TABOR Surplus Outlook

TABOR Surplus Outlook

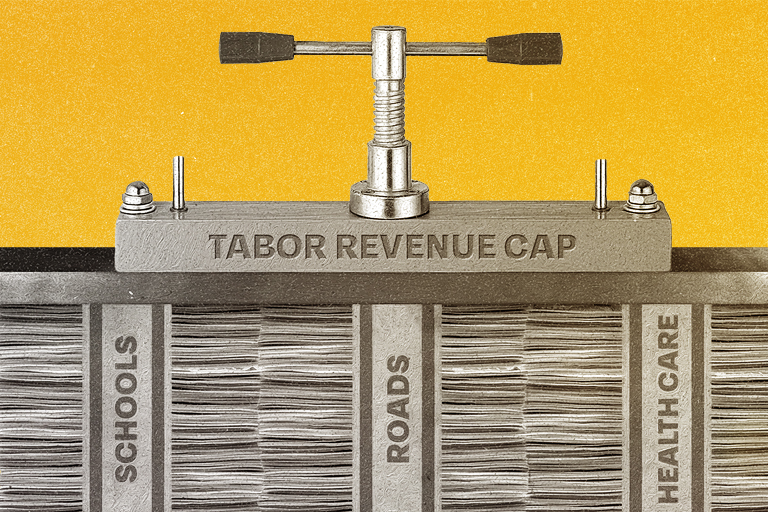

Whenever Colorado collects revenue above the so-called Referendum C cap, lawmakers must decide how to rebate that surplus money to taxpayers. There are a lot of ways state legislators can allocate these TABOR surplus dollars, including sales tax rebates, tax credits to support economic mobility, or rebates structured to emphasize equity.

In the final days of the 2023 legislative session, Colorado lawmakers decided to structure the rebate that will be sent in 2024 as an equal payout to each taxpayer regardless of their income bracket – roughly $650 to single tax filers and $1,300 to joint filers. They did, however, decide to tie that rebate structure to the success of a broad property tax relief measure that they referred to voters for consideration in November. If approved, it would last only one year.

Colorado lawmakers find themselves deciding how to rebate what is actually much-needed tax revenue because of the state’s complex revenue and expenditure picture. It has been shaped by constitutional amendments, formulas and statutory mandates that speak to how much revenue Colorado can keep and spend on services that Coloradans want and need.

For the purposes of this piece, the two most important of these structures are the Taxpayer Bill of Rights, or TABOR, which limits Colorado’s annual General Fund spending to the sum of the prior year’s inflation and population growth, and Referendum C, which allows the state to retain and spend some revenue in excess of that allowed by TABOR. Referendum C was approved by voters in 2005.

Together, these measures dictate that any money over the Referendum C limit is rebated to Colorado taxpayers in one form or another, regardless of the fact that Colorado has significant unmet needs. In surplus years, a big decision for lawmakers centers on whether and how they change the rebate mechanism. The structure of the rebate mechanism can be targeted to support greater equity and economic mobility.

Background

As the chart below shows, the state expects surpluses in the next two budget years as well. FY 2022-23 will end on June 30, 2023, at which point the State Controller will determine the exact amount to be sent to taxpayers. Legislative Council Staff projects the number will be approximately $2.75 billion.

If voters do not approve the property tax relief question that lawmakers sent to the November ballot, the bulk of the money will be sent to taxpayers in the form of the six-tier sales tax refund mechanism. That has been the case from 1997 through 2021. This refund mechanism gives refunds to taxpayers based upon their income tier, with those in the highest income brackets receiving a greater refund. The problem is that this mechanism is regressive, meaning it disproportionately benefits wealthier Coloradans. The formula governing this mechanism was based on research in the 1990s that showed higher earners paid more in sales taxes. However, even if higher earners pay more sales taxes in total, lower- and middle-income earners pay a higher percentage of their income in sales taxes than the wealthiest. Typically, this money is sent out during the next year’s tax season. For instance, rebates stemming from the FY 2022-23 TABOR surplus would be sent in April, 2024.

While this is the status quo, the Colorado legislature has wide discretion on how best to spend the money over the Referendum C cap. Since the first rebates were sent for FY 1996-97, rebate mechanisms have consisted of narrow tax credits, income tax cuts, money to counties to backfill property tax reductions, checks to taxpayers, or a combination of them all. As noted below, lawmakers have options to structure rebates in equitable, targeted ways that help Coloradans who need it most.

Property Tax Relief

Spiking property values and voters’ repeal of the Gallagher Amendment, a constitutional amendment limiting residential property taxes, have resulted in rising property tax bills and pressure on state lawmakers to lower those bills. Recognizing this problem, in 2022 lawmakers passed SB22-238. This bipartisan bill decreased assessment rates for residential and non-residential properties, as well as exempted from taxes the first $15,000 of residential property values and the first $30,000 for commercial properties. Lawmakers, however, understood that these changes could harm local governments dependent upon property tax revenue. As a result, SB22-238 set aside $200 million of the FY 2022-23 revenue over the Referendum C cap to backfill revenue lost by local governments as a result of the above-mentioned property tax changes. Notably, SB22-238 only applies to 2023 and 2024 property taxes.

The trend of escalating property values continued, and many property owners experienced sticker shock when they saw their 2023 property tax bills, which were driven by property valuations made at the height of the market in June, 2022. SB23-303, which lawmakers approved in the final days of the 2023 legislative session, asks voters to approve a 10-year plan to cut property tax increases. It includes reducing the amount of property value that is taxable and reducing the assessment rate. In addition, the plan would set aside dollars to ensure local governments and schools, which heavily rely on property taxes, would not experience revenue losses. To have money available for schools and local governments, the initiative that will appear on the November 2023 ballot also will ask voters to increase the TABOR cap on spending. As stated previously, the fate of flat TABOR rebates to be sent in 2024 hinges on the vote for this plan.

Tax Credits

Until 2005, most TABOR rebate dollars were sent to taxpayers in the form of various tax credits, both for individuals and businesses. After 2005, however, an income tax cut was introduced as a rebate mechanism, and the tax credits were either eliminated or became part of the normal budgeting ledger.

Because tax credits lower the amount of tax revenue the state collects – by reducing the amount of taxes owed by businesses, individuals, and families – they are a common way to utilize TABOR surplus dollars. Tax credits are allowed to be part of the TABOR rebate mechanism because they do not require direct appropriations. Because these credits can be easily targeted, they can be very popular.

There are nearly $700 million in tax credits that were introduced in the 2023 legislative session. Most did not pass both chambers, but for the ones that have – like tax credits for the purchase of products that reduce carbon emissions and pollution – the revenue over the cap presents a good opportunity to support these important initiatives.

An example of tax credits that will help numerous Colorado families – and Colorado’s economy overall – are the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC). HB23-1112, which passed this legislative session, greatly expands the Colorado EITC and the state CTC. These tax credits are proven tools to help families stay out of poverty, provide buffers against emergency needs, and stimulate local economies. Using revenue over the cap for targeted tax relief that helps people who need it is good fiscal policy.

In the 2023 legislative session, approximately $130 million in tax credits were passed and awaiting enactment. Along with the EITC and CTC, several tax credits were approved including tax credits for individuals that retrofit a home for health reasons, tax credits for teachers who get an externship in STEM fields, tax credits for manufacturing semiconductors, incentives for utilities to purchase cleaner energy, and many others that incentivize smart policy.

These tax credits, however, will cut into the dollars over the Referendum C cap starting in fiscal year 2023-24 and will not affect the dollars to be sent to taxpayers in 2024 from fiscal year 2022-23.

Checks for Coloradans

In 2022, state lawmakers made a progressive decision in structuring rebates. They decided that every taxpayer should get the same $750 check, instead of varying that rebate based on income. There ended up being $3.73 billion in revenue over the cap for FY 2021-22, and the legislature passed SB22-233 to govern just that one year of rebates. This was a historic move, as it replaced the six-tier sales tax rebate mechanism and ensured a more equitable formula governed the revenue sent to taxpayers. The chart below shows how that equity-focused decision changed the amount of money received by people in various income brackets. (The reason the numbers are not equal under SB22-233 has to do with the fact that the income tax rate reduction that was part of the refund mechanism prior to the 2022 election is included in the numbers.)

The legislature chose to pass HB23-1311, which would again give equal refunds, but it’s tied to the outcome of Proposition HH and it would only be for one tax year. The chart below shows projected TABOR refunds with, and without, the equitable rebate bill passed late in the session.

Fund Public Investments

During the legislative session, there were discussions about presenting voters with the choice of using some revenue over the cap to fund important public programs, like K-12 education. Under TABOR, Coloradans would have to vote affirmatively to allow this use of money over the Referendum C cap. This process is commonly known as “debrucing.” With a question on the November 2023 ballot, voters could choose to use some or all of the revenue to bolster public programs like education, infrastructure, or child care. This was the idea behind Proposition CC, which failed at the ballot in 2019. With SB23-303, voters will have a slightly different choice on this matter, as they will be asked to set aside 1 percent of dollars over the cap to be used to fund local government services and public education.

Income Tax Cuts

A proposal that has been discussed at the state Capitol is to bring back income tax cuts as part of the TABOR rebate mechanisms. From 2005 until 2022, an income tax cut was part of the TABOR rebate formula. When there was enough money over the revenue cap, tax rates were temporarily reduced to 4.5 percent. But with the passage of Proposition 121 – which permanently lowered the income tax rate to 4.4 percent – an income tax rate reduction is no longer part of the TABOR rebate mechanism. Nevertheless, some policymakers think Colorado should revive the temporary income tax rate reduction as part of the TABOR rebate mechanisms and bring the rate down toward 4.35 percent or lower.

The problem with using income tax cuts for the purpose of rebating money over the cap is that these dollars overwhelmingly go to the wealthy. Because Colorado has a flat income tax rate – which is mandated by TABOR – wealthier Coloradans would receive larger rebates, and there would be relatively little tax relief for everyone else. Compared to the other options above, an income tax cut would be best for the wealthiest Coloradans, but would do little to help many of those Coloradans who are struggling.

Bottom Line

Colorado lawmakers had many options to consider as they contemplated how to rebate the billions of dollars over the Referendum C cap. For the coming rebate year, the General Assembly voted to tie equal TABOR refunds to the fate of the property tax relief measure, which voters will decide on in November. However, those equal refunds will only be for one year. Questions about what to do with money over the Referendum C cap would remain, particularly those centering on ways to ensure rebates are fair and targeted.