TABOR Rebate History

TABOR Rebates History

Updated 12/20 based on numbers from December 2022 Economic Forecast

Colorado is in the midst of historic TABOR rebates and it is important to step back and understand the larger context and how the state legislature has historically sent lawfully collected tax revenue to Coloradans. Money over the revenue cap – known as TABOR surpluses – can be a significant portion of money collected. This past year, even as core public services remained underfunded, more than $3.5 billion had to be sent to Coloradans in the form of tax credits, income tax cuts, and cash. But in the past, this money has been used to provide relief to different groups around the state, and how to use this money in the future is not a settled question.

TABOR Rebates and Current Situation

Colorado stands apart from most states with its constitutional spending limit. Revenues are subject to an outdated and arbitrary formula (population growth plus inflation) that requires tax revenue above the limit to be sent to Colorado taxpayers. Every year the state’s General Fund expenditures can only increase by that formula. As a result, Colorado cannot spend all of its tax revenue to fund important public priorities like schools, health care, or roads.

As long as these limits are in place, it is crucial to understand what the legislature has done previously as it confronts questions about how to deal with revenue above the limit in the near future. Legislative Council Staff projects $5.37 billion of such funds over the next three fiscal years. The legislature has already earmarked about $240 million of fiscal year 2023-24 TABOR surpluses for property tax relief, and since the 2022 election, TABOR surpluses have been reduced by more than $700 million on top of that because of ballot measures that reduced the income tax rate and set aside 0.1 percent of income tax revenue for affordable housing programs.

Prior to 2019, Colorado never had TABOR surpluses above $1.04 billion (the amount in fiscal year 1999-2000). Now, the state is facing projected surpluses significantly higher than that for at least the next three years.

Over the first couple of decades that TABOR was in place, the Colorado legislature had used the TABOR surplus as a way of paying out various tax credits and deductions. The legislature used these as a way of funding public priorities, including the Earned Income Tax Credit, a deduction for charitable contributions, tax credits for rural health providers, and providing support to hardworking Coloradans who may have needed a helping hand. These credits and deductions included credits for businesses, wealthy individuals, agricultural interests, and low-income families.

However, it is crucial to remember that when faced with projected TABOR surpluses that were higher than expected in 1999 and 2000, the legislature made permanent income tax cuts that reduced revenue coming to the state. These were not TABOR rebates, even if they functioned as such, temporarily, because they were permanent tax cuts in response to temporary economic boom times. In 2001 and 2002 the United States faced a recession that made this fiscal decision seem shortsighted.

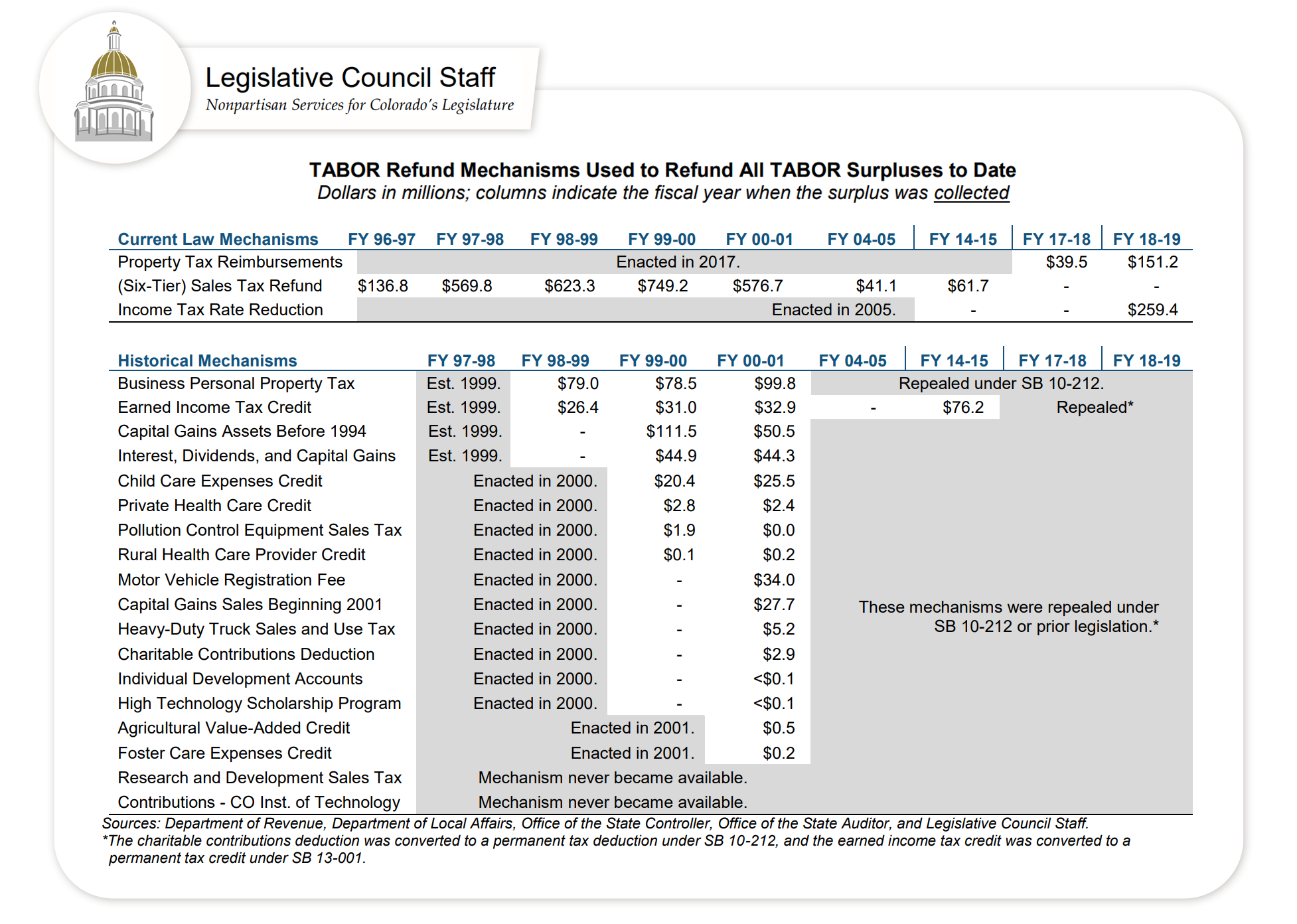

Legislative Council Staff has documented the various historical mechanisms in great detail:

The current mechanisms for giving this money to Coloradans are: the six-tier sales tax mechanism, which rebates percentages of the TABOR surplus based on the estimated consumption of various income groups, and property tax relief in the form of the Senior and Disabled Veteran Homestead Property Tax Exemption. A temporary income tax cut was a TABOR rebate mechanism as recently as this past year, but with Proposition 121 passing – which reduced the income tax rate to 4.4 percent – the tax cut is no longer an active mechanism. The six-tier sales tax rebate has been in place since the first rebate in FY 1996-97, the temporary income tax reduction was not active until 2005, and homestead exemption tax reimbursements were not part of TABOR rebates until 2017.

Ultimately, the legislature has wide discretion on how best to send out the money over the TABOR cap, as mandated by the Colorado Constitution. Since a successful ballot measured lowered the state income tax rate to 4.4 percent, there are questions as to how the legislature will decide to structure rebates going forward and whether whether the temporary tax cut would disappear as a rebate mechanism.

Considering Equity in TABOR Rebates

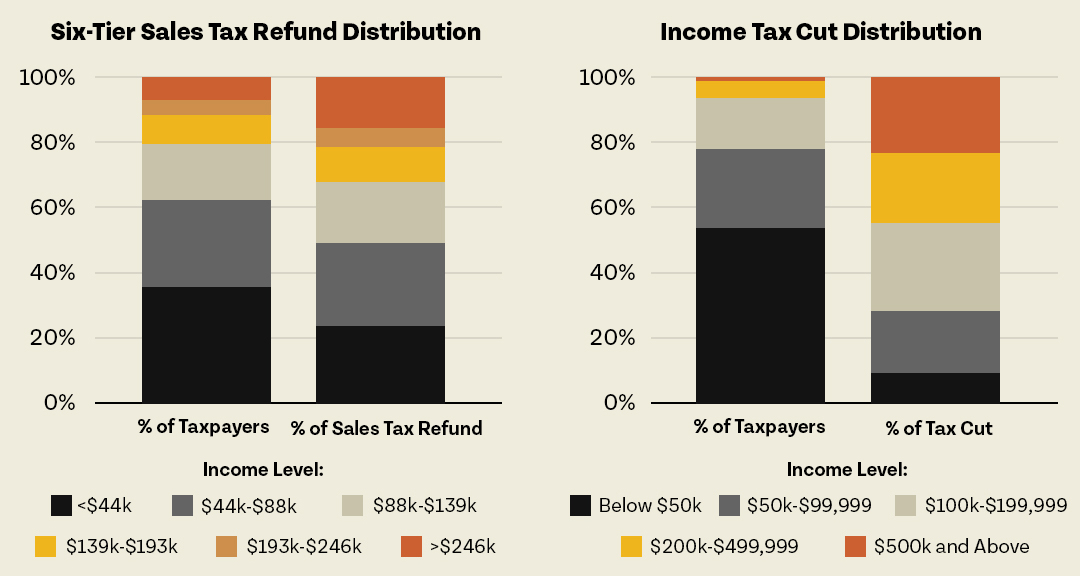

Some of these tax credits and deductions may have been misguided, as these public funds should not have gone to the already wealthy. For example, over $120 million was spent on tax credits for various types of capital gains – these are gains on assets sold and then the gains are taxed – in fiscal year 2001. While many people may have capital gains, the majority of the revenue that went to tax credits on capital gains likely went to the wealthy. In contrast, only $32.9 million was spent on the Earned Income Tax Credit in that year, showing misplaced priorities on who should benefit from tax breaks.

Another interesting aspect of the tax credits highlighted above, is that some of them have moved into being paid from the General Fund, as opposed to only in TABOR surplus years. The Colorado Earned Income Tax Credit became a permanent feature in 2013, and increased in amount in 2021. The Charitable Deductions Tax Credit was made permanent in 2010 and has been modified to keep pace with state needs in subsequent years. The Child Care Expenses Tax Credit is also a permanent tax credit in Colorado. This proves that in some ways, dollars from TABOR surplus go to things that should be funded more permanently, but the lack of capacity in the General Fund confronts lawmakers with difficult choices – choices that are made more complex when Colorado cuts income taxes that reduce overall state revenues.

The big takeaway from the above chart is that state lawmakers can look to clearly established precedents for using money collected above the TABOR cap as a way to meet collective priorities and promote economic mobility in Colorado.

This year, the legislature passed a one-time law to make the Sales Tax Rebate Mechanism equal for all taxpayers — $750 checks for all — instead of an amount based on one’s income. This made the rebates more fair and showed the capability of the legislature to make changes to help those who need it. However, that was just for 2022 tax year, and future TABOR rebates will be based on traditional mechanisms unless modified.

Why Are TABOR Surpluses So Big?

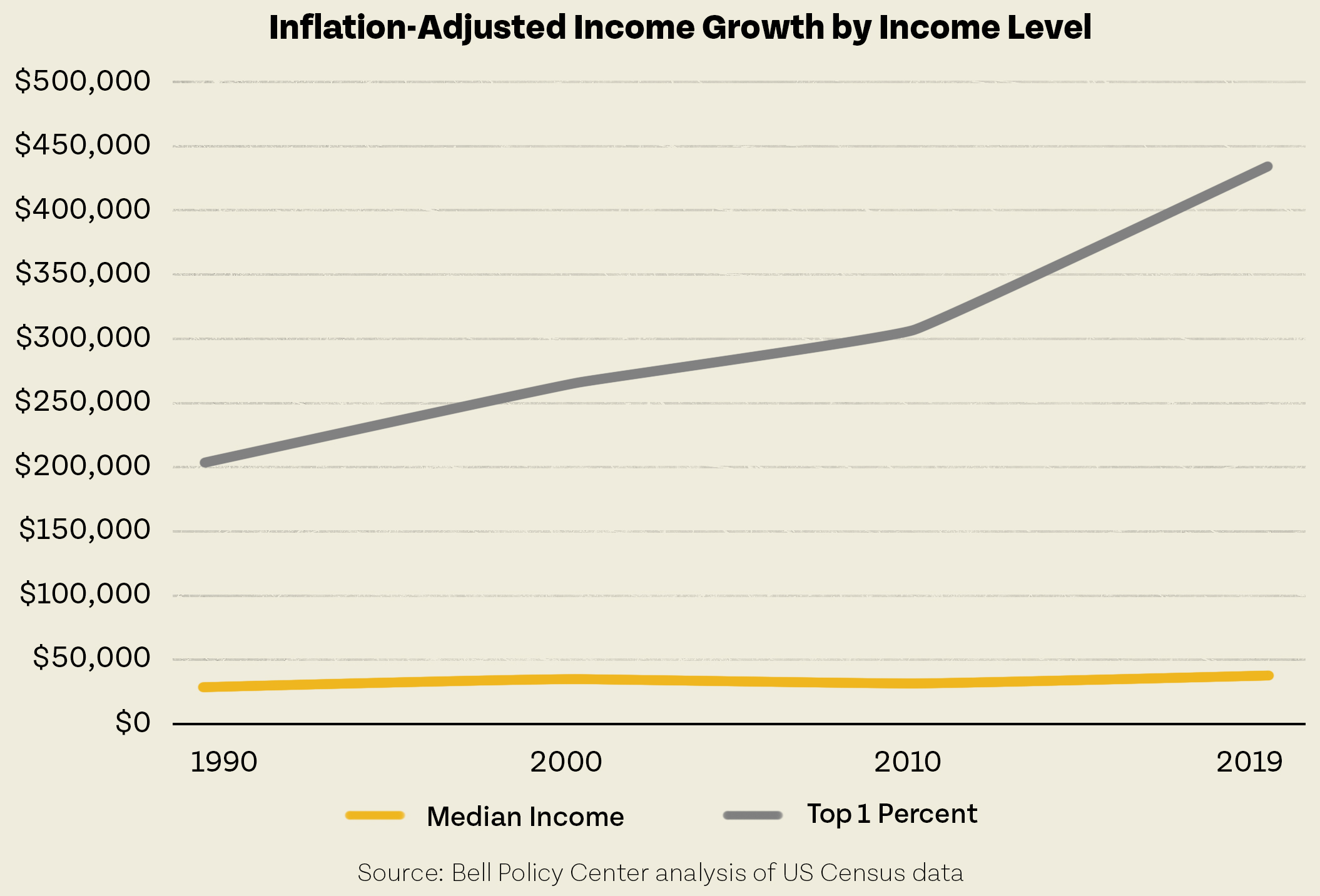

An important question in considering Colorado’s fiscal future is whether the current and projected TABOR rebates are a blip due to current economic circumstances or a continuing theme attributable to structural problems. One issue stands out, however, when looking at Colorado, and broader trends. While further research is needed to understand the true correlation, it is hard to see the increase in income inequality – especially the increase in income by those in the top 1 percent – and not think that it is playing at least some role in boosting tax revenues above the TABOR limit.

Remember, the formula to determine how much our state is allowed to spend is population growth plus inflation. That does not take into account personal income growth, or any other metric tied to how much revenue is to be taxed, and so a rise in income at the top, could push revenue above the limit.

When looking at types of tax revenue in the General Fund and whether certain taxes – for example taxes on investment income – push the General Fund into TABOR surpluses, there does not seem to be much correlation. There was not a TABOR surplus in fiscal year 2016-17, while FY 2018-19 had a small TABOR surplus. However, there was very little difference in those years in percentage of General Fund revenue from individual income taxes, corporate income taxes, sales and use taxes, and taxes on investment income. So it would seem those would not be the reason for TABOR surpluses.

As Colorado’s budget landscape comes into clearer focus and as the stakes of a shrinking surplus grow higher, Colorado lawmakers face a stark choice — benefit everyone or benefit the wealthy. TABOR surpluses, when structured as traditional sales or income tax rebates, have largely benefited Colorado’s wealthiest residents. However, as they demonstrated last year, legislators have the ability to shape the distribution of those surpluses in ways that support greater goals such as tax fairness and community investment.