State of Aging: Financial Security

State of Aging: Financial Security

Financial security — the ability to make basic ends meet and even cover the occasional unexpected expense — is essential to healthy aging. Among the dozens of people and organizations we spoke with while developing our Actionable Aging Policy Agenda, financial health was a universally recognized challenge in need of further examination. To better understand the general state of financial security for older Coloradans, we examine their income and expenses and the respective role these two budgetary items play in fostering an environment supportive of healthy aging.

The Data

Relationship to an established poverty threshold is a simple, high-level indicator of economic well-being. As seen below, poverty rates for older Coloradans and their families differ significantly based upon race, ethnicity, and geographic location.

Beyond the Topline

While important, relation to the poverty threshold only tells part of an economic story. To better understand financial well-being, however, we need to dig deeper into the two prime components of a family’s budget: income and expenses.

As household expenses differ significantly based upon homeownership status, we differentiate between older Coloradans who are homeowners with no mortgage, homeowners with a mortgage, and those who are renting. As seen in the chart below, there are notable differences in homeownership status across demographic groups.

In the charts below, we examine the major expenses for Coloradans aged 65 and older. As household expenses differ significantly based upon homeownership status, we differentiate between older Coloradans who are homeowners with no mortgage, homeowners with a mortgage, and those who are renting. Each of the graphs below are reflective of the expenses for a single individual.

A note on methodology: To estimate monthly expenses, the following sources and analyses were used.

- Health care: Given Medicare is the most prominent form of health coverage for older Coloradans, only Medicare costs were examined in this analysis. Additionally, given Original Medicare, as opposed to Medicare Advantage, is predominantly used in Colorado, cost assumptions were only made for this type of coverage. Specific estimates are based upon an assumed $148.50/month premium for Medicare B and county level out-of-pocket costs for FFS Medicare services in 2019 from CIVHC, which were paired with data from the State Demographer’s office.

- Transportation: Estimates are based upon data from the National Household Travel Survey (NHTS). Through NHTS, age disaggregated data on the number of miles driven per year is available. This information was paired with data from the state demographer’s office and the 2021 IRS reimbursement rate for business travel ($.21/mile) to develop a monthly expense.

- Food: Data costs come from USDA moderate-cost plan data for August, 2021 for those aged 51 to 70 years old.

- Miscellaneous: Miscellaneous costs are assumed to be 20 percent of all other costs. This number mirrors assumptions made in the Colorado Center for Law and Policy Elder Index.

All other expense estimates come from Bell analysis of 2019 ACS five-year data. Finally, due to a lack of quality, disaggregated data, this report does not estimate health care, transportation, or food costs based upon gender or race/ethnicity. Instead, these numbers are assumed to be the state average.

In addition to one’s expenses, income in is an equally important factor in assessing financial security. The chart below shows the personal and family income of older Coloradans.

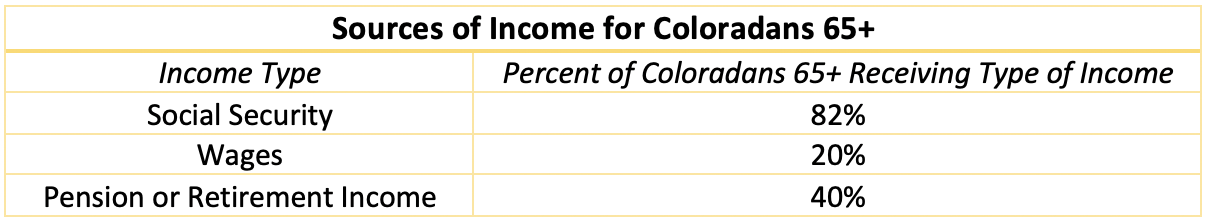

To better understand the income of older Coloradans, the graphs below show the prevalence of and median income from three prominent sources: Social Security, wages, and retirement accounts or pensions.

Social Security is the most prevalent form of income for older Coloradans. Benefits are based upon an individual’s earning history (generally, the more individuals earn, the greater their Social Security benefit). While an individual can elect to collect benefits beginning at the age of 62, their income from Social Security will be greater if they wait until they are 70 years old.

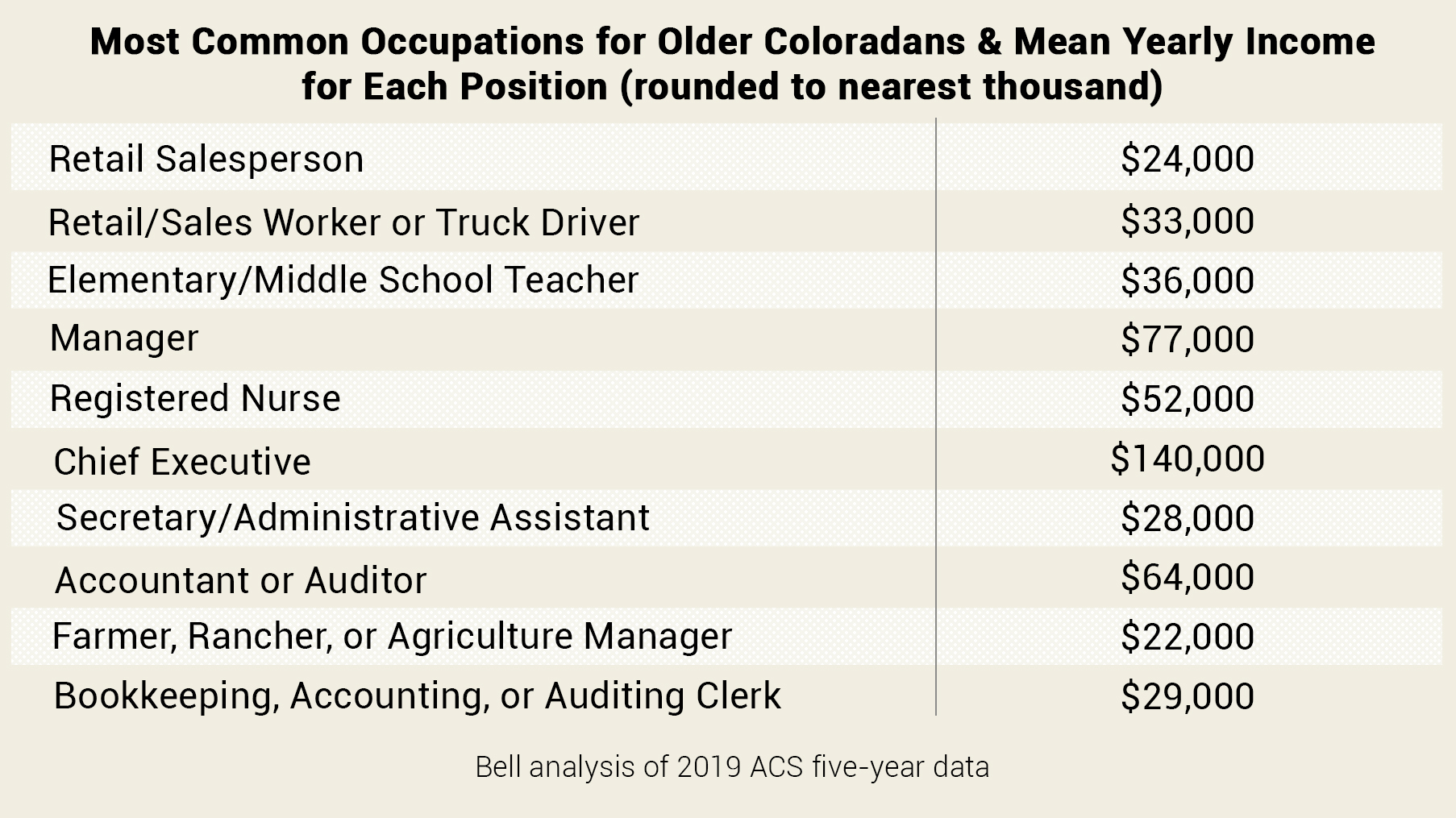

Older Coloradans comprise the fastest growing segment of our state’s workforce. The graphs below show the percentage of older Coloradans in the workforce by demographic group, the annual median wage for these individuals, and the most common positions held by older Coloradans.

Major Takeaways From the Data

For renters and homeowners with a mortgage, housing costs can account for upwards of 40 percent of total estimated expenses. As the cost of housing continues to rise, this poses a growing challenge for many older Coloradans.

Total estimated household expenses are largely connected to whether an older Coloradan rents, owns their home outright, or has a mortgage. Median estimated household costs for older Coloradans who rent or have a mortgage are between 65 percent and 95 percent higher than for those who own their home outright. Importantly, race and ethnicity are intricately connected to older Coloradans’ homeownership status.

Mirroring national data, Social Security is the most common type of income for older Coloradans. Concerningly, Social Security benefits alone are increasingly inadequate for maintaining a basic level of economic security. Especially for single older Coloradans who rent or have a mortgage, Social Security, by itself, does not provide enough to cover median expenses in our state.

Systems & Levers for Progress

We can support the financial security of older Coloradans by investing in solutions which increase family income and reduce expenses. Importantly, many of the systems which can help accomplish these ends are already in place. By leveraging existing supports, we can make progress in reducing the economic vulnerability of older adults throughout our state.

Of the various ways to help older Coloradans increase their income, our state already has mechanisms to support retirement savings and increase workforce participation. Focusing on these efforts will allow our state to invest in recognized, already-developed systems supportive of financial health.

Secure Savings Program: In 2020, Colorado’s legislature passed SB20-200, which created a new Secure Savings program. When fully operational, Colorado workers without a retirement plan offered through their employer will have the ability to participate in a new portable (meaning it travels with individuals between jobs), state-facilitated retirement option. As seen below, there are a significant number of Coloradans who currently lack access to workplace retirement plans, a recognized tool for supporting economic security in older age.

The Secure Savings program is in the midst of being setup within the state treasurer’s office. In the coming years, as this program becomes operational, we’ll need to track the following metrics to ensure the new effort has the intended impact:

- Number of individuals enrolled in the program

- The demographics of these individuals, including, gender, race, ethnicity, income level, industry of employment, and geographic location

Workforce Supports: Older Coloradans also have the ability to grow their income by participating in the workforce. Two essential state-based levers to support working older Coloradans include age discrimination laws and workforce development programs.

- Age discrimination laws: Survey and anecdotal data regularly show age discrimination is a major problem keeping older Coloradans from fully participating in the workplace. While older workers have some protections through the Colorado Anti-Discrimination Act (CADA), several important changes can be made to better support older workers. As described in more detail in our brief Age Discrimination in Colorado, these changes include prohibiting the use of age-identifying information, like college and high school graduation dates, on job applications and bringing age discrimination statutes into parity with protections available for other protected groups.

- Worker training: To support workers of all ages in need of employment assistance, Colorado has a number of workforce centers offering everything from career and resume help to skill development and training. Importantly, research from AARP shows while older workers can benefit from these opportunities, they often don’t receive adequate access to the full range of available workforce development services. Our state’s workforce development centers are an essential system which can support older Coloradans’ financial security. However, in order to understand their impact and better tailor services, we first need data. While the state collects information on the number of individuals who benefit from workforce programs, the data isn’t disaggregated amongst older age groups. As a result, we lack a clear understanding of the extent to which these systems are truly benefiting the range of older Coloradans.

Below, we examine levers to reduce older Coloradans’ expenses in two high-cost areas: home-based personal care services and housing, specifically for renters. We explore similar expense-reducing options regarding food and health care costs on other pages.

Home-Based Personal Care Services: As seen in the above sections, affording basic expenses can be difficult for many older Coloradans. This strain becomes even more prominent when families find themselves in need of paid, home-based personal care services.

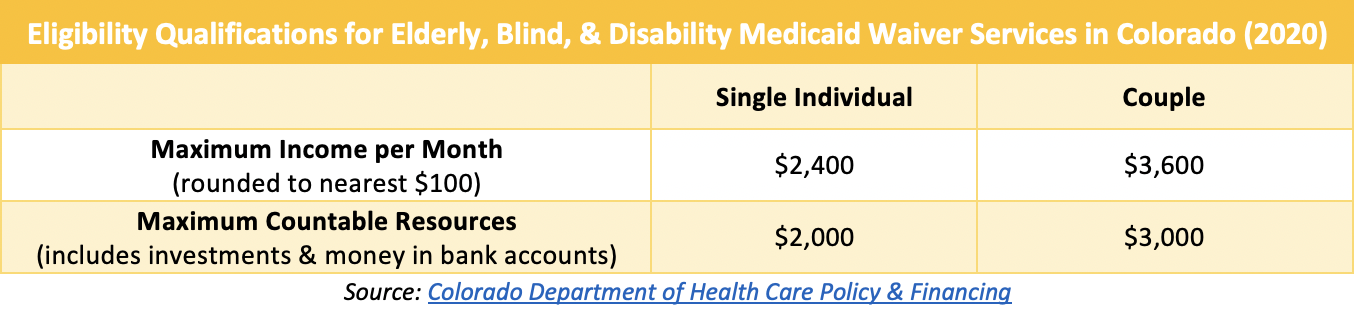

Colorado’s Area Agencies on Aging (AAAs), a statewide network of community providers, are essential in facilitating access to affordable homecare services. You can read more about the AAA network on the Communities of Choice tab. Outside of our AAAs, however, Medicaid is currently the main lever for reducing out-of-pocket personal care costs. Concerningly, as has long been noted, qualifying for these supports can be difficult given strict income and asset qualifications. These restrictions often require older Coloradans with moderate income and homecare needs to spend down much of their income and savings before receiving state-supported assistance.

Our state has the ability to leverage our Medicaid system to provide more affordable personal care by loosening existing eligibility qualifications or building out new programs, similar to demonstration efforts in Washington, that offer a limited set of personal care services to those with higher incomes and assets.

Housing Supports: As noted above, housing is often the largest expense for older Coloradans. This burden is especially significant for older adults who rent—a group disproportionately comprised of BIPOC older Coloradans. Programs, primarily from the U.S. Department of Housing and Urban Development (HUD), exist to lessen the financial challenges for low-income renters. However, as seen below, there are gaps in the availability of these supports.

While additional support for low-income renters remains an important lever for addressing rental housing availability, it’s also important to highlight the need to ensure rental units are safe and accessible. Unfortunately, agency reports and anecdotal evidence suggests accessibility challenges in publicly supported housing abounds. A first step to improving these outcomes rests in tracking the availability of not only rental affordability, but also the accessibility and safety of these units.