Tax Fairness & Economic Mobility in Colorado

Who we are

Welcome to the Bell Policy Center. For over twenty-years, we have worked to inform voters about Colorado’s unique fiscal issues and advance economic mobility across the state.

What are the issues?

- Colorado consistently struggles to fund services like schools, roads, mental-health, housing, and more.

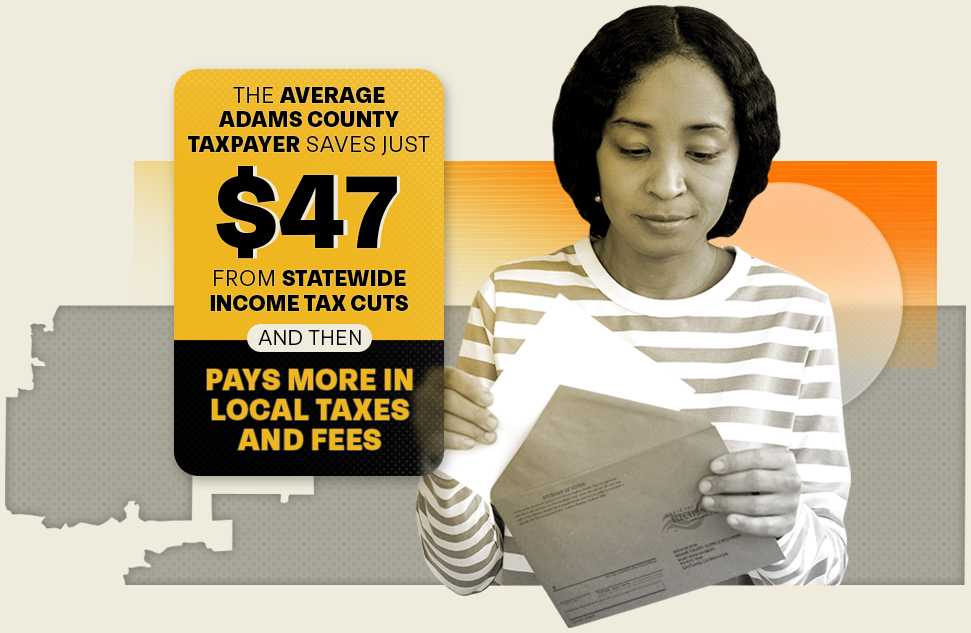

- Voters and elected officials have cut Colorado income taxes 3 times since 1999. The subsequent drop in revenue collected is why Colorado struggles to fund many public programs.

- Income tax cuts save thousands of dollars for millionaires around the state. When that cuts into public funding, local governments then have to ask for tax and fee increases to make up for the lack of tax revenue coming into communities.

Why does this happen?

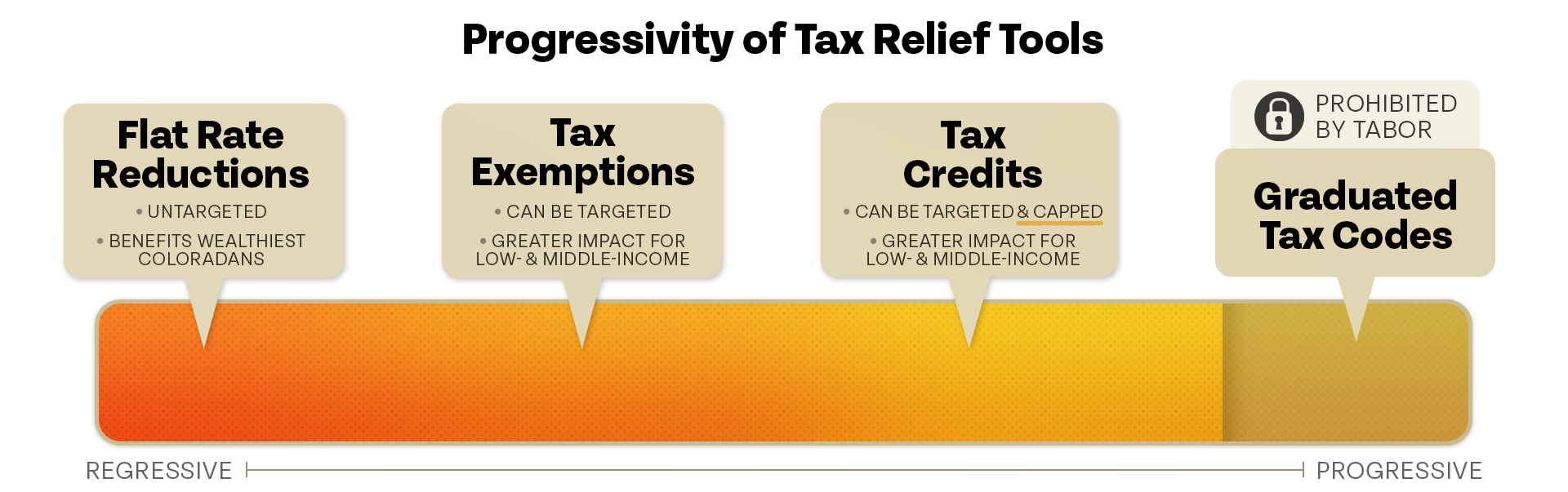

In 1992, Colorado passed TABOR which sets a cap on the amount our state can invest in communities. The cap level is based on population & inflation. TABOR also bans “graduated tax codes”, which means you can’t cut taxes for regular Coloradans who need relief, without also cutting them for the top 1% who do not. Additionally, TABOR prohibits other kinds of progressive taxation that could ensure wealthy Coloradans are paying their fair share. Not all tax relief tools are the same, and TABOR ensures that Colorado is often forced to rely on the worst options.

How do we fix it?

In Colorado, voters have the power. Many tax policies are decided by the ballot and it is crucial that voters are educated about all of the consequences – positive and negative – that occur as a result. The Bell Policy Center is here to provide voters and legislators the knowledge and understanding to build economic mobility for all Coloradans.

To learn more, follow us on social media, join our email newsletter, and check out some of the posts below!