New Tax Reform Package Introduced: What’s Inside?

This post was updated June 21, 2021 to reflect the bills as passed by the Colorado General Assembly.

Two new bills were recently introduced to update and modernize our state’s tax code, while also making it more fair for low- and middle-income Coloradans. HB-1311 and HB-1312 will close loopholes and deductions used by wealthy Coloradans and large corporations that do not need them and are distorting our tax code. At the same time, the bills will expand and fund tax credits for working families and small, local businesses.

Certain tax breaks have been on the books for decades, even as the state auditor has found deficiencies with a number of tax credits and deductions. These types of credits, deductions, and exemptions — known as “tax expenditures” because it is money the government spends through the tax code — either are much larger than what is in other states, do not stimulate economic growth or job creation, do not meet their intended purpose, or go to very few businesses or individuals.

As we have seen over the last year, there are many Coloradans who are struggling financially — both families and small businesses. And while these problems did not start with the pandemic, it has become clearer these groups need help. Targeted tax credits — tax credits that go to a particular slice of the economy — have been proven to be great tools to help people. Expanding and funding tax credits that work, like the Earned Income Tax Credit and the Child Tax Credit, would help millions of families across Colorado.

Tax Credits for Working Families & Small Businesses

Earned Income Tax Credit & Child Tax Credit

Since 2013, Colorado has had a state level Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) that are percentages of the federal credits that have been around for decades. Helping families make ends meet and afford basic necessities, like rent, child care, and food, is a tenet of these tax credits. However, Colorado has never actually funded the Child Tax Credit at the state level, and the EITC has been only 10 percent of the federal credit since its inception.

HB-1311 would finally fund the state Child Tax Credit and increase the state Earned Income Tax Credit to 25 percent of the federal credit. Furthermore, the CTC would be available to all Coloradans, including the undocumented population in our state who qualify, and the EITC eligibility would extend to all Coloradans over 18 who qualify — as opposed to just those 25-64, as is currently the case.

332,000 Colorado families currently benefit from the Earned Income Tax Credit and will receive a raise with the doubling of the credit. Over 200,000 more Coloradans will benefit from the increased eligibility thresholds. The federal version of the Child Tax Credit has helped over 250,000 Colorado families, and many of those families will benefit from the state version of the credit, which targets families with children under 6. According to the Economic Policy Institute, the average cost of infant care in Colorado is $1,277 per month. That accounts for up 21 percent of a median family’s income in our state and a fully funded child tax credit would help countless families with those bills.

Business Personal Property Tax Threshold

To help small, local businesses that are struggling, HB-1312 will increase the Business Personal Property Tax threshold by nearly 700 percent, up from $7,900 to $50,000. Businesses are responsible for paying taxes on the items inside their business. Think of anything inside of a business that could be moved to a different location, and those are the items that need to be appraised to determine one’s business personal property tax. For example, in a coffee shop, an owner would need to calculate the espresso machines, furniture for customers, refrigerators, a cash register, and any other type of property. As of 2020, if those equaled to more than $7,900 — as determined by the county — then the business would need to pay taxes on all of that to the county.

However, HB-1312 proposes raising that threshold for taxes to be paid all the way to $50,000. If a business has less than that in business personal property, that business would not need to do the paperwork and pay taxes for that property. This will relieve tens of thousands of businesses across Colorado of paying those taxes, as well as doing the necessary paperwork. Instead, the state will reimburse counties the estimated $65 million that they will lose from this revenue source, ensuring that they will be able to maintain the same level of public services.

Closing Loopholes & Making the Wealthy Pay Their Fair Share

Individual Income Tax Changes

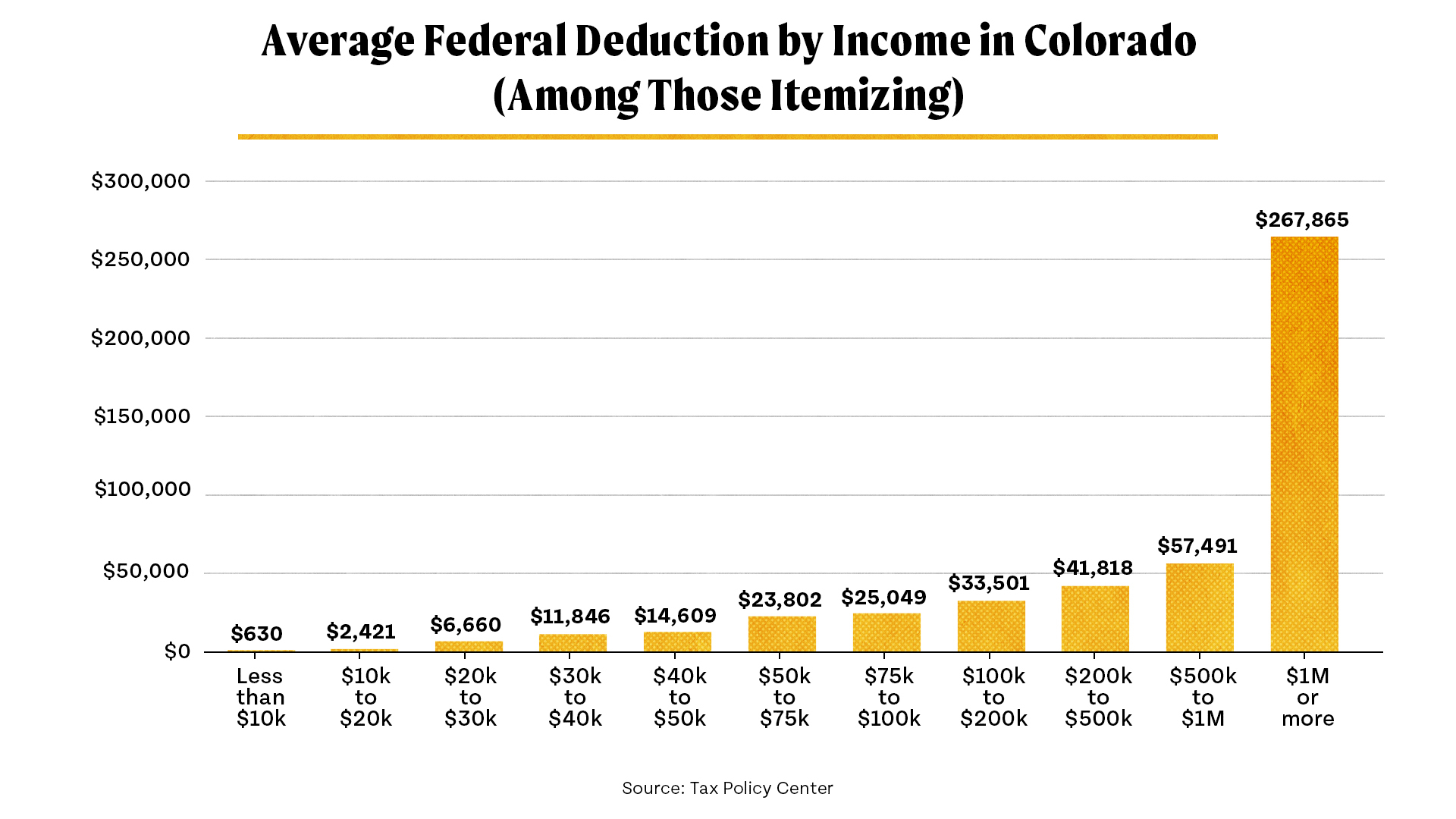

- Cap Itemized Deductions for Taxpayers Making Over $400,000: The 2017 Tax Cuts and Jobs Act lifted a previous cap on itemized deductions, providing a windfall for the wealthiest Americans, and this was passed down to Colorado, as all federal income tax changes are absorbed into our state tax code. HB-1311 will cap deductions for those making more than $400,000 at $30,000 for single filers and $60,000 for joint filers.

- Extend Cap on Qualified Business Income: Last year, the legislature passed a measure that closed a previous TCJA loophole giving business owners a 20 percent deduction on their income taxes, just for owning a certain type of business. That deduction was eliminated through 2022 for those making more than $500,000 as a single filer and $1 million as a joint filer. HB-1311 will extend that reform through 2025, which is when the changes in TCJA will expire at the federal level.

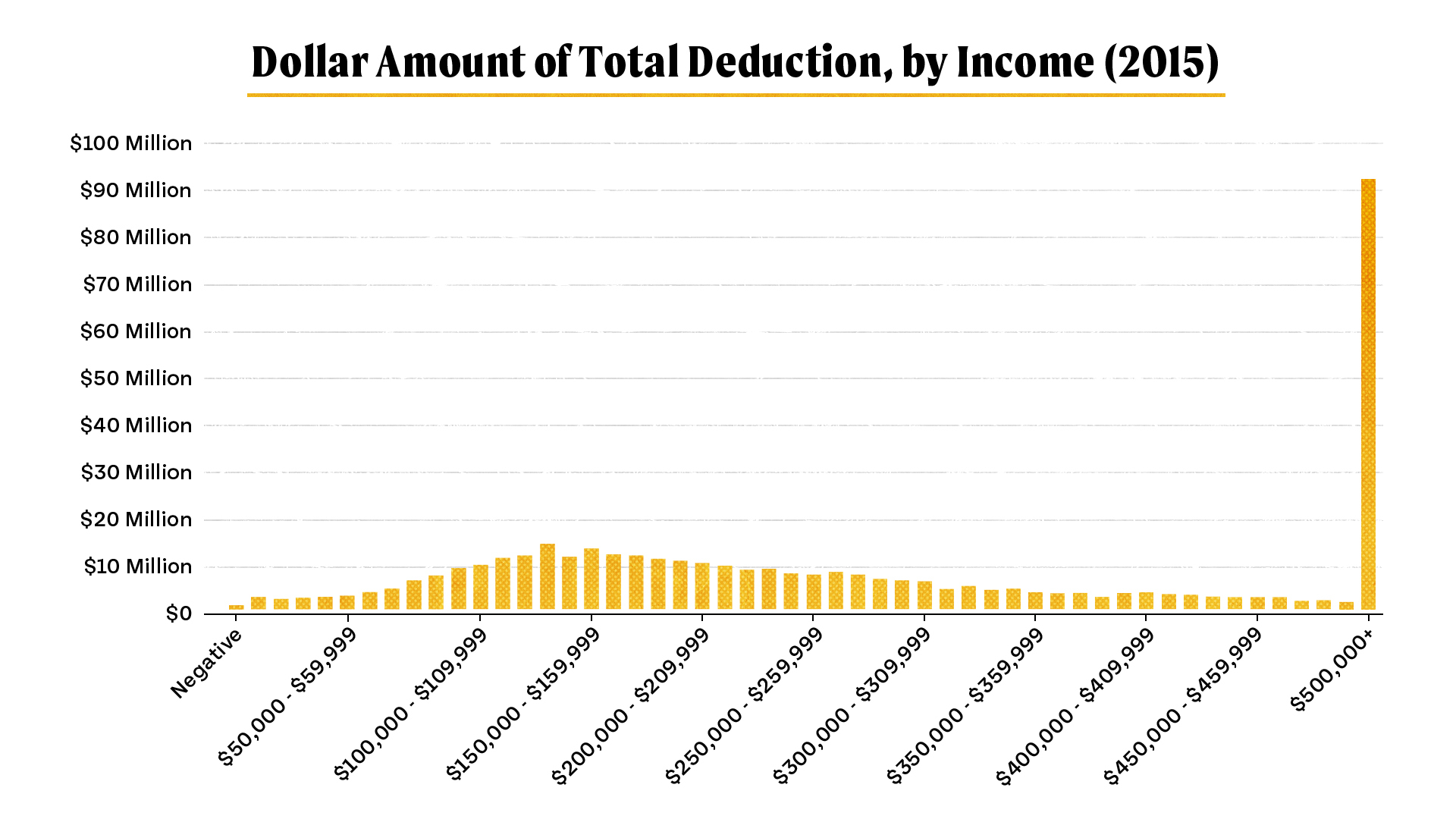

- Cap on 529 Deductions: 529 accounts are college savings accounts and are great tools to save for higher education. However, as the chart below shows, some wealthy people have been using it more as a tax shelter for income. HB-1311 would limit the deductions a taxpayer can take for 529 accounts to $20,000 for single filers and $30,000 for joint filers, ensuring 529 accounts are used for their intended purpose.

Corporate Income Tax Changes

- Multi-State Corporation Changes: The Multi-State Tax Commission has put forward ideas on how best to capture profits that corporations make amongst many different states. Many states have adopted these methods, and HB-1312 will align Colorado with these other states and ensure multi-state corporations cannot sell in Colorado while claiming taxes in another state, and vice versa.

- Clamp Down on Tax Havens: HB-1312 would make sure that corporations that use subsidiaries to hide profits in overseas tax havens still calculate all their profits for corporate tax purposes.

Sales Tax Changes

A part of Colorado’s tax code that needs significant updating and modernization is the sales tax. Sales taxes are supposed to be a tax on tangible goods with some exceptions. However, as the way we buy and sell goods has changed over the years, our sales tax laws have not kept pace. HB-1312 attempts to modernize parts of those laws in order to be more in line with our current economy.

- Clarify Tangible Personal Property Definition: There are goods that have been exempt from sales taxation without a real discernable reason. HB-1312 would include photocopying, packing and crating, and mainframe computer access in the definition of “tangible personal property”, ensuring they are subject to a sales tax.

- Eliminate Vendor Fee for Big Business: The vendor fee was put in place many years ago to compensate businesses for the time and effort it takes to remit sales taxes. In 2019, a bill passed to reform the vendor fee by putting a cap on the amount of money a business could keep for remitting sales tax. HB-1312 proposes eliminating the vendor fee for businesses making $1 million per month in taxable sales.

Insurance Premium Tax Changes

Insurance companies do not pay income taxes like most businesses do. They pay an insurance premium tax on all coverage they extend for people and businesses. That premium tax sits at 2 percent, but there are many ways for insurance companies to lower that tax.

- Strengthen Regional Home Office Credit: An insurance company with a regional home office in Colorado gets to cut its premium tax from 2 percent to 1 percent. Historically, many insurance offices open a “regional home office” without any real presence in Colorado to claim the credit. HB-1312 would mandate that any insurance company claiming this credit has to have at least 2.5 percent of its domestic workforce in the state by 2024.

- Strengthen Annuities Exemption: The annuities exemption was established in 1977 to encourage retirement savings. However, the annuities market has changed significantly in the last 45 years, and many annuities are more targeted for short-term investments – the opposite of the intention for long-term retirement savings. HB-1312 will restrict the annuities exemption to only be available as part of a qualified retirement savings program, like an IRA or 401(k). Structured settlement annuities would also be exempt.

Changes to Oil, Gas, & Coal Taxes

- Close the BP Loophole: In 2016, the Colorado Supreme Court sided with British Petroleum in BP vs Colorado Department of Revenue on a technical tax issue. BP had been taking a tax deduction that was meant for manufacturing, processing, and transportation costs, but they were adding in their capital and indirect costs, instead of just the direct transportation, processing, and manufacturing costs. Because the CO Supreme Court ruled that the law allowed that, it has become a loophole in the tax code. HB-1312 ensures the tax deduction would only be for the direct costs associated with oil and gas transportation, manufacturing, and processing. This would keep with the original intent of the law.

- Coal Severance Tax Changes, With Savings to Just Transition: The Underground Coal Credit and the Coal Tonnage Exemption would be eliminated over the course of a few years, with the money saved from those tax breaks going to the Office of Just Transition in the Colorado Department of Labor and Employment. That money will help get displaced coal workers in Colorado retrained and help those coal towns in our state be able to provide necessary services to its residents.

Importance of Tax Reform

Taxes are a crucial way to ensure we can provide services and funding for millions of Coloradans. Education, health care, transportation improvements, mental health, and many other programs are funded through taxes. But when the state asks people to pay their taxes, there should be an expectation that our system is fair, efficient, and working for the vast majority of Coloradans.

When we have a tax code that disadvantages low- and middle-income Coloradans — as our current one does — while handing out tax breaks to large corporations and the wealth, then the tax code doesn’t work for the majority of Coloradans. When we have a tax code that includes expenditures that “don’t work as intended” or “don’t grow our economy or create jobs” then it doesn’t work for the majority of Coloradans. When we have a tax code that doesn’t adequately fund public services going forward — even though Colorado currently has a good budget picture, that will not last forever — then it doesn’t work for the majority of Coloradans.

Colorado’s budget has rebounded significantly since the beginning of the pandemic. But the good times from better-than-expected tax revenue and federal stimulus dollars will not last forever. That is why sustainable long-term investments in hardworking Colorado families, small businesses, and our local communities is so crucial.

These bills, HB-1311 and HB-1312, are not silver bullets. They will not fix every problem outlined above. But they will make important and tangible improvements to the tax code and give needed relief to millions of Coloradans who desperately need it. That is why these bills are so important, and that is why the Bell Policy Center is excited to advocate for them and see them passed to improve economic mobility for Coloradans of all sorts across our state.