Colorado 2022-23 Budget Breakdown

The Colorado legislature is finalizing the fiscal year 2022-23 budget and there are some interesting details within the document that give insight into the present and future of Colorado.

It is crucial that Coloradans understand their state budget. Too often, scary numbers pass for analysis. We should instead focus on what the money is doing and who benefits. The state budget is a formulation of the direction that the legislature, with input from the Governor, wishes to go. Increasing dollars in certain places means investing in those programs, people, and communities. A number tells much less of the story, as compared to the increase from previous years, and the people and communities that will benefit. The dollars in the budget are investments in Coloradans. That is why we care, and why Coloradans should better know the budget and how it works.

Below are some notes about the fiscal year 2022-23 budget, and what it means for our state and Coloradans, more generally:

Big Budget?

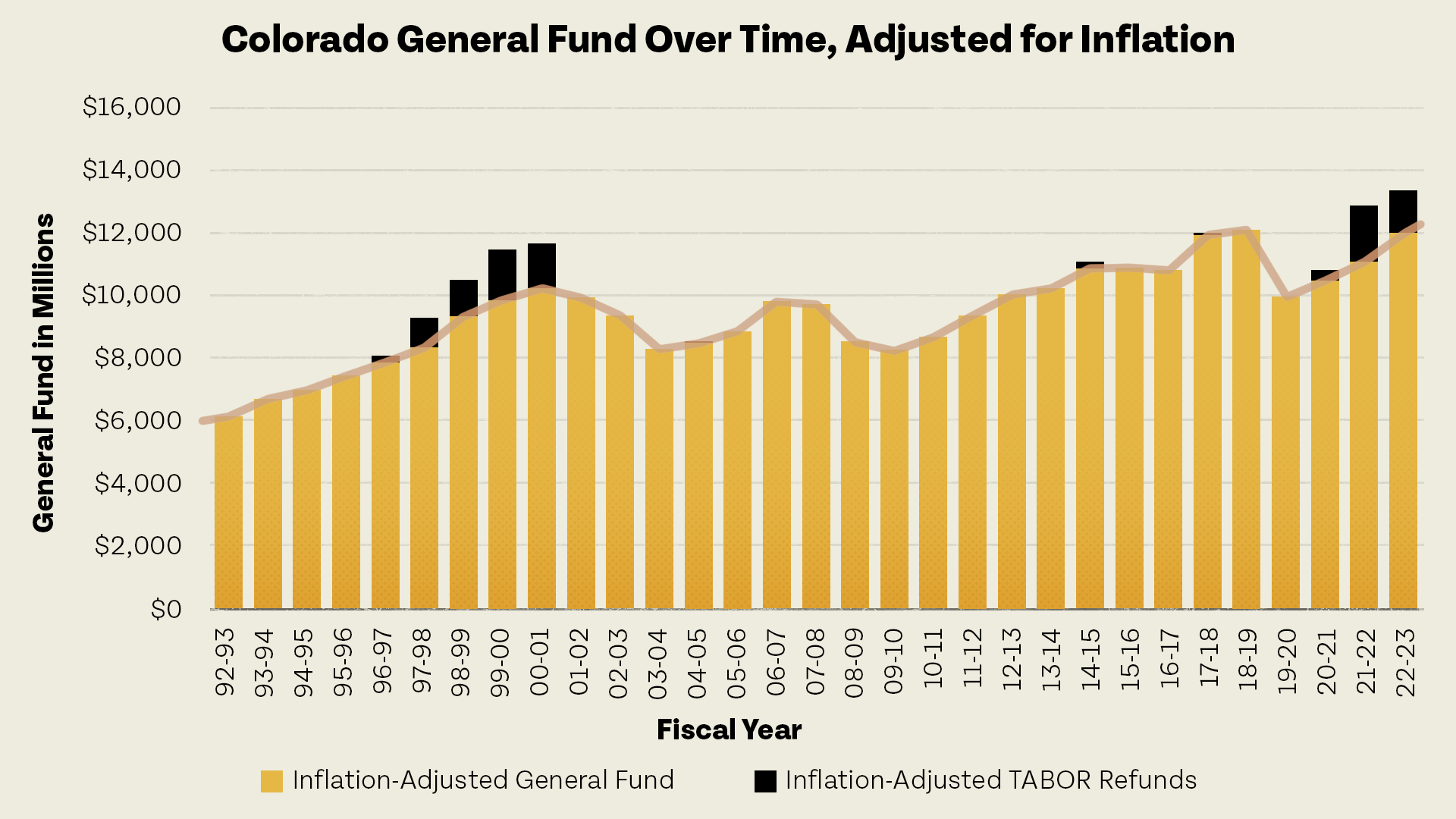

Much commentary around the fiscal year 2022-23 budget is anchored in how large it is and its unprecedented size. But this largely misses the mark in actually illuminating how this budget fits in with previous iterations. In fact, this budget is largely aligned in size and scope with previous years, and the General Fund – the portion of the budget that is mostly discretionary – has risen very little when accounting for inflation, especially when also factoring in the recent growth of Colorado’s population.

Compared to previous years, the biggest change in this budget is the influx of temporary dollars. Much of this can be attributed to federal dollars that have flowed into Colorado. These federal dollars have allowed the state to shift costs in other areas, allowing for more flexibility within the General Fund. That shifting in one-time dollars has allowed budget writers to give Coloradans some economic relief, as well as plan for any future downturns.

One hundred and fifty seven million was set aside to provide relief from certain fees that will directly help Coloradans in the coming year. These fees that will be delayed for Coloradans include:

- Employee and employer fee for paid family and medical leave,

- A newly passed fee on gasoline,

- Fees on certification and licensure

Furthermore, legislative budget writers put $2 billion into the “rainy day” fund to protect the budget against future economic downturns, and provide a budgetary buffer if a recession were to occur. While it would be great to be able to put that money into community investments, arbitrary structural limits on our revenue force us to use one-time funds to try and build reserves rather than invest in true innovation.

What Increased This Year?

K-12 and higher education funding has been a long standing budgetary issue for the state. However, the Governor and the legislature have made education a top budget priority. Notable increases in education funding are:

- K-12 spending from the General Fund is increased by 4.6 percent.

- Colorado’s per pupil funding would increase to $9,560 under this budget, a six percent increase from last year, however that is still well below the national average of $14,455 per student.

- Higher education spending is increased by 10.9 percent within the General Fund, but it is only a 4.3 percent increase overall. This is in large part due to the significant share of federal relief dollars that went towards Higher Education in last year’s budget.

- Need-based financial aid is increased by $24 million, however tuition is still set to increase for most public higher education institutions. For most in-state residents, tuition will increase by 2 percent and 3 percent for out of state attendees.

Another increase that needs to be mentioned is within the Department of Health Care Policy and Finance (HCPF)’s budget. This department saw one of the largest increases between 2021-2022 and 2022-2023. But this is a prime example of one-time federal funds inflating the state budget. For example, this year alone, the state is intentionally investing funds into making structural changes to the home and community-based services system, eliminating waitlists, and reinvesting one-time increased federal match dollars from the federal government into much needed support systems. It is crucial that one-time dollars that have run out – because of how the federal legislation was structured – are turned into long-term, sustainable funding that can actually reform and support the structures put in place.

The Impact of Inflation

As Colorado’s economy rebounds from the negative impacts of the pandemic, one of the barriers to a robust economic recovery is record-high inflation. From groceries to gas, prices are going up at record levels with the Denver-Aurora-Lakewood inflation index hitting 7.9 percent in 2022. While consumers often bear the brunt of high inflation, Colorado’s budget is also impacted by inflationary pressures. High inflation is increasing sales tax collections and, thus, more state revenue as the General Fund saw a $200 million increase in projected revenue since December due to higher inflation.

Another way the budget is impacted by high inflation is in our revenue cap, which mandates that our budget cap increase according to inflation and population growth. However, while revenue is set to go up because of inflation – and the revenue cap will as well – so will the cost of government projects. The most significant government increase is in capital construction — building bridges, roads, and other projects — which saw a year-over-year increase of 34 percent. As inflation has hit construction costs and gasoline prices, the costs of these projects have increased, and will affect how much the government spends. Thus, while higher inflation will lead to more state revenue, it is important to remember that government costs will also increase, as well.

Revenue Returns to Taxpayers

A very clear headline from this budget is the amount of money that the state has to send back to taxpayers. While the amount of money above the cap has yet to be confirmed by the State Controller, it is expected to be more than $1.8 billion for fiscal year 2022-23. The amount of money returned to taxpayers is governed by the Taxpayer Bill of Rights, which sets an outdated limit on how much tax revenue governments are allowed to spend. Under the state constitution, the state cannot spend above the revenue cap. However, how that money is sent back to taxpayers is up to the General Assembly.

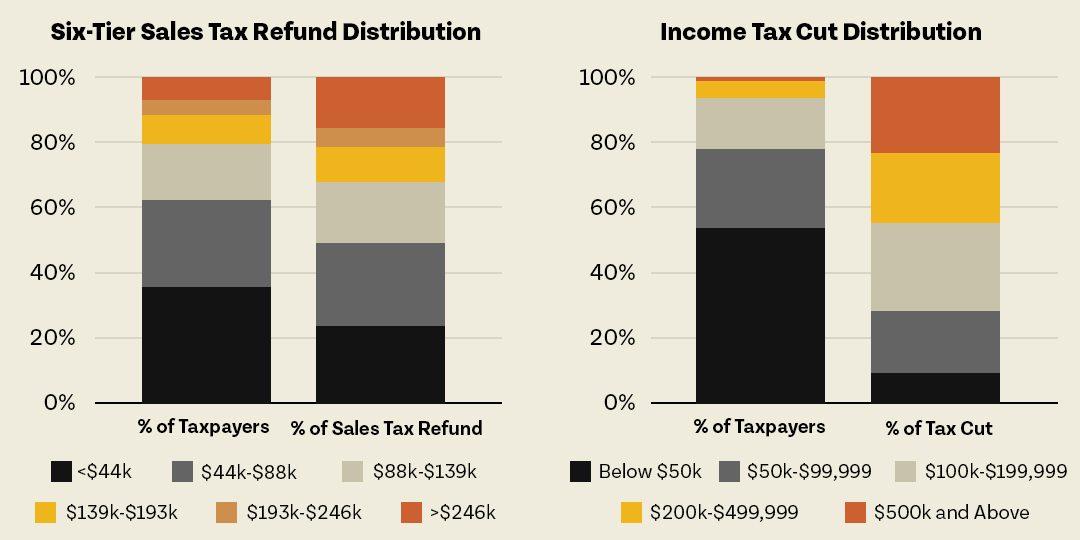

Current law dictates that the rebates are given to taxpayers in a highly regressive manner. The wealthiest Coloradans will get a disproportionate amount of the money over the revenue cap, through a temporary income tax rate reduction and a sales tax rebate.

The legislature should reform these mechanisms. For example, there is a bill that would increase the Senior and Disabled Veteran Homestead Property Exemption so that renters and those who do not own homes can benefit as well. Other ideas include increasing the state Child Tax Credit that goes to families making less than $85,000 in annual income or increasing the Affordable Housing Tax Credit. These are examples of ideas that would ensure the money is allocated towards Coloradans who need economic relief, not the already wealthy.

There’s More!

The budget also sets aside $200 million in property tax relief. With the rapid growth in the state’s housing market, property tax rates have also accelerated. Property taxes are an important source of revenue for local communities as well as an effective tax on wealth. However, for many Coloradans, higher property tax bills only add to economic difficulties. In allocating these funds, the legislature must target middle and lower-income Coloradans and small businesses struggling to get by. Reducing property taxes for everyone overwhelmingly benefits the wealthy. Focusing on small businesses and low- and middle-income Coloradans will deliver help to the people who need it the most, while ensuring that schools and local governments – entities that rely overwhelmingly on property tax revenue – are not hollowed out. As a useful guide, the Bell has recently written on current proposals for offering property tax relief to those who most need it. We should be extremely wary of using General Fund dollars to backfill property tax assessment cuts since those dollars will be needed for other priorities in just a few years.

Besides the money set aside for property tax relief, there are several hundred million dollars more that the legislature and the governor will decide upon. The Bell Policy Center has been focused on opportunities, within this pot of money, to provide economic relief for economically vulnerable Coloradans. With the end of important financial supports like the child care tax credit, financial strains are real for far too many, and may cause families to turn to high-cost, often predatory loans, when they fall on hard times. HB-1359, Colorado Household Financial Recovery Program, would give these folks a financial lifeline by providing low-cost, small dollar loans and a connection to financial support services.

Conclusion

This budget is a welcome return to normalcy. The last two years have seen record budget cuts and record budget recovery, respectively, but this year is more stable and in line with previous budgets. However, that does not mean that everything is fiscally stable in Colorado. Inflation has been wreaking havoc on many families’ bottom lines and it has affected our budget numbers in terms of revenue, the revenue cap, and spending. Instead of investing and innovating, we are sending record revenue to taxpayers and trying to save for future downturns. Nevertheless, the legislature has found ways to increase investments in public education and provide economic relief to all Coloradans.

A structural deficit is still looming. As Governor Polis’ budget department has been saying over the past year, our state is facing the likely prospect that the needs of our population will outpace the revenue we are allowed to spend in the very near future. The Office of State Planning and Budget has made clear that in the coming years “average annual operating growth will exceed the TABOR growth formula.” Without structural changes, Colorado will face a point in the near future where the state will not be able to fund the basic needs of its residents with the projected tax revenue that the state is allowed to spend. That means that hard choices are coming.

As Colorado continues to move out of the economic downturn caused by COVID-19, we have to use the budget to invest in people who are struggling. We should be using the budget to target economic support to low- and middle-income Coloradans. That means working to reform our tax code to make it more fair, and use revenue to lift up communities and families across our state. That is the best way to improve economic mobility in our state, and our budget is a crucial tool in that work.