Proposition 116 is a Double Whammy

Proposition 116, an across-the-board tax cut, is a double whammy for almost all Coloradans. Not only do the majority of the tax cuts go to the wealthiest Coloradans, but almost all Coloradans lose significantly more in public services than they would gain in tax relief.

Based on analyses from Legislative Council Services (LCS) and other non-partisan groups, across-the-board tax cuts like the one in Proposition 116, disproportionately benefit wealthy Coloradans while delivering little help to most Coloradans. The LCS analysis of Proposition 116 estimates the average Colorado taxpayer makes a little over $46,000 annually and will receive $37 in tax cuts. A Coloradan making $1 million would see a tax cut of $800.

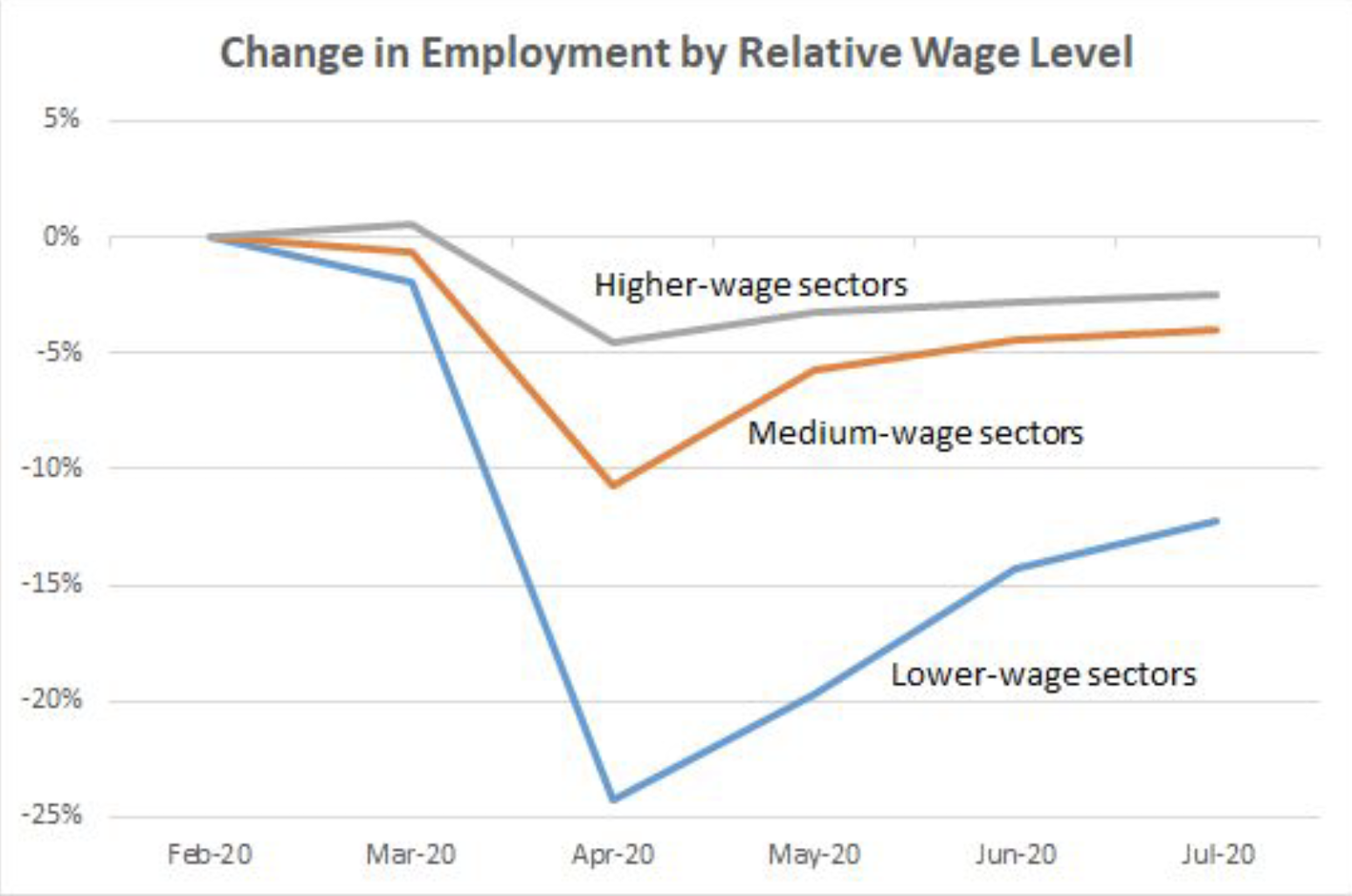

Due to COVID-19, low-wage workers lost their jobs at much higher rates than higher earners, and those jobs are returning much slower than jobs in medium or high-wage sectors. Proposition 116 — by giving significantly larger tax cuts to those at the top of the income ladder — will not significantly help those Coloradans who need it most. At a time when the wealthiest Coloradans are increasing their wealth, a tax cut that greatly benefits the rich is not a solution to the economic problems facing Coloradans.

Based upon the Bell’s analysis of taxable income provided by the Legislative Council, it’s estimated 55 percent of the tax cut will go to the top 3 percent of Coloradans.[i] That means about $90 million will go directly to the wealthiest Coloradans.

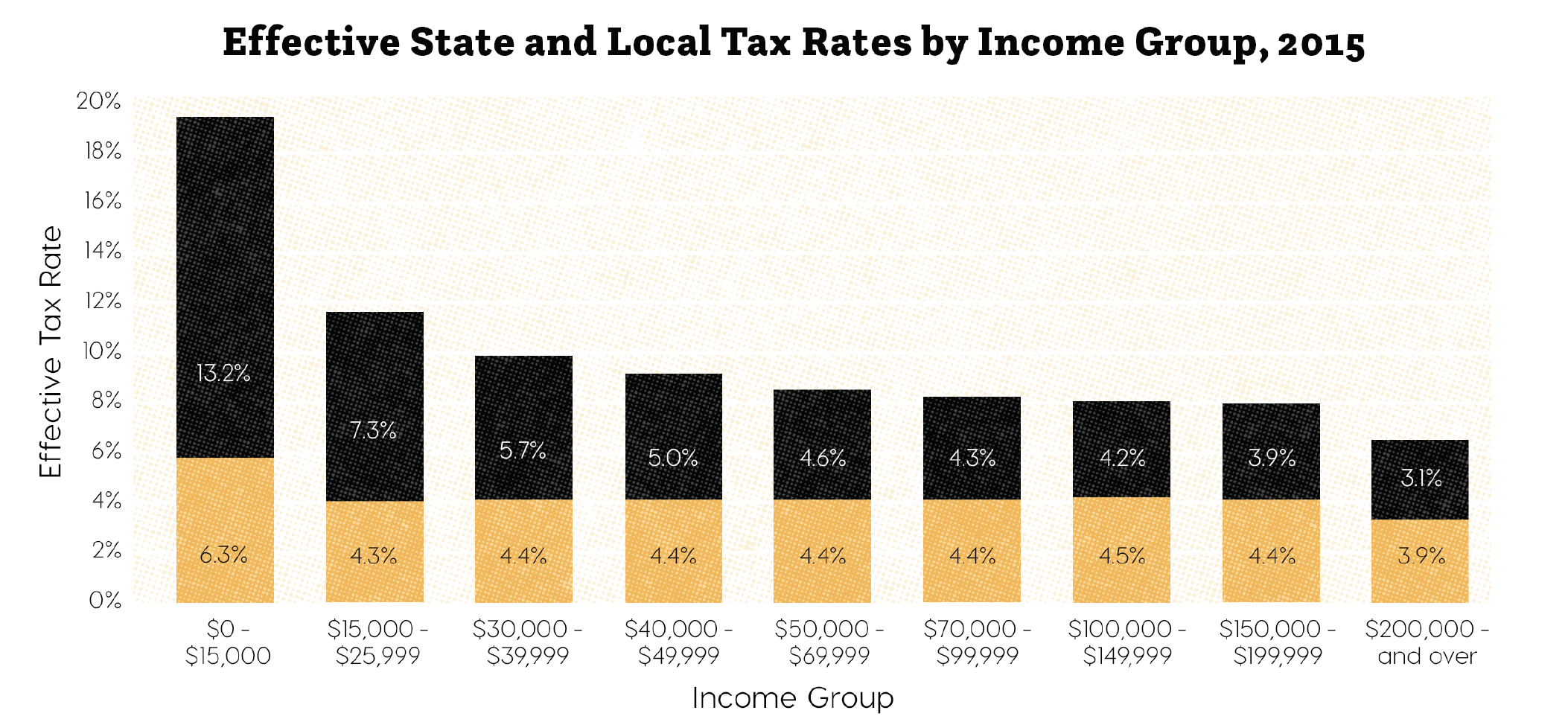

Colorado has an unfair tax system, as shown in the graph below. Wealthy Coloradans pay most of their taxes through income taxes and a cut to the income tax will increase the regressivity within Colorado’s overall tax code.

On top of its regressive effects, Proposition 116 would also cause a $2 billion decline over 10 years in our state budget ($357 million in just the first two fiscal years), forcing cuts to education, transportation, health care, and other state services millions of Coloradans depend on. Colorado was already struggling to recover from cuts to public services caused by the Great Recession, then it was forced to slash the state budget by another 25 percent due to COVID-19 and its associated economic recession.

For the vast majority of Coloradans, the amount of funds they lose in public investment through Proposition 116 are far greater than the tax cut they receive. That’s because our taxes pay for most of the government services. The stats tell the story:

- For Coloradans earning less than $80,000, Proposition 116 would lead to over $4.50 in lost public investment for every $1 in tax reduction they receive.[ii]

- For Coloradans making less than $100,000, Proposition 116 would lead to over $3.30 in lost public investment for every $1 in tax reduction they receive.

These numbers likely understate the actual loss in public investments, as income inequality has only gotten worse since 2016, the year in which the income data was last available. Government services can mean anything from K-12 education, colleges and universities, public transportation, Medicare and Medicaid, tax breaks for housing, dependents, or child care, and everything in between.

An income tax cut hurts everyone because state services support everyone. Proposition 116 would force cuts that would disproportionately fall on the least fortunate among us. We should be moving toward a fair tax system — one that requires the wealthy to pay their fair share — not one that just exacerbates the regressivity of the current tax code. Proposition 116 does not provide significant targeted relief for those in Colorado who need it most, and its cuts to public services will make recovering from this recession even more difficult. Colorado cannot afford Proposition 116.

[i] Calculations are upon Legislative Council’s analysis of 2018 taxable income provided in Legislative Council’s review of Initiative 271. Using the distributions of incomes and taxpayers provide in that review, the Bell was able to calculate the amount of Proposition 116’s tax cut that would go to the top 3 percent and the bottom 97 percent.

[ii] Calculations are based upon analysis of 2016 Colorado Source of Income Data, which is the latest year of data available, that is broken into $10,000 increments. To calculate the amount of public investment lost compared to tax reduction received, a total projected tax reduction for incomes below a certain level were totaled. The total public investment lost among all incomes based upon the 2016 estimates was divided by the total estimated tax reduction for those below certain incomes.