The Bell Supports Proposition HH: Property Tax Relief That Helps Schools

The Bell Supports Proposition HH:

Property Tax Relief That Helps Schools

Proposition HH: Expanded Analysis

A surging housing market once again made property taxes an important issue in the legislature. In an effort to blunt spiking property tax bills, legislators introduced SB23-303, which offers relief to homeowners and businesses. This measure provides property tax relief while maintaining support for critical local services that derive most of their funding from property taxes, particularly K-12 education. Cutting property taxes without a revenue alternative comes at the expense of schools, fire and water districts, and other public services. To ensure both public interests were met, the legislature proposed a mechanism allowing a portion of the TABOR surplus to offset lost property tax revenue. Still, trying to figure it out? This explainer will break down what happened with property taxes this session, how it will affect Coloradans, and what you’ll vote on in November.

The legislature incorporated efforts to address these pressures and more with a far-reaching bill, SB23-303 – Reduce Property Taxes And Voter-approved Revenue Change. It’s dependent on Colorado voters passing its contents in Proposition HH this November. If enacted, relief would begin this year and remain in place until 2032. In 2032, property taxes would return to current rates unless legislators choose to extend the changes in Proposition HH.

Property Tax Changes & Reductions for Homeowners

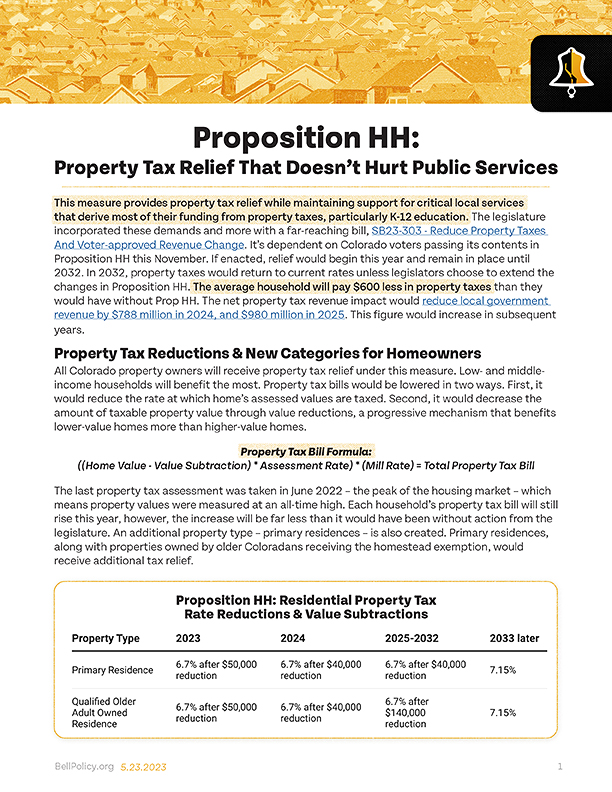

All Colorado property owners will receive property tax relief under this measure, however, low- and middle-income households will benefit the most. Property tax bills would be lowered in two ways. First, by decreasing the amount of taxable property value through value reductions, a progressive mechanism that benefits lower-value homes more than higher-value homes. For example, with a $40,000 value reduction in 2024, a home worth $500,000 would only be assessed on $460,000 of its worth. Second, the measure changes how much of that assessed value can be taxed. Rather than taxing 7.15 percent of that $460,000 assessed value, that property would be taxed at 6.7 percent instead. This household would pay $600 less in property taxes.

The last property tax assessment was taken in June 2022 – the peak of the housing market – which means property values were measured at an all-time high, just as they began to stabilize. Each household’s property tax bill will still rise this year, however, the increase will be far less than it would have been without action from the legislature. Without Prop HH, a typical house would see a tax increase of 38 percent. With the passage of Prop HH, this increase drops to 17 percent, or about a 50 percent reduction in total tax growth.

Older Coloradans who are eligible for the existing Senior Homestead Property Tax Exemption (to qualify, individuals must be 65 or older and have owned their home for at least a decade) will receive additional relief under the plan. Starting in 2025, these homeowners will be able to continue utilizing the benefit even if they move into a new home. In other words, the Senior Homestead Exemption will be portable. This has long been an appealing policy for many, as it may help individuals who want to move into a smaller home, but are concerned about losing the tax benefit.

Further, property tax relief would differ for different types of houses. Within a few years, a distinction will be made for owner-occupied, primary residences for homeowners who reside in that home as compared to second homes or investment properties. A task force of local officials will determine best practices for creating this new assessment classification, and funding has been allocated for software to administer this additional data. Primary residence properties will eventually receive lower taxes than corporate-owned investment property. This represents an important step towards identifying corporate-owned investment properties and separating them from everyday Coloradans’ homes. Initial findings suggest that as much as half of the housing stock in mountain resort communities are second homes or investment properties; roughly 10 percent of the housing units in the state fall into one of these two categories.

Property Tax Changes & Reductions for Businesses

After repealing the Gallagher Amendment in 2020, the state was left with traditionally high non-residential property tax rates and low residential rates. This remnant still needs to be addressed, and businesses across the state have correctly pointed to the disproportionate portion of property taxes carried by non-residential properties. Although the non-residential property market grew slower than the residential market over the last few years, the higher assessment rates for these properties also demonstrate a need for tax relief.

Under the measure, the types of non-residential property vary more than the residential assessment types. The property tax changes and reductions were almost entirely made through assessment rate reductions, which determine how much of a property’s assessed value can be taxed. Whereas the value of a person’s home is a strong indicator of household wealth, a business’ property value is not as closely linked to its annual revenue. Thus, progressive value subtractions do not necessarily target relief to smaller businesses like they do for residential properties. Assessment rates varied depending on property type, with the legislature affording preferential treatment to some, like renewable energy businesses. From a status quo assessment rate of 29 percent for most businesses, all will see an incremental reduction over the next ten years so as to not dramatically reduce property tax revenue in one year. Each two-year assessment period will see further reductions.

Other Mechanisms for Regulating Property Tax Growth

Independent of individual reductions on property tax rates for homes and businesses, Proposition HH offers other control levers. The first allows for a soft cap on property tax revenue growth. A local taxing district, such as a water district, cannot collect more property tax revenue than the previous year’s revenue plus inflation. The metric is the commonly used Denver-Aurora-Lakewood Consumer Price Index, currently at 5.7 percent year over year. If the taxing district exceeds this soft cap, it must refund that portion of property tax revenue to their constituents. Notable exceptions are made to this limit, including schools and home-rule cities and counties. If the tax district determines it is necessary to exceed this limit, they may do so after holding a public hearing and passing an ordinance.

A second lever allows tax districts to create temporary mill levy credits to refund the money over the limit. This is an efficient way to refund property tax without permanently lowering mill levy rates. Any permanent mill change requires a public vote. A temporary credit allows government to respond more nimbly to high-growth years without permanently hampering a district’s ability to collect property tax in lower-growth years.

The rapid growth of the last assessment cycle is an outlier in Colorado’s historical trends. Residential rates are no longer cushioned by floating non-residential rates due to the repeal of the Gallagher Amendment. That, combined with a pandemic-driven housing market boom, led to massive growth in property values. According to our forecasts as well as industry leaders, residential property values are expected to flatten into the next assessment period of June 2024. Politically this soft cap is a useful diversion for radical Prop 13-like limits proposed by outside groups; for local districts, this soft cap is unlikely to hamper them as property values begin to decline. As seen below, the statewide average of assessed value growth was large (22.5 percent) in this last year but will begin to moderate going forward. If Proposition HH passes, this year’s growth will reduce slightly.

The Pay For: Newly Retained Revenue

All told these proposed changes will considerably reduce property tax revenue in the state. Merely cutting property taxes for Coloradans without a backfill would not serve our communities interests. As we’ve studied previously, property taxes in Colorado are local taxes that fund essential public services and investments. Local taxing districts, like fire or school districts, plan and budget for the coming fiscal years based on projected property tax revenue. Any reduction in property taxes can severely hamper a local government’s ability to provide these services. For this reason, the legislature proposed the state backfill losses from property tax reductions under Proposition HH. What homeowners and businesses gain in tax relief should be accounted for elsewhere.

If voters approve of this plan, then an additional 1 percent of state income tax revenue will be retained and spent above the existing Ref C Cap. In the first year, the retained revenue will be minimal, likely $166 million in FY 23-24 and $358 million in FY 24-25. This will be in addition to the $200 million from this year’s General Fund that has already been set aside to backfill districts. Each dollar will be necessary to backfill local districts so that public services are not cut to compensate for relief to homeowners and businesses. As the 1 percent retained revenue is cumulative, the gains will increase over time, allowing the state to hold onto about $10 billion over the next decade to be directed to the State Education Fund.

School Finance

Since education funding is so intertwined with property taxes, Proposition HH will ensure that there is adequate funding for our schools. Over the first two years, school funding should remain fairly constant. However, direct property tax backfill needs will be less dramatic in the third year, and the bulk of retained revenue will be directed to the State Education Fund. Colorado’s chronically underfunded schools will receive a boon from this measure, reaching an estimated $2.2 billion in FY 2031-2032. The measure mandates that this revenue supplement not supplant General Fund revenue to the State Education Fund.

The additional funding in this legislation would allow Colorado to, over time, catch up with its peers. Colorado is 35th in the country in per-pupil funding and last among all states in teacher pay compared to similarly-educated professionals. To reach 25th in the country in per-pupil spending, Colorado must spend $1,263 more per pupil, or $1.1 billion total for next year. Colorado schools and our young students will be the primary beneficiaries in the out years when property tax relief is not needed. This additional funding would make massive inroads in getting per-pupil school funding to the middle of the pack and beyond.

Renters

Despite property tax relief over the last few years, rents continued to skyrocket across the state. Price increases are passed through to renters – landlords profit by passing along property taxes and utilities to their renters each year. Conversely, price relief is not passed on to renters. Rents have outpaced inflationary costs in Colorado and can not be explained by pass-throughs alone. Reporting suggests that price collusion and market-setting algorithms have exacerbated the rent spike, encouraging property owners to raise rents dramatically while withholding housing units from the rental market.

Without a cap on rents in the state, any property tax relief package should include the large portion of the state that rents; this measure sought to address this challenge. As much as 40 percent of the state falls into this category, and nearly half are housing cost-burdened. That is, they spend 30 percent or more of their income on housing each month, making it difficult to pay other bills let alone save.

The measure mandates that a portion of the newly retained tax revenue be directed to the Housing Development Grand Fund administered by the Colorado Department of Local Affairs, to address this challenge. Up to $20 million annually will be sent to this fund to provide rental assistance to struggling Coloradans. While this is a meaningful start to help renters, future legislators should consider more targeted approaches, such as income tax credits that directly provide relief to renters as Proposition HH would for homeowners.

TABOR Rebates

Proposition HH is connected to another bill that addresses the state’s budget and fiscal health. HB23-1311 – Identical Temporary TABOR Refund would alter the 2023 TABOR refund mechanism if – and only if – Prop HH passes. This refund mechanism adds to the progressive value subtraction measure in SB23-303, where lower-value homes will have larger proportional savings than high-value homes. Likewise, this one-year refund mechanism will return TABOR surplus dollars at a flat rate to all taxpayers. Single filers will receive $650, and joint filers will receive $1,300. The combined progressivity of property tax relief through value subtractions and identical TABOR refunds is significant. Lower- and middle-income households stand to gain the most from this provision, as we discuss further here.

Conclusions

In a period of historically high inflation and lagging real wages, the Colorado legislature chose to progressively target property relief to lower-income property owners, while offering some measure of relief to all. Ultimately, the passage of Proposition HH depends on Colorado voters. Its passage would balance efforts to assist struggling Coloradans while maintaining public services and investments our property taxes pay for. Further, underfunded Colorado schools are a major beneficiary in out years, allowing us to play catch up with our better funded peers. The changes are significant, though ultimately set to sunset in 2032 unless the legislature decides to extend these changes. Property tax rates will reset to pre-pandemic levels in 2033 if they choose not to. By then, Colorado will have had sufficient time to appreciate lower property taxes without diminished public services.

Related

FISCAL POLICY

TABOR Surplus Outlook

HOUSING