Key Budget Takeaways for this Session

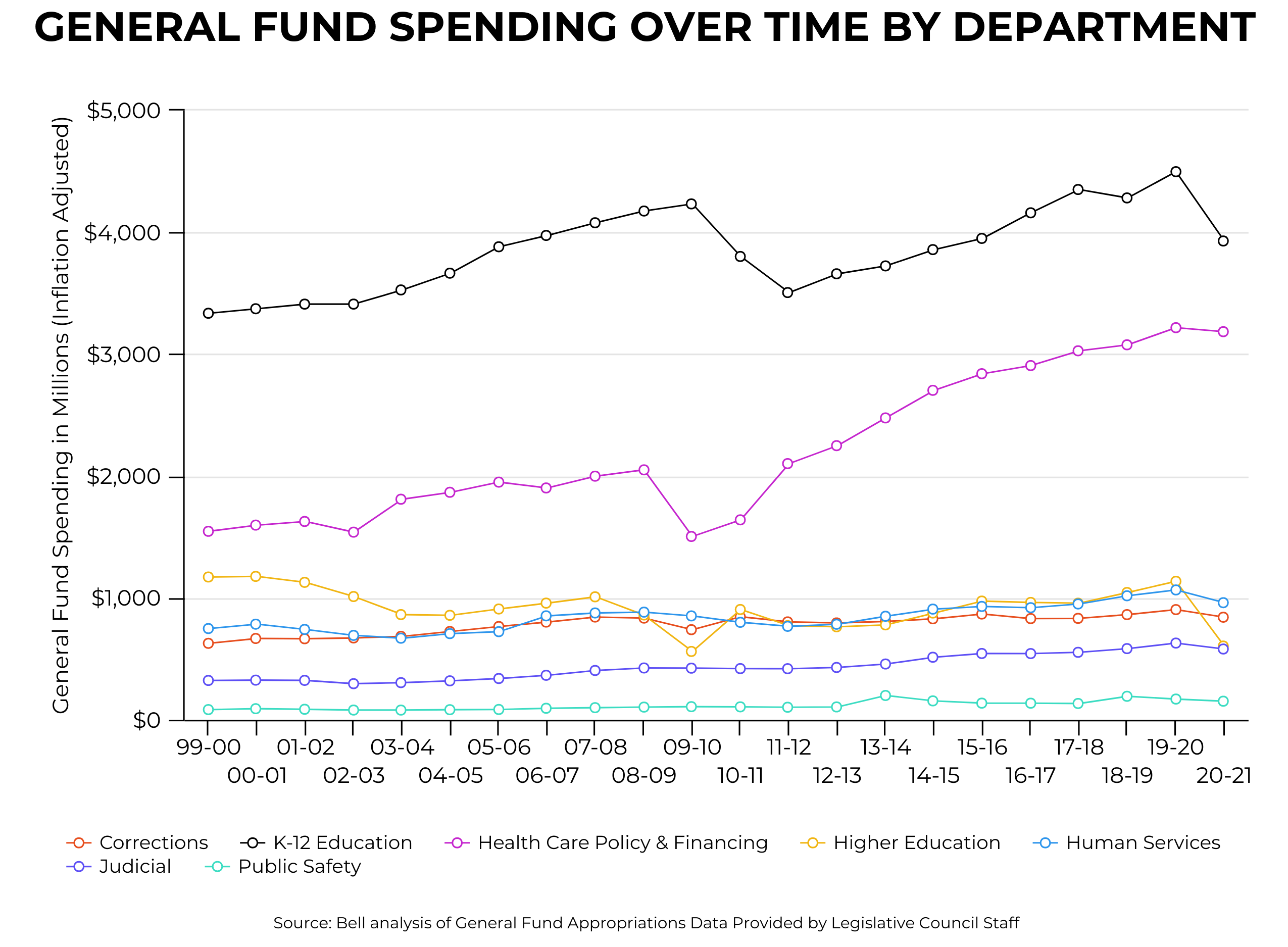

In Colorado, COVID-19 will result in a 5.6 percent General Fund shortfall for FY 2020-2021. This contraction is relatively small, due to strong economic activity and the deep cuts made by the Joint Budget Committee last session. However, these cuts still occur on top of a budget that was too small to meet the needs of Coloradans.

Cuts to Base Funding Add to Years of Underfunding for Key Programs

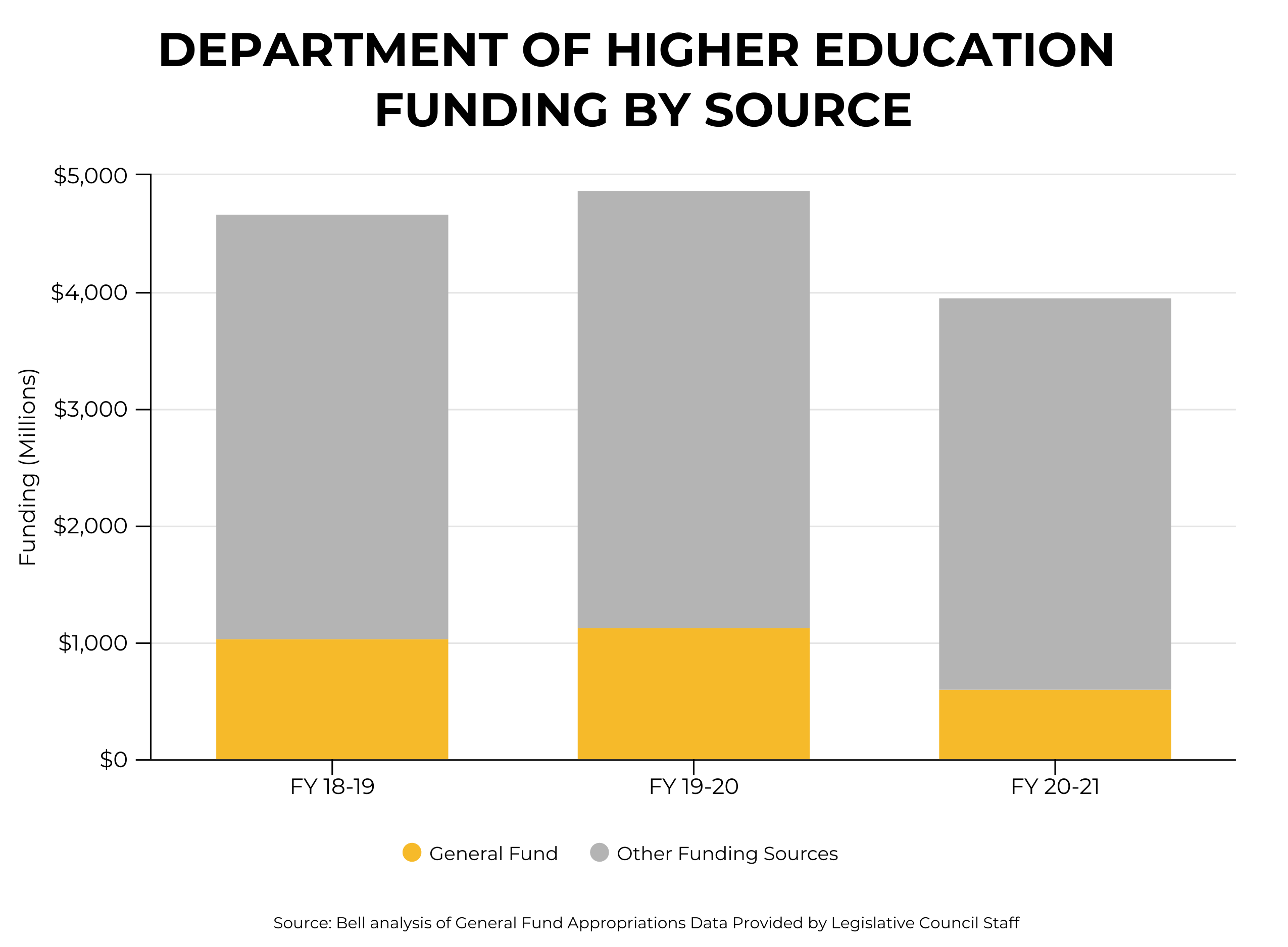

In the Department of Education and Department of Higher Education, dramatic cuts compound on trends of underfunding and growing demand. Restoring funding here is critical to advancing long-term equity. Research shows that public investment in these areas facilitates upward economic mobility for communities of color. Cuts in both departments were to base funding that goes directly to schools and add to existing underfunding. “Across-the-board” cuts such as these have deeper impacts for rural communities and communities of color. These communities are more likely to attend institutions that are more reliant on state funding to backfill local budgets.

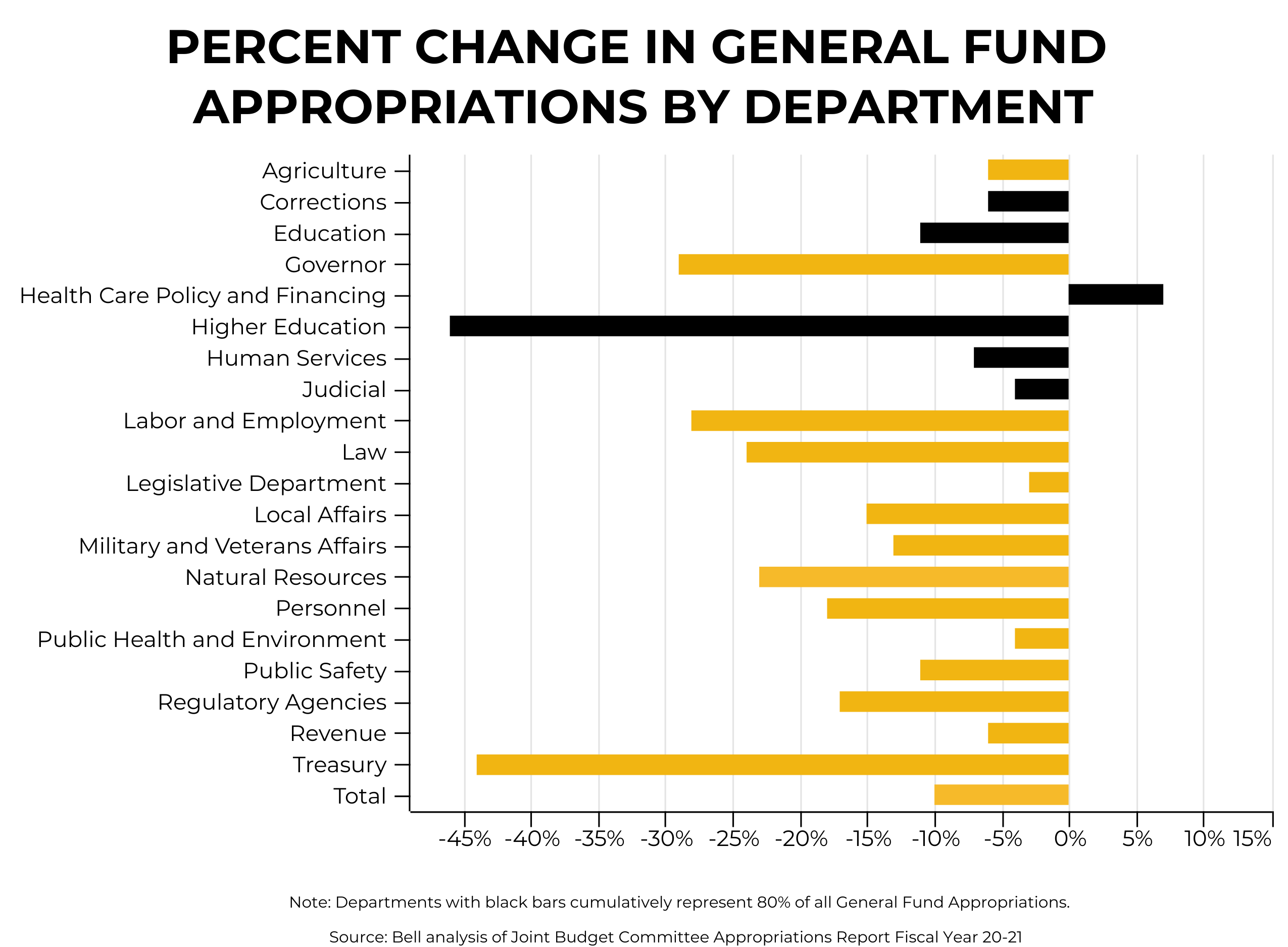

Where Budget Cuts Had the Biggest Impacts

Due to constitutional obligations, budgetary flexibility, and the availability of alternative funding sources, budget cuts were not equally felt. Cuts to places where we invest in the lives of Coloradans saw the biggest cuts, and places where spending is required saw smaller cuts. For example, the Department of Health and Human Services cut funding to programs that support Coloradans with services for mental health and substance abuse. Meanwhile, the Department of Corrections received additional funds to open and operate state-owned prisons to compensate for the closure of private prisons, rather than investing in preventative services.

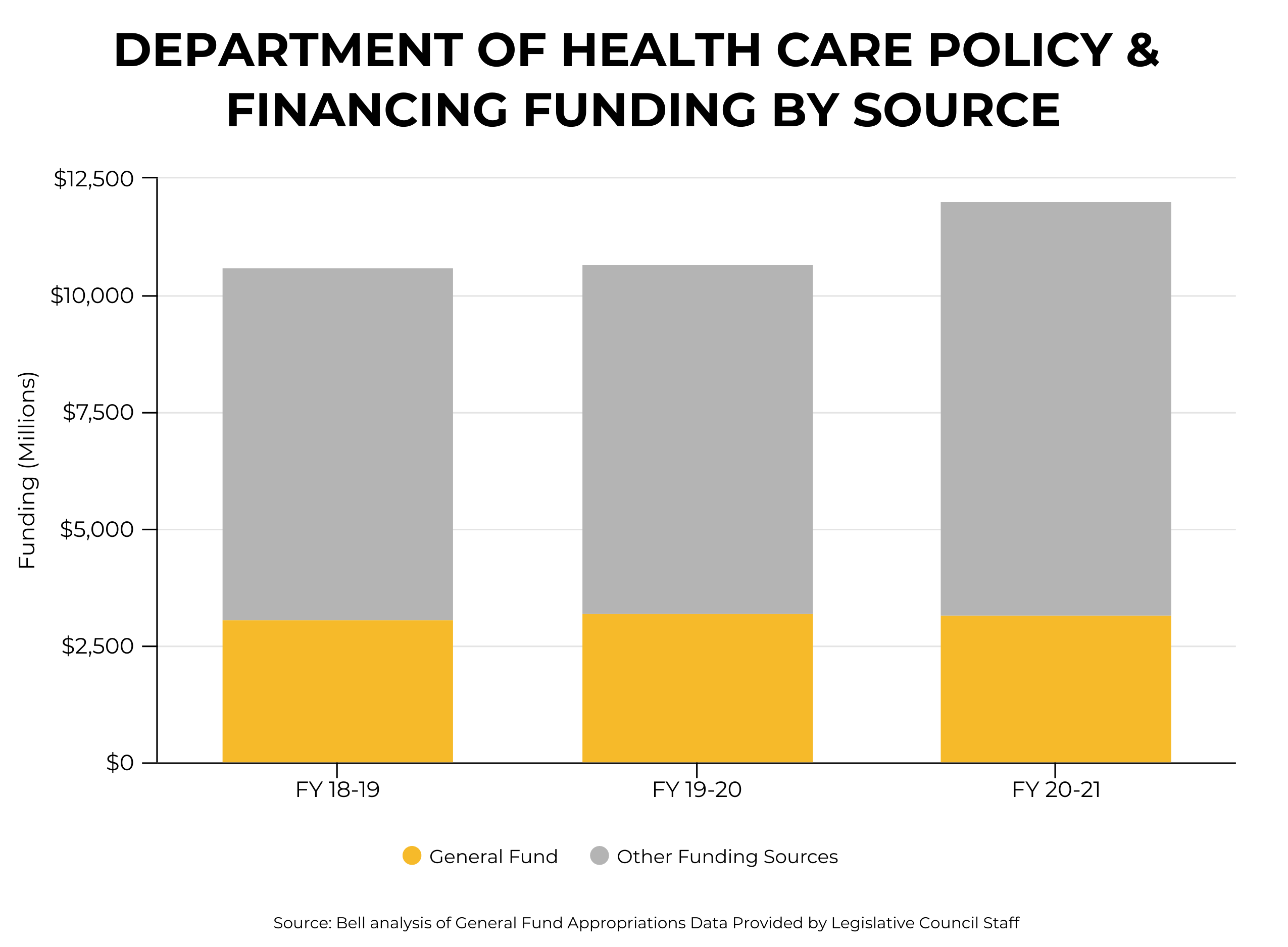

One department, the Department of Health Care Policy and Financing, saw increased appropriations. This is because of the need to help Coloradans pay for health care amidst the twin issues of a health crisis and economic crisis, which increased the number of people eligible for income-based programs like Medicaid.

Multi-Departmental Changes

PERA & Benefits

For many smaller departments, such as the legislative, treasury, and revenue departments, employment is one of the biggest spending categories. Consequently, one way for the state to reduce spending was on the Public Employees’ Retirement Association, or PERA, a retirement savings program for public employees. The public sector is a key employer, and PERA currently covers 1 in 10 Coloradans. However, by suspending state payments to the pension program, its solvency is jeopardized.

Community Provider Rates

For departments that provide direct services and programs to Coloradans, reductions to community provider rates were key to reducing spending. Departments like health and human services and corrections, often contract out medical and mental health services with community-based providers. Rural, low-income, and incarcerated Coloradans are more likely to receive services that are subsidized by these departments. As such, reductions to provider rates may reduce service availability for these communities.

The Impact of CARES Act & Cash Funds

Not all departments equally rely on the General Fund for their funding. In some cases, one-time federal funds through the CARES Act and the availability of cash funds staved off immediate damage. For the Department of Health Care Policy and Funding, this meant relatively flat overall funding as one-time funds helped fill the gap. However, for the Department of Higher Education, overall funding significantly fell for FY 2020-2021, because they strongly rely on General Fund appropriations and the legislature lacks constitutional obligations for spending in higher education.

Cash funds, or revenues generated through fees from different services and programs, make up the majority of funding for some departments, like agriculture, treasury, and judicial. These departments rely less on the General Fund and could more easily replace lost general fund revenue through cash funds.

What the December Budget Forecast Says to Expect for 2021-2022 Budget

According to the December forecast, the economy is recovering faster than expected compared to September expectations. However, the strong economic activity that led to an improved General Fund outlook still results in revenue that is below pre-pandemic levels when accounting for population growth and inflation.

Given the urgency of centering equity as JBC budget writers restore funding, the Bell will continue to follow budgetary issues, especially in the following key areas:

- Restoring appropriations to remedy base funding cuts that threaten key public investments

- Restoring funding to community providers where cuts threaten long-term community well-being

- Securing the long-term fiscal well-being of departments after one-time federal funding disappears