Colorado OFE Can Create a Road Toward Financial Stability

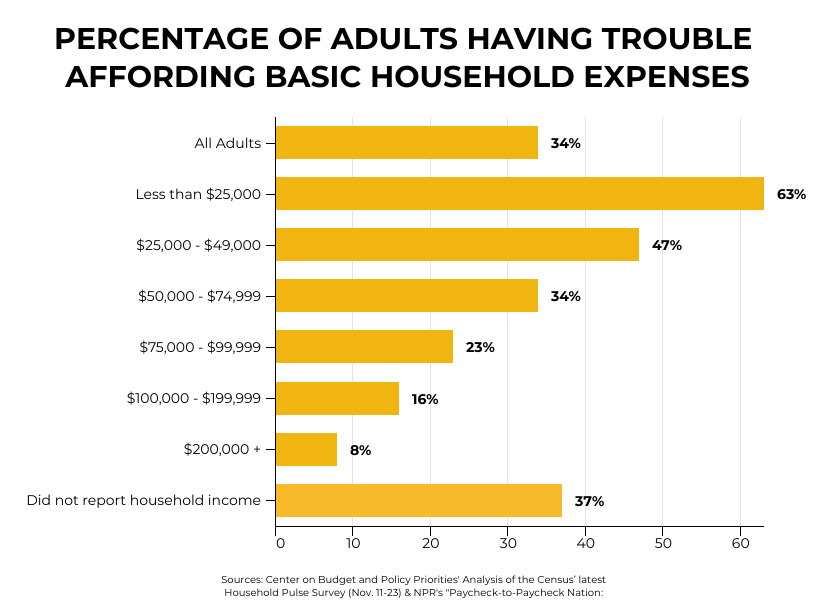

A startling number of Americans live paycheck to paycheck, where one unexpected visit to the doctor or car expense can lead to inescapable debt. A recent story from NPR shows the all-too-real implications of financial precarity not just for those under or at the poverty line, but also for a growing number of middle- and high-income families.

For these Coloradans, ongoing financial challenges are simultaneously caused and aided by a reactionary, limited system of short-sighted options. As a result, when faced with unexpected costs, too many of these families are forced to go without or turn to high-cost predatory loan products.

There are no easy solutions to widespread financial vulnerability. Instead, Colorado needs holistic, flexible tools, capable of ensuring a lasting and systemic chance. By creating a statewide office of financial empowerment (OFE) dedicated to proactive, community-based financial resilience, we can support thousands of economically vulnerable Coloradans.

A Broken System

Financial precarity is nothing new for many Coloradans. A 2017 study shows approximately 40 percent of Americans couldn’t pay for an unexpected $400 expense without either borrowing money or selling possessions. This problem is only growing as a result of COVID-19:

- As of the beginning of January, 2021 over 30 percent of Coloradans report difficulties paying for usual household expenses

- Nationally, the number of Americans living paycheck to paycheck has grown to more than 60 percent

- A growing number of nonprofits offering food, rental assistance, and other social supports report a rise in new clients — many of which are new to the social services orbit

COVID-19 has exposed just how vulnerable Coloradans across the economic spectrum truly are. Without adequate savings, financial supports, or community resources, many must take on debt to meet basic needs. If unaddressed, these unmeetable expenses will contribute to cyclical, deepening poverty that lasts far into the future of many Coloradans.

The Value of a Colorado OFE

In order to catch financially vulnerable Coloradans before they spiral into debt, our state needs an interwoven, reinforcing set of proactive policies and programs. A statewide OFE can play an essential role in both creating and sustaining this system.

Uplifting Innovative & Affordable Lending Products

Predatory lending products, from payday to alternative charge loans, are known for their exorbitant interest rates and fees that trap families — many of whom look to these options to pay for unforeseen expenses — in cycles of debt. But not all short-term lending products are predatory. Instead, a number of organizations have been developing sustainable, consumer-friendly, low-cost alternatives, such as those offered by WorkLife Partnership. Extrapolating best practices from these efforts is difficult when done organically, but a statewide OFE can help communities learn from and build upon one another’s work.

Supporting Community-Based Lending & Banking Efforts

Coloradans of all economic statuses benefit from lending and banking institutions that prioritize community-based solutions. Fortunately, there are plenty of these throughout our state, from traditional banks, to credit unions and Community Development Financial Institutions (CDFIs). COVID-19 has shown how these institutions can play an essential role in ensuring Black, Hispanic, Indigenous, and other communities of color have access to needed financial services. With dedicated state attention, Colorado can expand the presence and reach of these important lenders and bankers.

Empowering Communities to Develop Tailored Financial Empowerment Services

A host of services like financial coaching, resources navigation, and connections to low-cost bank accounts are proven and effective ways to reduce debt and increase savings. A Colorado OFE capable of helping local communities build the infrastructure to provide these services can make meaningful headway in keeping families from falling into ruin in the event of an unexpected expense.

Exploring Innovative Statewide Solutions

In addition to the already established set of recognizable financial empowerment tools, there are a growing number of innovative solutions that can help low- and middle-income families cope with unexpected expenses. This includes policies like the Rainy Day Earned Income Tax Credit, which would pay out tax credit refunds twice a year, providing families a biannual economic boost. With the centralized attention provided by a statewide OFE, Colorado can be at the forefront of helping to identify and assess the viability of policy options like these in our state.

Financial vulnerability is not a problem confined to Coloradans living below the federal poverty line. Instead, it touches Coloradans across the financial spectrum. Without dedicated effort and attention, too many of our friends and neighbors are at risk of falling into inescapable cycles of debt due to an inability to afford one unexpected expense. A Colorado OFE, however, has the ability to provide the needed resources and focus to grow financial resilience across our state.