, in its first couple of years, public schools, housing initiatives, programs to reduce the use of nicotine products, and the Universal Preschool Program (UPK). Starting in Fiscal Year 2023-24, the revenue will only be distributed to the Preschool Program Cash Fund, the Tobacco Tax Cash Fund, and the General Fund. Money distributed to the Tobacco Tax Cash Fund, administered by the Colorado Department of Health Care Policy & Financing (HCPF) and the Colorado Department of Public Health and Environment (CDPHE), funds primary care programs, treatment programs, tobacco education programs, and various other healthcare programs. In future years, funds will also be distributed to the Tobacco Education Programs Fund. However, as shown below, over 90 percent of Prop EE funds will go to the Preschool Program Cash Fund.

TABOR Constraints Lead to Prop II

Due to a provision in the Taxpayer’s Bill of Rights, commonly referred to as TABOR, any revenue collected from the tax beyond the original estimate must be refunded to taxpayers, unless voters allow the state to maintain the excess funds. (That’s the question going to voters this year, which is titled Prop II.)

In 2020, the state estimated that in Prop EE’s first full fiscal year, FY 2021-2022, the measure would generate $186.5 million in revenue. It actually amounted to $208 million, meaning voters will decide what to do with the additional $21.5 million, which is actually $23.65 million when interest is included.

If voters pass the ballot measure, Prop II, the additional amount will be retained and transferred to the Preschool Program Cash Fund and a small portion to the General Fund. The current tax rate (6.5 cents per cigarette, 30 percent of manufacturer’s list price (MLP) on tobacco products, and 50 percent of MLP on nicotine products, among other minimum tax rates) and future increases will continue as outlined in the 2020 passage of Prop EE. If voters reject the ballot measure, approximately $23.65 million will be refunded to taxpayers, though the exact mechanism will be decided by the legislature. The Department of Revenue will then determine how to lower the tax rate by 11.53 percent to avoid surpassing the estimate in future years.

What are Prop EE Funds Used For?

As mentioned above, most of the revenue collected from Prop EE is directed to the Preschool Program Cash Fund, which supports tuition free preschool for all 4-year-olds, known as UPK. With the current funding from Prop EE, UPK this fall will offer up to 15 hours a week of free preschool for every 4-year-old in the state, 3-year-olds with qualifying factors, and 30 hours a week for 4-year-olds with qualifying factors. It is well known that access to quality early childhood education (ECE), is correlated with higher academic outcomes, a higher likelihood of graduating high school, and higher earnings in the workforce. Additional revenue for ECE and UPK would expand these benefits.

How Much Is Enough?

Given the constrained state budget and the plethora of other important funding needs, ECE is below the level the Bell would consider adequate. Using the Bell’s Cost Model and current funding levels, it would require an additional $1.6 billion in FY 2023, and $4.168 billion through FY 2025 in order to fund high quality care and pay early childhood educators a self-sufficient wage.

Holistic and comprehensive investments in ECE are necessary for children, families, and our communities. Access to affordable, high-quality care not only increases school readiness and earning potential later in life, but it allows parents and family members to remain in the workforce with positive ripple effects on our economy. An additional $23.65 million would certainly bring Colorado closer to funding ECE adequately.

Who Pays the Taxes Under Prop EE?

Many of the important programs we fund as a state, including ECE and K-12 education, rely on a mix of funding sources.

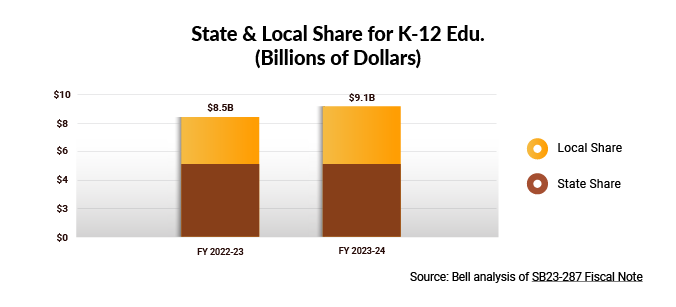

K-12 education, for example, relies on local sources (property taxes) and state sources (overwhelmingly the General Fund and the State Education Fund). As shown in the graph below, the overall funding for K-12 education from FY 2022-23 to FY 2023-24 will increase from approximately $8.5 billion to $9.1 billion, largely due to an increase in the local share.

Different Payers For Education

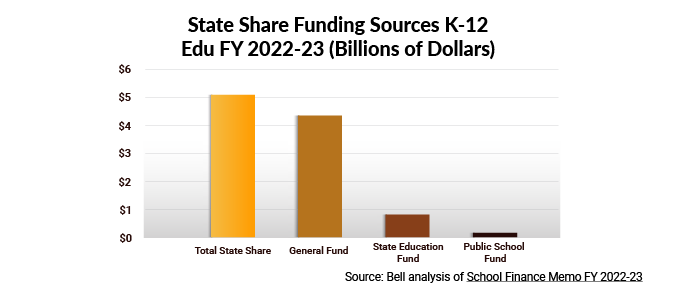

Notably, K-12 funding is supported by a diverse group of payers. For example, property taxes are paid by all businesses and individuals who own property, General Fund dollars come from income tax and sales tax, while the State Education Fund comes from taxable income.

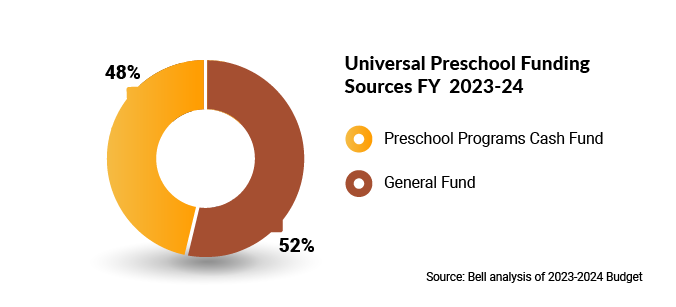

In contrast, Proposition EE taxes 12 percent of the adult population who are smokers, who are disproportionately people with low incomes, and people of color. As shown below, there is almost equal reliance on the General Fund as the Preschool Program Cash Fund. However, a portion of the General Fund will be used to build a fund balance in the Preschool Program Cash Fund and will not be a recurring source of funding.

Proposition EE taxes wholesalers for these products, though these taxes are largely passed on to consumers through increased prices. According to 2021 CDPHE data, Colorado households with income at or below 250 percent of the Federal Poverty Level (FPL) see a higher prevalence of smokers compared to households with income greater than 250 percent FPL.

Notably, in 2018, more than 50 percent of smokers have low household incomes while less than one-third of nonsmokers have low household incomes. Additionally, in 2021, Black and Hispanic Coloradans had the highest percentage of smokers compared to white and Asian Coloradans; and while most communities saw a decrease in the prevalence of smoking, Hispanic communities saw an increase in the prevalence of smoking compared to 2020. The higher prevalence of tobacco use by Black and Hispanic Coloradans may partially be due to the fact that the tobacco industry has historically targeted communities of color in their marketing.

Conclusion

Despite the known importance of ECE and the immeasurable benefits it provides, we have a long way to go in fully funding ECE in Colorado. Importantly, the additional funds provided by a successful ballot measure would expand the UPK program. However, as the state navigates the complex funding landscape and searches for ways to fund programs we know to be crucial for the success of our children and communities, it is important to consider who is paying for these services.

The situation Colorado finds itself in when funding ECE is the unfortunate result of a fragmented, broken funding system that is directly tied back to TABOR. Restrictions on state funding make it difficult to sustainably create the new programs we need. While voters will have a chance to vote on Prop II, the above-described measure this coming fall, we must also consider and work toward fundamental reforms that allow us to create new programs that support economic mobility for all.