Tax Credits for Working Families

Tax credits are ways to use the tax code to target investments into various groups. A tax credit reduces the amount one pays in taxes after the full tax bill is calculated. There are many types of tax credits, like credits for education, homeownership, retirement savings, child care, and others. Two of the most important and known are the Earned Income Tax Credit and the Child Tax Credit.

What is the Earned Income Tax Credit (EITC)?

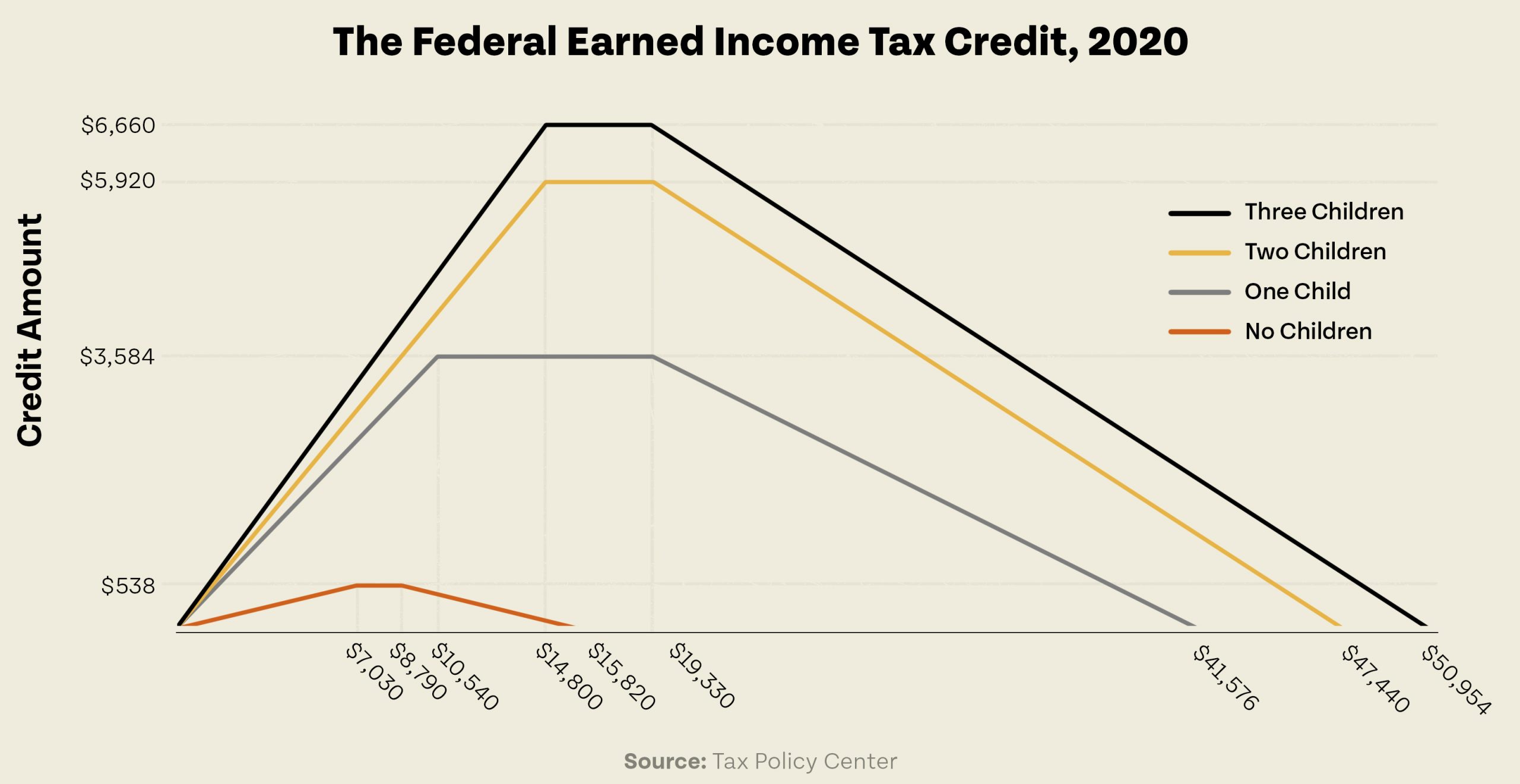

The Earned Income Tax Credit (EITC) is a federal tax credit that has been around in some form since 1975 and updated several times since then. The EITC’s purpose is to encourage work for those with children, as it is only eligible for workers aged 25 to 64. Childless workers receive much lower tax credits than workers with children. The credit increases depending on size of family and income, with a phase out starting for those making $19,360 in 2020. You can see the sizes of the credit at the federal level in the graph below.

At the federal level, the EITC is a refundable tax credit. That means if you owe zero dollars in taxes, the EITC still applies and it will give those who are eligible a tax refund.

States can pass their own state-level Earned Income Tax Credit to reduce low- and middle-income families’ state tax bill. In Colorado as of January 1, 2021, the state level EITC is 10 percent of the federal credit and is refundable like the federal version. So, if someone were to get a federal EITC of $2,000, the Colorado EITC would be $200. Furthermore, Colorado is the first state to allow those who file taxes, but do not have a Social Security number (known as filers who use an Individual Taxpayer Identification Number, or an ITIN) to claim the state level EITC.

The Colorado EITC ensures when the EITC is increased at the federal level (as being considered in Congress as part of the COVID-19 relief package) those increases are passed along to Colorado residents in the state tax code as well.

What is the Child Tax Credit (CTC)?

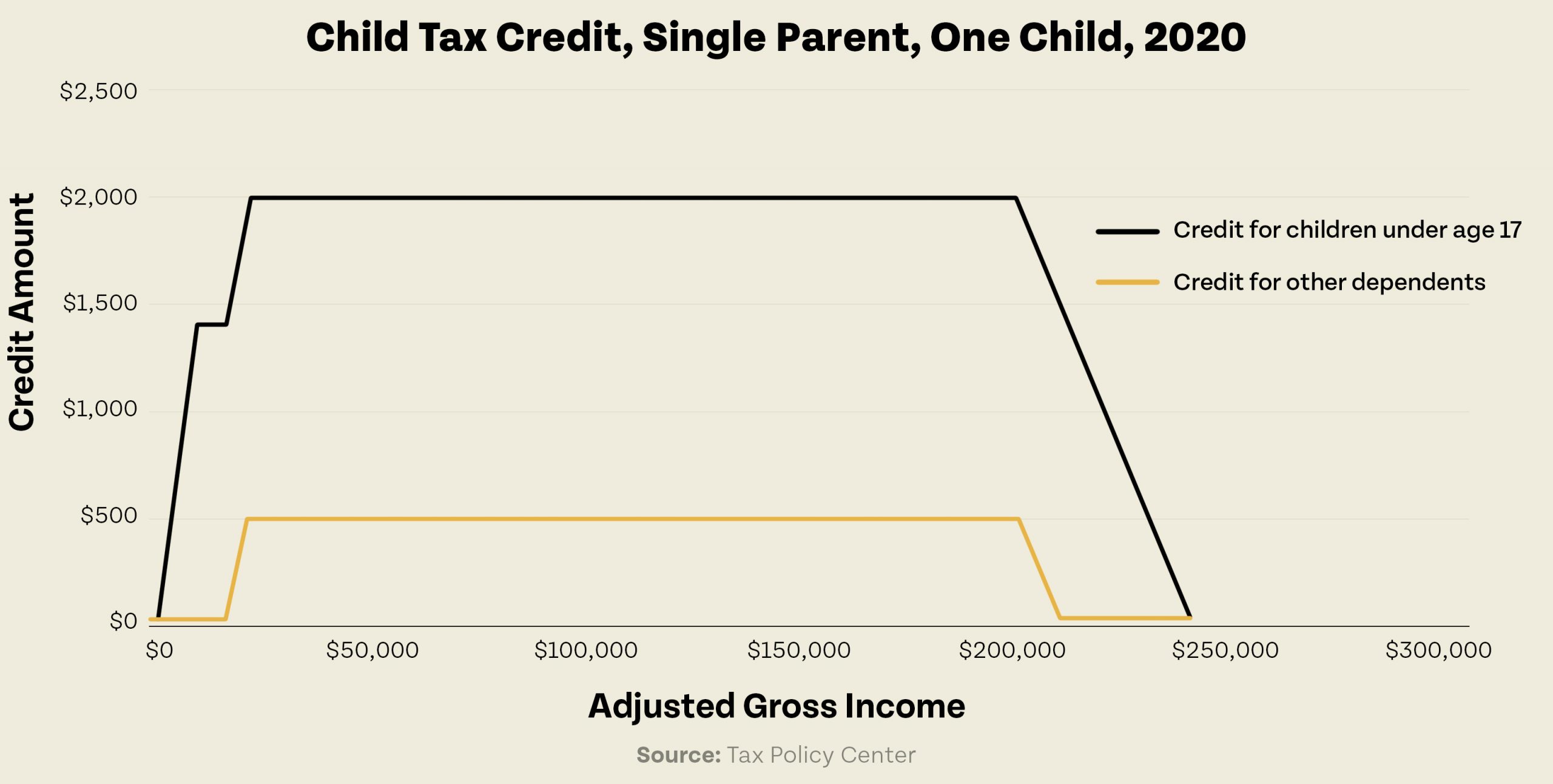

The Child Tax Credit (CTC) is a federal tax credit for taxpayers with dependents 17 years old and younger. CTC has been around since 1997 with a couple of increases and modifications since, with the possibility of a substantial increase in the COVID-19 relief bill being debated in Congress. As of January 1, 2021, the federal Child Tax Credit gives up to $2,000 to eligible families making up to $200,000 annually. There is then a phase out for families making between $200,000 and $400,000 annually.

Unlike the Earned Income Tax Credit, the Child Tax Credit is only partially refundable. It is structured so only $1,400 of the credit is refundable and available to those with zero-dollar tax bills. The CTC is meant to help families pay for the needs of their children and keep kids out of poverty. In 2018, as part of the Tax Cuts and Jobs Act, the CTC became available to taxpayers with dependents over the age of 17 in a small amount.

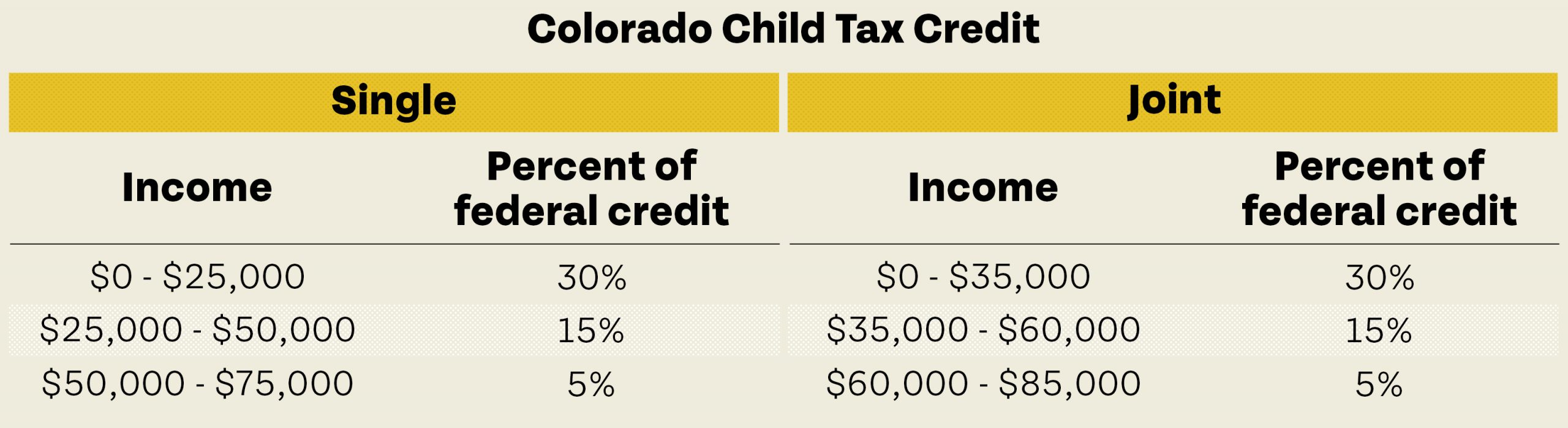

Colorado has a state-level Child Tax Credit that was passed into statute in 2013. Unfortunately, it has never been funded by the legislature. The state CTC, unlike the federal version, is only for families with children under the age of 6. It was structured this way to target families in need of help with child care and early childhood education. The Colorado Child Tax Credit looks like this in statute:

Why Do These Tax Credits Matter to the Bell Policy Center?

Decades of research has shown targeted tax credits are great anti-poverty tools. In particular, the EITC has been revealed to be a fantastic way to help working families stay out of poverty. As wages have stagnated at the lower end of the income spectrum and it has been harder for families to move into and stay in the middle class — and just as difficult for those in the middle class to actually afford a middle class lifestyle — it is paramount we do everything we can to help those who need it. Giving families money through tax credits allows some ability to make ends meet and not fall into poverty traps.

Furthermore, giving money to those who are most likely to spend it — because they have real needs in the present and will not just save the money — helps our economy more than anything. Getting more money circulating into businesses and the broader economy helps stimulate job growth and higher wages.

Both of these reasons are why the Bell Policy Center has long advocated for expanding the Earned Income Tax Credit and finally funding the Child Tax Credit, so that more people have more money to help gain more economic mobility for them and their children. While these tax credits are not a panacea, they are important tools to be able to help families that need help.