Colorado’s Revenue Base – 2023 Update

Colorado's Revenue Base 2023 Update

Colorado’s General Fund, where statewide income and sales taxes are deposited, pays for services in health care, public education, corrections, the judiciary, natural resources and state parks, and much of the new revenue coming in only covers caseload growth, and not new programs. Constraints imposed by the Taxpayer Bill of Rights (TABOR) have left this fund unable to keep up with demand for increased funding for K-12 education, higher education and health care, among other needs. There is very little room in this fund for expanding or adding programs that Coloradans want and need. Even as state revenues have increased, TABOR has restricted additional spending for necessary services.

This report will start by refreshing the Bell’s prior report on the General Fund, as well as take a closer look at K-12 funding, which makes up the largest share of the General Fund. Changes in K-12 spending have a significant impact on potential funding for other areas.

But that is only part of the story. Facing high inflation and economic uncertainty, Colorado must prepare for potential fiscal downturns. Examining the impacts of prior recessions reveal painful lessons and programmatic cutbacks.

Key Facts

- While COVID-19 forced significant cuts to the 2020 budget, the macroeconomic recovery was quick and complete, putting the state in a much stronger economic position than originally projected.

- TABOR surpluses are projected to be more than $5 billion over the next three fiscal years, and without updates to state statutes, may well be rebated to taxpayers in a regressive manner.

- Income taxes, as a percentage of General Fund revenue, have decreased, while excise taxes from marijuana, alcohol, and gambling have increased.

- It took 10 years from the beginning of the Great Recession for K-12 education spending to significantly increase, showing how important it is to prepare for economic downturns when the economy is doing well.

- Past recessions show that inadequate reserves limit government’s ability to weather economic downturns. Policymakers seemed to have learned and are now putting away reserves to deal with future economic uncertainty.

- More than $500 million in income tax cuts over the last three years make Colorado less prepared for significant economic shocks.

General Fund Update

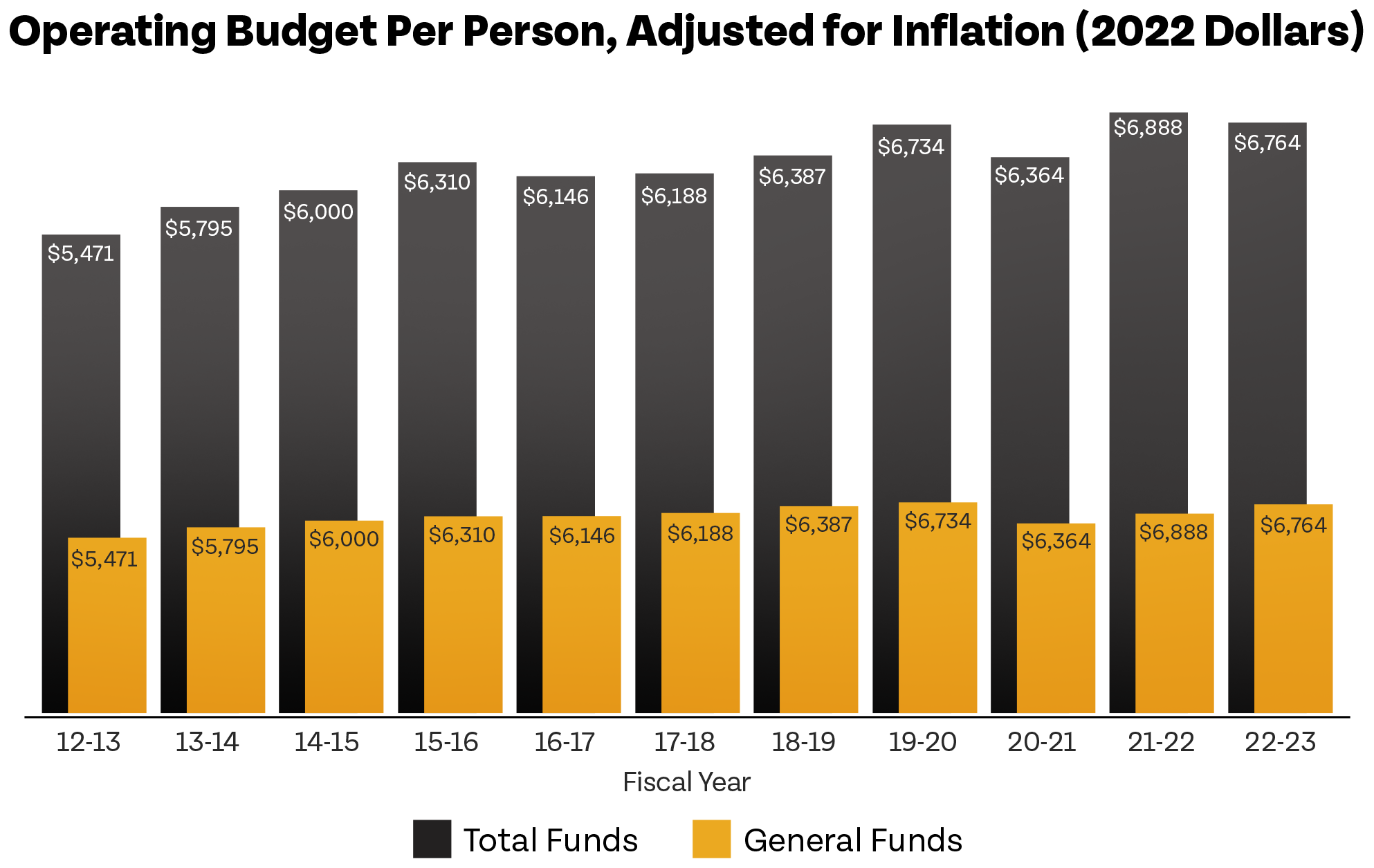

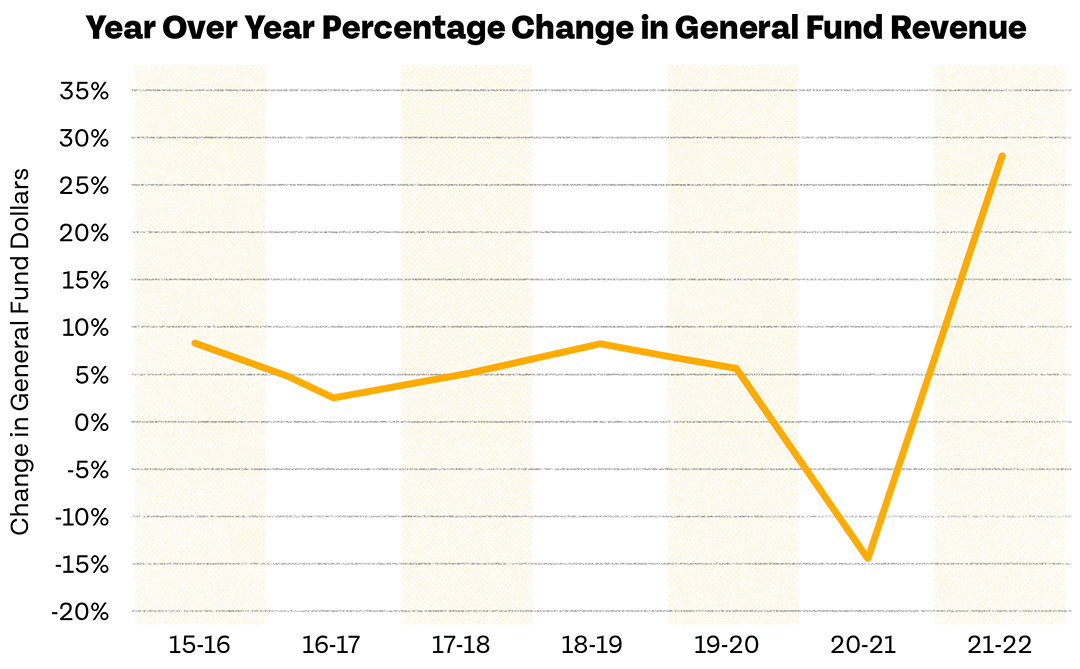

The Bell’s last analysis of the state’s General Fund encompassed the 2019-20 fiscal year, but none more recent. The economic turmoil wreaked by the COVID-19 pandemic made rational comparisons to pre-COVID years difficult, if not impossible. With the macroeconomic recovery and a relative stabilization of economic conditions, it’s possible to recalibrate. Pandemic projections for 2020 had predicted severe declines in revenues, the worst of which did not come to pass. Instead, growth in the state’s General Fund, when adjusted for inflation, has been nearly flat in the last two budget years.

The graph above shows, on a per capita basis, how lawmakers responded to the COVID-19 pandemic. The graph below shows the volatility of the General Fund in this timeframe as lawmakers quickly made severe budget cuts and revenues rapidly rebounded. Over time, General Fund growth, when adjusted for inflation and population, has been nearly flat.

An interesting finding that comes out of the last three years is that the percent of the General Fund coming from income taxes dropped significantly from FY 2019-20 to FY 2020-21, falling to 60.5 percent. This is the lowest share of the General Fund ascribed to income taxes since the turn of the millennium, when Colorado was recovering from a recession. From FY 2008-09 through FY 2019-20, income taxes made up anywhere from 63.5 percent to 66.4 percent of the General Fund. But during the last three fiscal years, that number has not gone above 60.9 percent.

Based on data published by the Department of Revenue, much of the above-mentioned change is due to significant increases in various excise taxes that go to the General Fund. For example, marijuana sales taxes that go into the General Fund increased by 28.2 percent from 2020 to 2021, while alcohol sales taxes increased by 20.4 percent, and gaming taxes increased by 75.5 percent. Over the last decade, statewide sales tax revenue has stayed relatively flat as a percentage of General Fund revenue.

While it is unclear how durable this relative shift is – income taxes still make up the majority of General Fund revenue – it is a trend worth following. And if it were to continue, a shift away from income taxes to excise taxes would be a regressive one, as sales and excise taxes disproportionately affect low- and middle-income families.

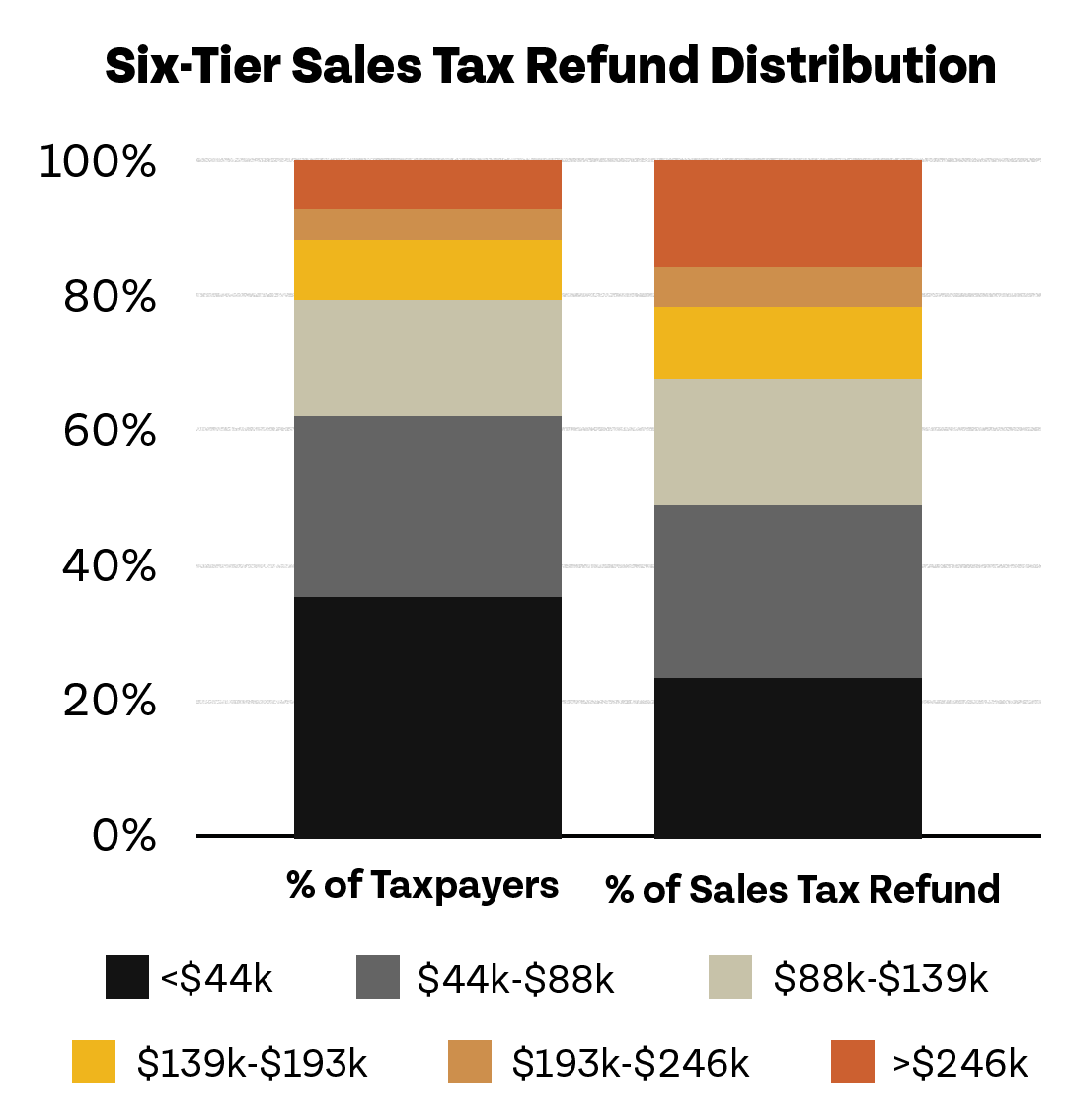

The other important update concerns the projected TABOR surpluses over the next few years. The passage in 2022 of Proposition 121 (an income tax cut that will cost the state about $440 million in revenue in FY 2023-24, a number that will increase annually) and Proposition 123 (a measure which earmarks $300 million in income tax revenue annually for affordable housing programs) will significantly reduce TABOR surpluses. But TABOR rebates are still projected to exist. In fact, according to Legislative Council Services, they are projected to be more than $5 billion over the next three fiscal years. And, according to current law, these surpluses would be rebated to taxpayers in a largely regressive manner.

The legislature already has earmarked about $240 million of FY 2023-24 TABOR surpluses for property tax relief. Governor Polis has requested an extra $200 million for more property tax relief that would further reduce the money above the TABOR cap, although it will be up to the legislature to decide if that should be included in the budget. After that money has been spoken for, the remaining dollars will be rebated through a sales tax rebate. A temporary income tax cut has been a rebate mechanism in previous years, but due to Proposition 121 passing – which reduced the income tax rate to 4.4 percent, below the statutory income tax rate for TABOR rebates – that is no longer in effect. Below, is the distributional look at how a sales tax rebate works.

Without changes in state law, the wealthiest will get a huge return from the TABOR surpluses. The rest of Coloradans will get much less by comparison and important community programs like schools, mental health services, public safety departments, and many other priorities will get less than adequate funding. This showcases one of the biggest problems with TABOR. Other states can invest all of their revenue in public priorities. But Colorado cannot because TABOR requires funds over the allowed limit – to be sent back to taxpayers. So instead of improving schools, roads, health care, public safety, environment, and many other areas within Colorado, the state sends it to taxpayers.

Colorado’s revenue cap makes it difficult to sustainably invest in needed programs and meet the evolving needs of residents, even with a robust recovery from the worst of the economic effects of the COVID-19 pandemic. As we discuss in the next section, these challenges directly impact one of the largest and most critical aspects of our budget – public education.

Public Education Funding

Colorado has long tried to figure out a sustainable way – one that isn’t beholden to boom or bust economic cycles – to fund K-12 education, which is the single largest line item in the state budget. Amendment 23, which passed in 2001, was meant to help with this. The Amendment mandates that one-third of 1 percent of Coloradans’ federal taxable income be used for K-12 education and that per-pupil funding be increased by at least the rate of inflation on an annual basis. The passage of Amendment 23 created the State Education Fund to receive the tax revenue earmarked specifically to support K-12 education.

One of the main reasons that Amendment 23 was necessary is that the local share of K-12 education funding, which is supposed to be the primary funding mechanism for public education, was stagnant as a result of constitutional amendments (TABOR and Gallagher) that kept forcing residential property assessment rates down. This meant state government had to step in even more to ensure that public education was adequately funded. With the state doing more to fund education, funding for every other program depending on the General Fund was constricted.

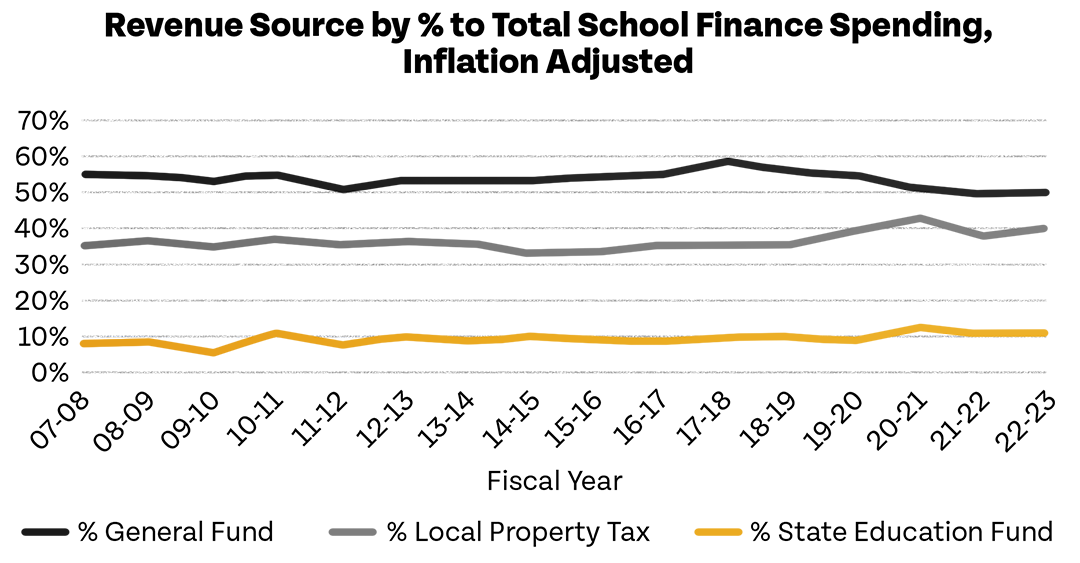

Given that State Education Fund revenue is well below what is needed to cover the state share of K-12 costs, the General Fund is the largest source of education funding.

As will be discussed in more depth below, the state’s ability to invest in the K-12 system has been largely dependent upon Colorado’s fiscal health. In good times, the state is able to put more money into the public education system. For example, largely due to a massive influx of federal funds, the state was able to increase K-12 funding by 7.5% for FY 2022-23. However, during severe downturns, as we’ll illustrate in more detail below, education often suffers significant cuts.

These historical examples remind us that changes in economic conditions force difficult budget choices for some of the state’s most important budget priorities. During downturns, when General Fund revenues drop, the state is forced to either cut K-12 services, or – in order to maintain extant funding levels – cut into other important programs funded by the state. It also reminds us of how interconnected state and local funding are. Higher local revenues alleviated pressures on state funding.

Preparing for Economic Uncertainty

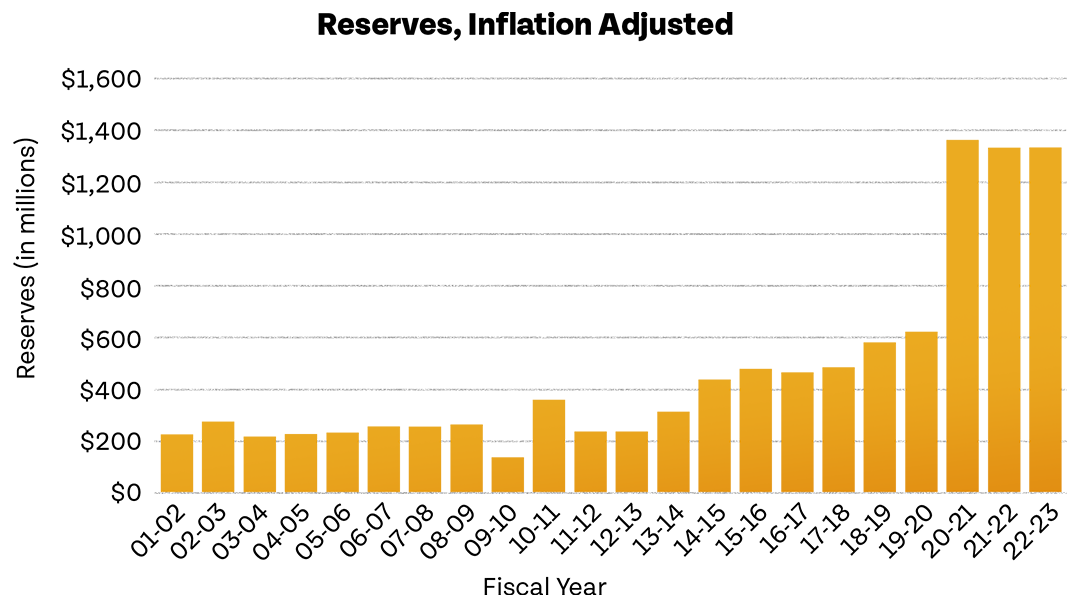

Given the current economic uncertainty – inflation, supply chain struggles, and global turmoil in energy markets – it is very important that budget writers are prepared for possible downturns in the state’s economy. A history of Colorado’s reserves, as a percentage of General Fund revenue, shows that, in some ways, we are now more prepared than ever for a downturn.

But what does an “economic downturn” actually mean in practice? What happens to Colorado’s General Fund and the programs that depend on the revenue when the state’s revenue dips and lawmakers have to make tough choices? In the 2000s, prior to COVID-19, there were two major recessions that caused economic distress in Colorado: the dot-com crash at the beginning of the millennium and the Great Recession that started in late 2008 and went into 2009. Looking at how the legislature managed these events provides insight into what to expect and how to handle it going forward.

Early 2000s Recession

The burst of the dot-com bubble, combined with the aftermath of the September 11th terrorist attacks, caused a recession in 2001. However, the peak of unemployment from the recession didn’t occur until the middle of 2003. The General Fund in Colorado dropped by 4 percent in 2002 and then an additional 10 percent in 2003. While Colorado was able to weather FY 2002-03 budget by shifting some costs toward user fees — instead of using tax revenues — and leaning on federal funds in some areas, the fiscal year 2003-04 budget was much worse.

The following denote drops in General Fund revenues for various departments:

- The Department of Agriculture dropped by 50 percent,

- The Department of Higher Education dropped by 13.7 percent,

- The Department of Natural Resources dropped by 12.5 percent, and

- The Department of Public Health and the Environment dropped by 23.5 percent.

While other departments saw modest increases, some of the cuts and shifts in the budget were stark. For example,

- Financial aid for colleges dropped by 16 percent with need-based grants being cut by 12.7 percent, or $5.6 million, and merit-based aid cut by 53 percent, or $8 million.

- About $4 million was cut from mental health programs and $5 million cut for developmental disabilities support.

- $7 million was cut from the Division of Youth Corrections.

- Approximately $12.5 million in General Fund revenue for the Departments of Agriculture, Local Affairs, Public Health and Environment, and Revenue was replaced by revenue from user fees.

Replacing General Fund dollars with user fees does not necessarily mean services are cut. Instead, those using the service are directly responsible for the cost. Problematically, when user fees are assessed on common, necessary public services, they disproportionately impact low- and middle-income families. During the dot-com recession, there were some shifts to fees that made sense, such as those that had ranchers pay fees for agricultural inspections instead of using General Fund tax revenue. However, others were far more burdensome to low- and middle-income families. For example, the legislature instituted a drinking water fee that impacted nearly all Coloradans.

It’s crucial to keep in mind that Colorado had very little in General Fund reserves at this time. The state’s reserves were only about 3-4 percent of General Fund revenue in the early 2000s, which was not nearly enough to shore up the budget. Furthermore, the legislature had just cut taxes at the turn of the millennium – twice, in fact, to go from a 5 percent income tax rate to a 4.63 percent rate – because of projected TABOR surpluses. That meant there was less money coming into the General Fund than there would have been.

The Great Recession

The Great Recession of late 2008 through 2011 caused significant economic disruption around the country for hundreds of millions of people. Of course, Colorado’s budget was also hit hard. General Fund revenues decreased 15 percent over FY 2009-10 and FY 2010-11, the impacts of which were felt statewide.

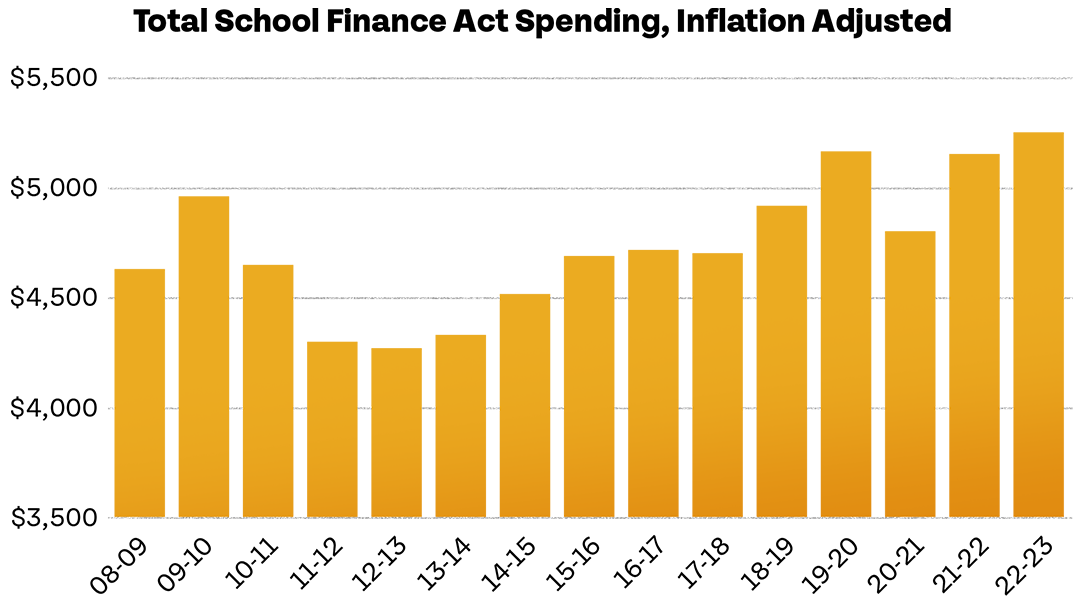

Notably, the FY 2009-10 budget was the first year the Budget Stabilization Factor (BS Factor) was established as a way for the legislature to not fully fund K-12 education, which was required by Amendment 23. In that year, the legislature put in place a $130 million IOU for K-12 education, and it has grown since then. Last year, the BS Factor was $321.2 million, and since 2009, the cumulative IOU for K-12 education is $9 billion.

During FY 2010-11, because the economy had yet to stabilize, cuts to education were even more severe. The legislature reduced General Fund revenue to K-12 education by 2 percent, which was a cut of $256 per pupil in Colorado. Year-over-year changes in K-12 General Fund expenditures, shown in the graph below, speak to the severity of the recession and illustrate how long it took for funding to return to pre-recession levels.

The School Finance Act is an annual piece of legislation that delineates the amount of money to fund public K-12 schools through state and local dollars. It took a decade for inflation-adjusted K-12 education spending through the School Finance Act to return to pre-recession levels. Because school finance spending is such a large part of the General Fund, when significant cuts happen there, it is harder to make up the full amount in a typical budget cycle. Furthermore, education funding must be sustainable. It’s fiscally irresponsible to use one-time money for recurring costs such as teacher pay raises or ongoing social and behavioral student health programs.

Education wasn’t the only program hurt as a result of the Great Recession.

Other budgetary impacts of the Great Recession include:

- Colorado voters passed Amendment 35 in 2004 to fund health care programs through an increase in tobacco taxes. However, in FY 2010-11 the legislature redirected $12 million from a primary care program established through Amendment 35 to plug other holes in the budget.

- Newly imposed fees on providers and patients were substituted for $89.7 million in General Fund revenue in the Department of Health Care Policy & Financing.

- Provider rates were cut significantly, impacting both patients and providers throughout the state. Provider rates for the Department of Human Services – including those servicing Medicaid developmental disability support and the Division of Youth Corrections – were cut from .5 to 1 percent below FY 07-08 levels. Also, there was a 1 percent rate cut for providers in the Medicaid medical program.

It is also important to remember that cuts would have been much worse without the federal government’s support. The American Recovery and Reinvestment Act patched many holes in the state budget temporarily. Federal help in times of deep economic distress has occurred previously. For example, in FY 2009-10 the General Fund portion of the budget for the Department of Higher Education was cut by 35 percent, but increased federal funding nearly closed the gap, allowing post-secondary institutions across the state to maintain services. However, there is no guarantee the federal government will act to fill gaps caused by future downturns.

In less severe economic downturns, legislators can trim program expenditures knowing that even small cuts will have negative consequences. But in major recessions it’s not possible to trim the margins and still balance the budget. That is why lawmakers made significant cuts in K-12 education and various health care programs in the Great Recession. Lawmakers often turn to K-12 education and health care when large budget cuts are necessary because those are the two largest parts of the General Fund.

Is Colorado Currently Prepared?

In some ways, Colorado is more prepared for an economic downturn than it has been in recent years. Colorado’s reserves – a pot of money set aside in case of future need – is as high as it has been since the passage of TABOR, giving legislators a good buffer if there is a downturn. Furthermore, the BS factor – the annual factor by which education funding is lowered from where it should be, according to Amendment 23 – is lower than at any time since 2010. Those two facts leave Colorado in a better place for any type of decrease in General Fund revenue.

But digging deeper shows systemic issues and long-owed debt.

First of all, even though the annual BS factor is lower than at any time since 2010, it is still quite high. As of FY 2022-23, it meant that $321 million was deducted from the amount the state constitution requires for K-12 education. That is an underfunding of slightly more than $380 per pupil across the state. Additional cuts to education would increase what Colorado owes schools, teachers, and students, which is $9 billion.

Colorado also is facing some significant budgetary problems given the state’s growth and the inability of the budget to grow at the same pace. As we wrote last year in our Revenue Base Part 2 report:

According to the Centers for Medicare & Medicaid Services, Medicaid spending is expected to grow at 6 percent on average between 2020 and 2027. For Colorado, this 6 percent increase is very close to the expected increases in the TABOR cap – the projected addition of population growth and inflation. This increase would put the state share of Medicaid premium spending at about 18 percent of the General Fund budget. Combined with K-12 education spending, that would be more than 45 percent of the budget for just two important programs.

Combined with the fact that Medicaid spending grows in recessions due to increased unemployment and economic hardship, an economic downturn would substantially squeeze the state’s ability to fund every department adequately. As has been the case in previous recessions, discretionary health care and education funding would be cut if the downturn were severe enough, just to meet basic expenses in other parts of the government and in local communities. So while Colorado might have up to 15 percent of our budget in reserves for a rainy day, legislators would have to deplete nearly all of it in a severe recession just to preserve current funding – assuming the federal government does not step in.

Moody’s Analytics does a stress-test of state budgets on an annual basis to determine preparedness for a “moderate” recession.” Their latest report, published in September 2022, finds that Colorado would need 19.1 percent of General Fund revenue in reserve to cover the projected loss of revenue and increased Medicaid spending that would happen in a moderate recession. Having 15 percent in reserves leaves Colorado close to what would be needed in a moderate recession, but depleting the reserves quickly would leave Colorado financially vulnerable in the event of continued shocks or a protracted recovery.

Another worrying aspect is that Colorado continues to cut income taxes – the primary source of funding for the General Fund – reducing overall General Fund revenues. In 2020, voters approved an income tax rate decrease from 4.63 percent to 4.55 percent. Then in 2022, voters approved another income tax rate decrease from 4.55 percent to 4.4 percent. Combined, these tax rate decreases will reduce revenue by more than a half-billion dollars on an annual basis. In a severe economic downturn, which would surely cause TABOR surpluses to disappear, that $500 million plus could have been used to shore up funding for many departments. Of particular note is that those tax cuts overwhelmingly benefit the wealthiest Coloradans, as well as force cuts to programs in the future.

Colorado is more prepared for a recession than it has been in recent years, and that is a credit to prudent decisions made by policymakers. Colorado has used the last two fiscal years – which have been strong – to prepare for downside risks, which is wise. But given how much time it takes the state to recover from economic downturns, Colorado needs more than temporary fixes to help keep the state above water during recessionary times. Sustainable revenue best prepares Colorado for economic downturns and the tough recoveries that often follow.

Conclusion

The state’s elected officials have worked hard to put Colorado in the best place possible in the face of economic uncertainty and the rising chances of an economic downturn. Increasing state reserves to provide a buffer, and paying down the BS factor in good times are both smart and prudent fiscal choices. However, a recession, or even a smaller negative economic shock, could force cuts that would not just reduce program funds, but cut resources for Coloradans. As past recessions have shown, this is not just a one year problem; deep cuts would take years to recover from, as happened in the Great Recession.

The economy goes through peaks and valleys. But what sets strong state economies apart from others is the ability to continue providing essential services at adequate levels in good times and bad. Colorado has a strong economy, but economic downturns can radically reshape the state’s ability to provide for Coloradans. Policymakers have taken some important steps to put Colorado in a better position for the future, but the state is still at risk of longer and deeper economic downturns because of income tax cuts, revenue limits, and constitutional restraints. Colorado must find a way to bring more revenue into the system in a way that doesn’t disproportionately fall on low- and middle-income families, and do it sustainably so that the state can invest in communities now, and weather bad economic storms later.