Headlines from the Colorado Tax Report

Every two years, the Colorado Department of Revenue (DOR) puts out a comprehensive report examining taxes and tax expenditures — deductions and special tax breaks — in Colorado. The 2020 Tax Profile and Expenditure Report was just released and examines the most recent tax information that is publicly available — Colorado’s taxes from 2017. This statutorily mandated report provides crucial information for those wishing to better understand the true landscape of taxes in Colorado. Here are some key highlights.

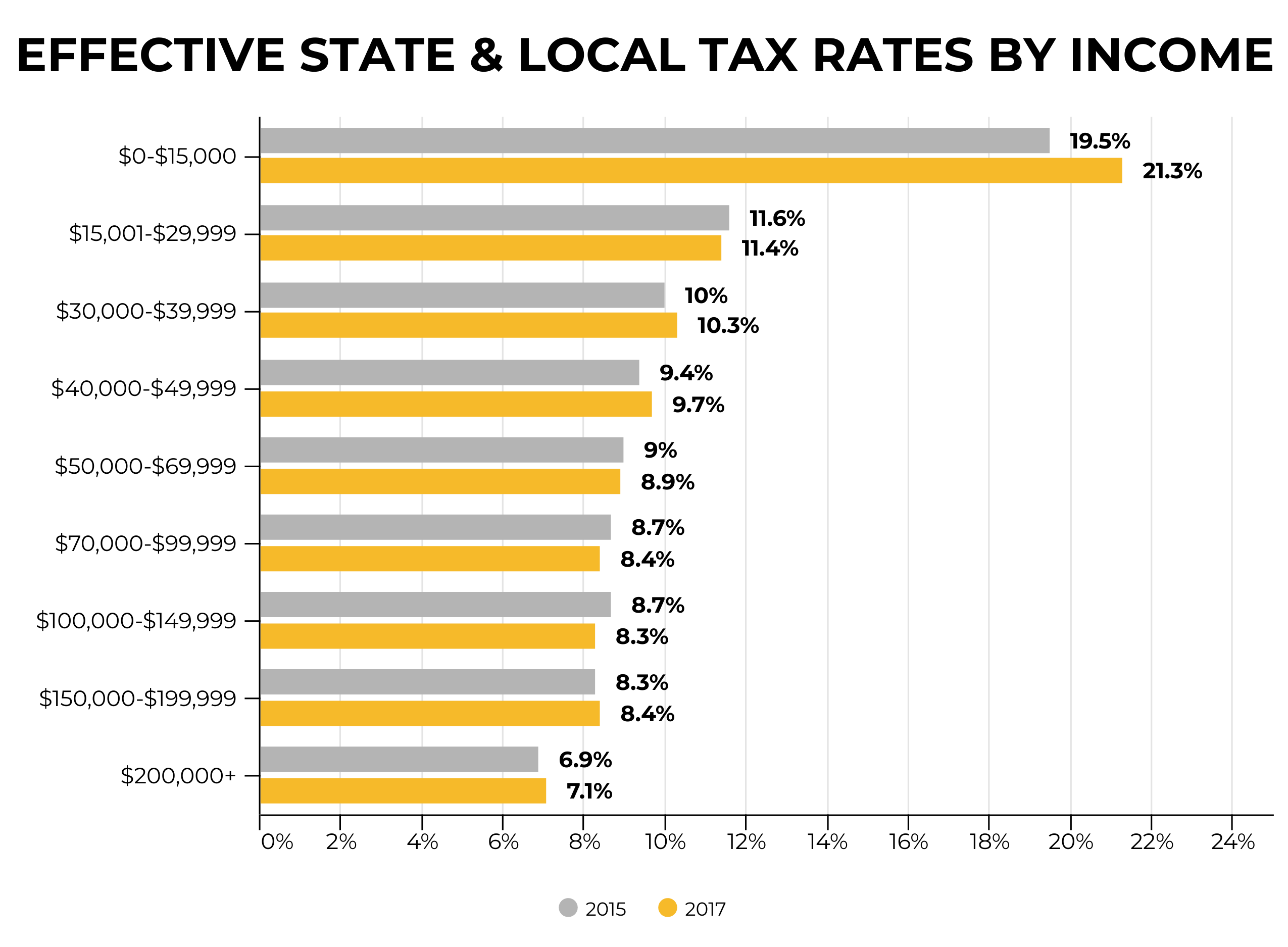

Colorado’s Tax System Became More Regressive

Inclusive of state and local taxes, Colorado’s tax code is regressive, meaning middle- and low-income Coloradans pay more taxes as a proportion of their income. As the above graph makes clear, the effective tax rate for Coloradans making less than $15,000 in annual income went up. This regressivity has increased because of the addition of local and statewide sales taxes to finance important public programs.

How Colorado raises revenue to pay for critical public services matters. While the Taxpayer Bill of Rights (TABOR) severely limits the tools available in Colorado, we need to continue to keep in mind how sales taxes are regressive and hurt low-income families the most, while income taxes — if structured well — can address income and wealth gaps that continue to persist. Legislators should also look at closing tax loopholes and deductions that overwhelmingly go to the wealthiest Coloradans and do not produce larger economic value.

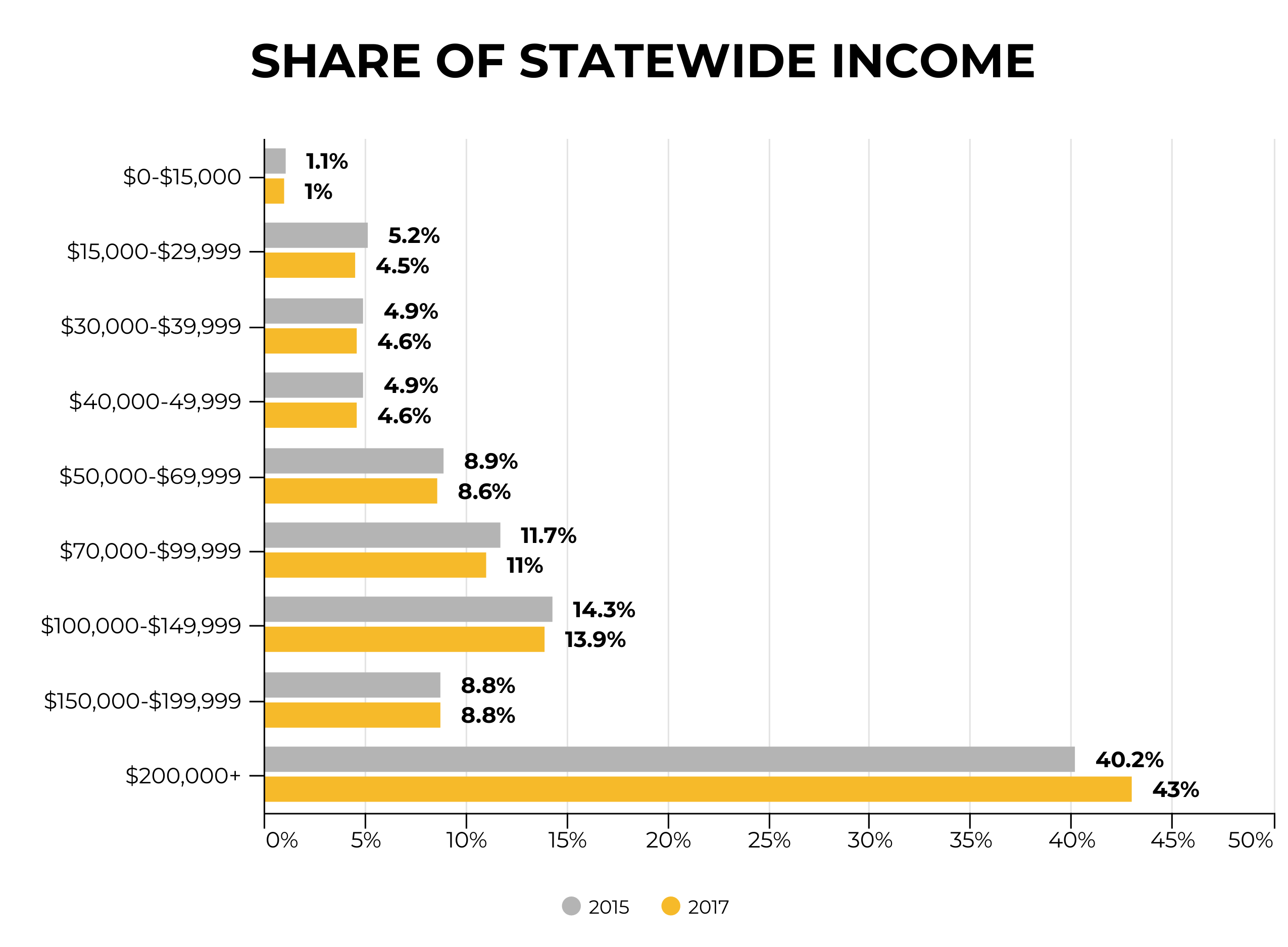

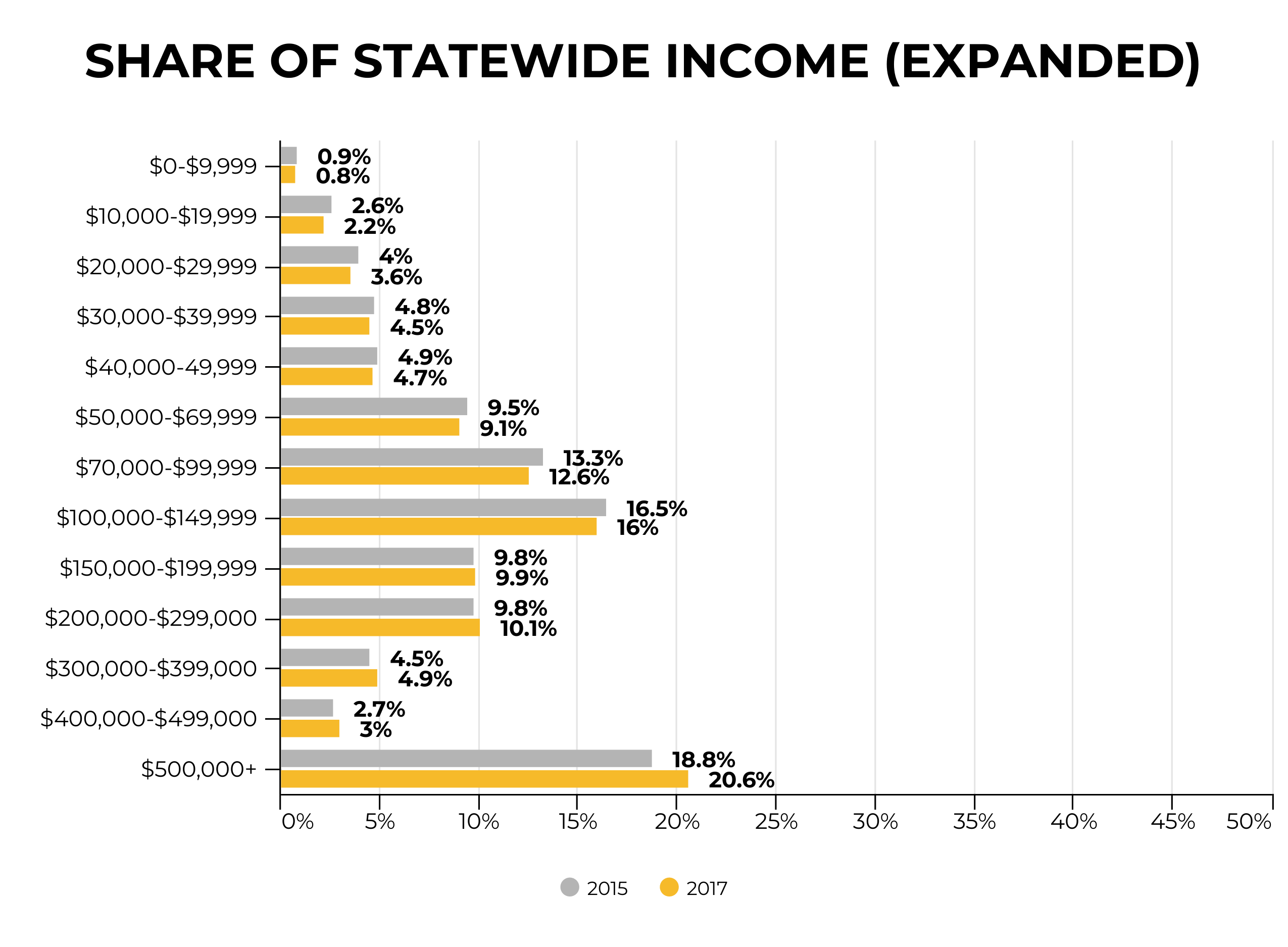

Income Inequality Has Grown

From 2015 to 2017, the only income bracket that increased its share of statewide income was those making $200,000 and above. When that bracket is examined more closely (as seen in the second graph), it is the top 1 percent of Coloradans who are seeing vast majority of those gains. Colorado is above the national average in income inequality and from 1973 to 2007, the top 1 percent gained more than all of Colorado’s income growth. That trend appears to be continuing.

For middle- and low-income Coloradans, stagnant wages and decreased state investment have led to a decrease in the size of Colorado’s middle class and the ability of families to affording the growing costs of living in Colorado.

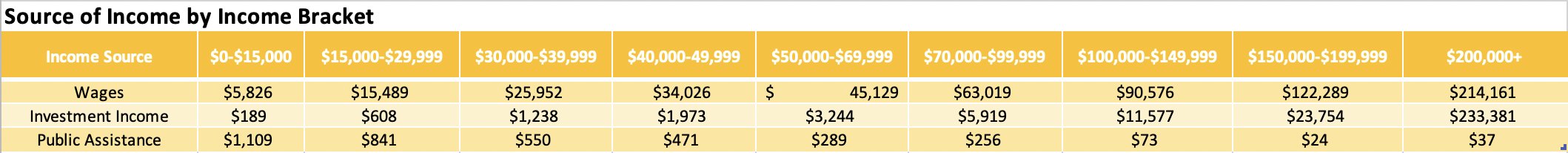

Focusing on Wage Taxation Benefits the Wealthy

A feature of Colorado’s (and the nation’s) tax system is we treat investment income differently than income from wages. Those with incomes above $200,000 annually average more income from investments than from wages. However, individuals and families below that $200,000 threshold have significantly less in investment income, as seen in the chart above. Because we have substantial tax breaks for capital gains — income made or lost from investments — that investment income is privileged in a way wage income is not. That, in practice, significantly advantages the wealthy. Differences in how we treat sources of income exacerbates the income inequality and the racial wealth gap.

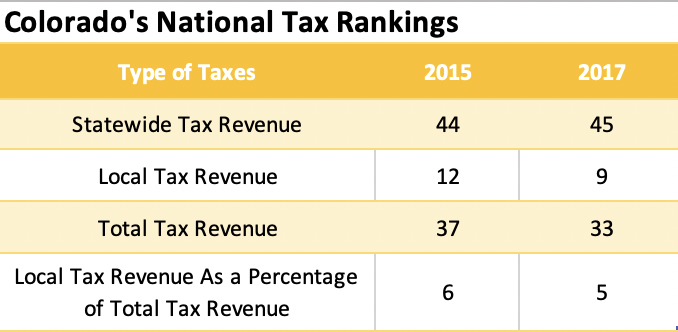

High Local Taxes That Exacerbate Inequity

Colorado is ranked near the bottom in statewide taxation and our ranking is getting worse (45th in the U.S.). When combining both state and local taxes, Colorado is lower than the national average. This difference in rankings occurs because our local taxes — and local taxes as a percentage of total taxes — are very high. As a state, Colorado is heavily dependent on local taxes as the mechanism for funding critical public services

Colorado’s overreliance on local taxes increases the regressivity of our tax code and produces stark inequalities between areas of the state. Because TABOR requires governments to only use regressive tax tools (e.g. sales taxes), a reliance on local revenue has a disproportionate impact on lower-income Coloradans. Also, without greater state support to fill gaps in public investment between localities, opportunity and adequate public spending is highly dependent on one’s zip code. A greater use of the state income tax to fund public services could help to address both problems.