Q&A with Logan Jones on Alternative Loan Products

We regularly hear the false claim that high-cost payday loans are necessary, and even helpful, for low-income Coloradans who lack access to traditional forms of credit. The argument follows that by offering these products, payday lenders are providing a service many Coloradans can’t access elsewhere.

The facts, however, show the dangers of these predatory lending products. With high interest rates and fees, many Coloradans find themselves caught in inescapable cycles of debt after taking out these loans.

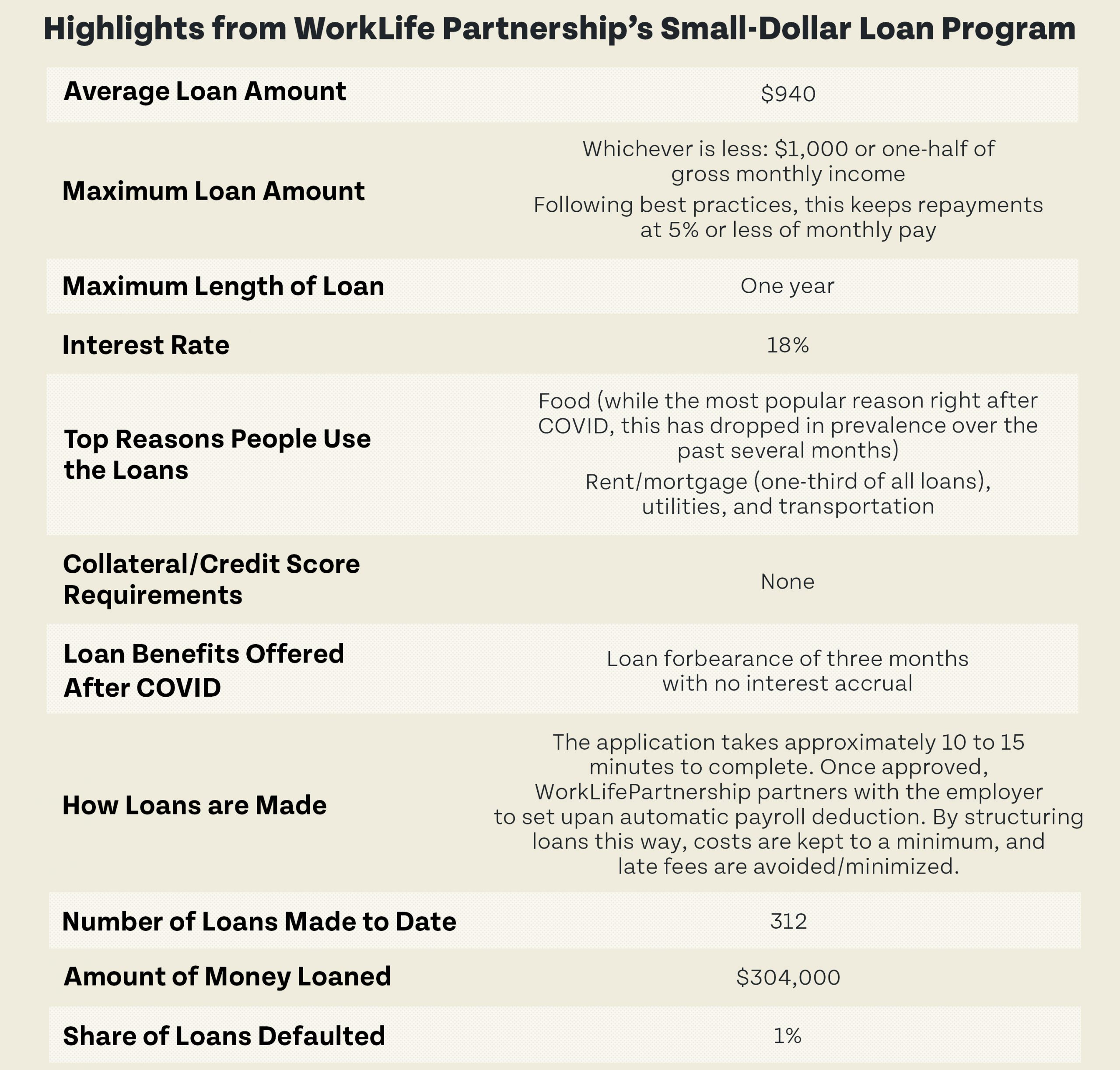

While we’ve made significant progress in capping the worst of predatory loan abuses, work remains in building on these efforts in order to create meaningful, alternative lending products, ones that allow vulnerable Coloradans to develop credit without endangering their long-term financial security. This is where efforts like WorkLife Partnership’s small-dollar loan program come in. A Colorado nonprofit that partners with businesses to provide a variety of wraparound support services to employees, WorkLife Partnership recently developed an affordable small-dollar loan product to counter payday and other high-cost loans.

We talked to Logan Jones, WorkLife Partnership’s financial services manager, to find out a bit more about WorkLife Partnership’s work and loan program.

Can you tell me about WorkLife Partnership and the work you do?

The concept behind WorkLife Partnership began with an agency in Grand Rapids, Michigan called The SOURCE. A business out there saw a lot of employees jumping ship when a competitor offered just a quarter more an hour. It seemed a little odd people were leaving for so little. When the employer hired a social worker to get a better understanding of what was happening, they found there was actually a lot going on in employees’ lives. Sometimes we forget even though we’re supposed to separate what’s happening at home from our work life, that it’s really hard if you’re a parent trying to put enough food on the table. No matter how good you are at compartmentalizing, the wear and tear from life stressors follows you into the workplace.

We think if people can get help in resolving some of the stuff in their home life, they’ll be more productive in the workplace, but also healthier and happier. A lot of our work involves meeting people where they’re at, figuring out the issues they’re facing, breaking problems into bite-size chunks, and starting to tackle things together. When we’re able to do this for one person, it has an impact on their life, but it also benefits the employer and the wider community.

Why and how did you come up with the small-dollar loan program?

As our resource navigators were meeting with people and talking about their financial issues, payday loans kept coming up. They’re really hard for people to get out of, no matter how hard someone works. Once they’re big enough, those things can take on a life of their own.

I think some people have the idea anyone can waltz down to the bank and get a loan, but things have changed. Banks now want credit scores and collateral. However, people who don’t have these things still need access to credit. Providing an alternative to payday loans, and a way for people to access safe and affordable lending products was really the motivation for our program.

Setting up the loan fund was a years-long process. We found the Community Loan Center of the Rio Grande Valley, who was encountering a very similar situation — they had a main street lined with payday lenders. We made contact with them and spent quite a bit of 2019 developing our product with their help. Since we couldn’t find a bank or credit union to jump into this space, we became the lender.

Have you been able to measure the impact of the loan program?

We do a lot of surveying of our borrowers, and we found:

- 32 percent have used a payday loan in the past;

- 54 percent, because they had our loan option, didn’t pursue a payday or similar type of predatory loan;

- 95 percent say the loan puts them in a better financial place;

- 90 percent are less stressed about the issue they took out the loan for; and

- 97 percent are more likely to stay with their employer because they have access to the loan.

Employers are also pretty happy. They want to be able to offer this type of assistance. Surveys consistently show employees want things like matched savings, student loan matching, and access to credit. So, this product fits nicely.

How do you think COVID-19 will impact WorkLife Partnership’s small-dollar loan program?

Initially, we thought the small-dollar loan program would be a standalone service, separate from our other navigation resources, but I think what we saw is there’s value in having wraparound, integrated supports. People only have so much bandwidth so it’s helpful to consolidate services and intake processes. Moving forward, we’re thinking about ways we can make it easier and less time intensive for people to access a collection of services, including our small-dollar loan program.

But besides the programmatic pieces, I also think COVID has just been so universal. Everyone’s been facing the same issues, and we’re all in the same boat. I think the past year has done wonders in illustrating the many work-life issues that grew as a result of COVID. I’m hopeful that in the future we’ll be able to better understand each other’s stresses and struggles and develop needed workplace supports.

How do you think the state can help WorkLife Partnership build upon/expand your work?

The state could help with a few things like:

- Expanding and growing awareness of the loan program. We’re also always looking to pick up additional employers, and working with a state agency would be great.

- Help with federal advocacy. For example, recent federal rulings have allowed some lenders to bypass state interest rate protections on high-cost loan products, undermining what many of us have worked so hard for. We’d love state help in fighting back against some of these federal actions.

- Connecting us to additional funders. If we had additional financial support, we could lend to more people. With more money in circulation, our program would become healthier and sustainable more quickly.

- Putting federal rules and regulations into layman’s terms. Sometimes these regulations can be a bit obtuse.