SB20-207: Needed Changes to Unemployment Insurance for Colorado’s Recovery

The current unemployment rate is the worst since the Great Depression. Over 500,000 Coloradans have filed for unemployment insurance (UI). In response to the crisis, Colorado needs to modify the UI system to give employers more flexibility to bring their employees back to work as soon as possible and provide short-term relief to businesses, while still ensuring workers’ health and safety.

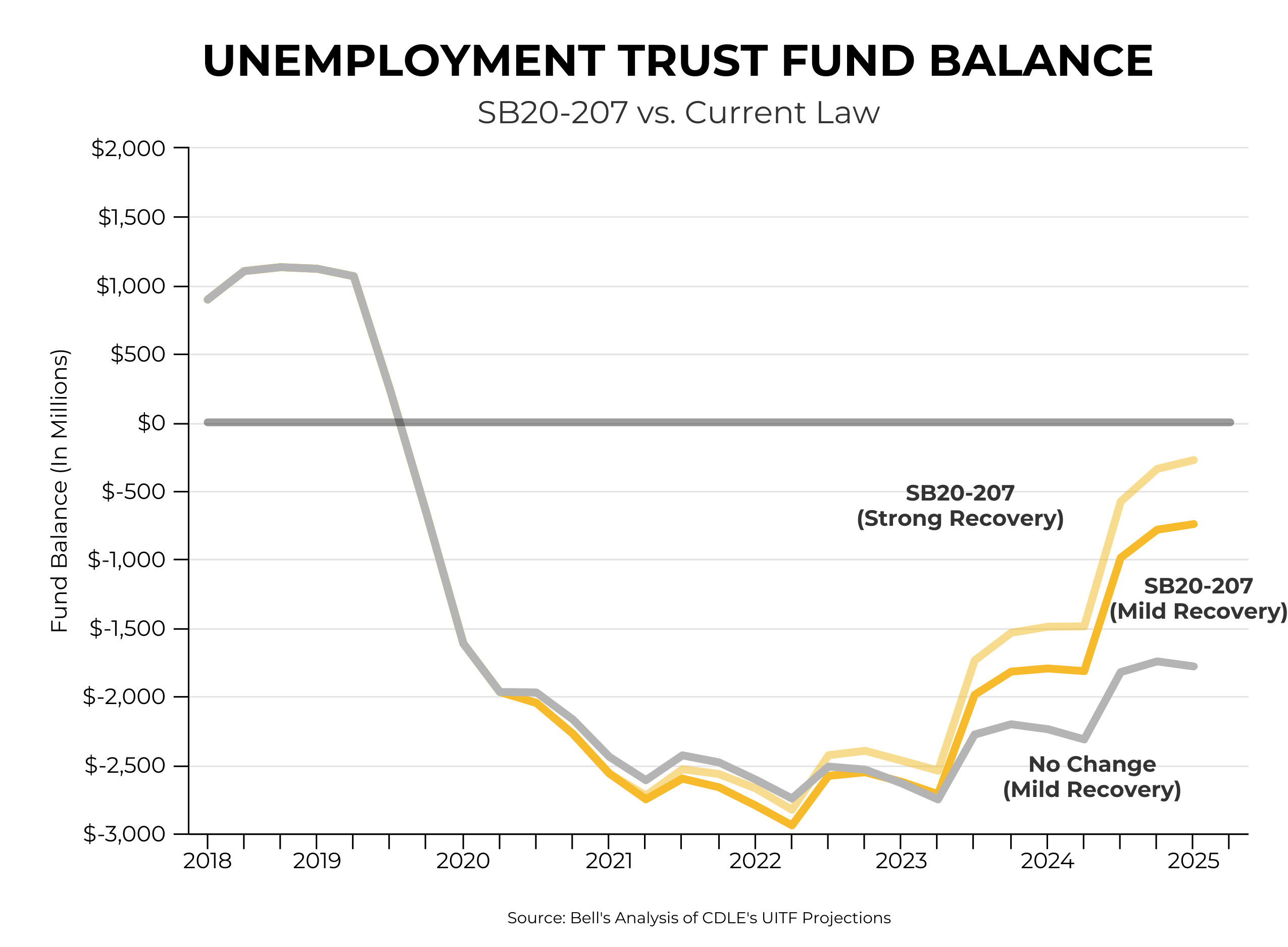

Colorado must also make smart changes that allow for future solvency to the Unemployment Insurance Trust Fund (UITF). These changes were needed before COVID-19 and are even more important now. If we do not take these steps now, we will be positioning Colorado for a future crisis.

SB20-207 is a smart compromise that protects workers, provides short-term relief, and makes needed long-term reforms.

Short-Term Relief for Business & Long-Term Solvency

Solvency, or the measure of how much a state has in its UITF compared to the highest average benefits the state has had to pay out over the last 20 years, is an extremely important measure of a well-functioning UI system. As of 2020, Colorado’s solvency ratio was .87, meaning Colorado’s UITF was not at or above where it needed to be to pay out potential claims (i.e., a ratio of 1 is thought to be a minimum level of solvency). In fact, Colorado ranked 37th among states in our solvency ratio.

One of the primary reasons for Colorado’s low solvency ratio is the amount of wages we apply an insurance premium to, referred to as “the wage base.” Currently, 29 states have a higher premium wage base than Colorado. Colorado’s wage base is currently $13,600, meaning the UI premium is only charged to the first $13,600 of an employee’s wages. In comparison, states of comparable size and economies have much higher wage bases, such as Washington at $49,800, Oregon at $40,600, Minnesota at $34,000, and North Carolina at $24,300. Our surrounding states are all higher than Colorado, including Wyoming at $25,400, Utah at $35,300, and New Mexico at $24,800.

SB20-207 will provide short-term relief to businesses in exchange for much needed long-term fixes to the taxable wage base.

- In the short term, the state will delay the implementation of a solvency surcharge for two years. This surcharge is triggered whenever the UITF becomes insolvent and is required to borrow from the federal government. This will help businesses to recover in the coming years.

- Gradually over the next six years the taxable wage base will increase to $30,600. Most of the increases will occur in later years, providing an opportunity for the economy to recover while also ensuring Colorado is on a long-term plan to solvency.

These changes are extremely important for both solvency and future business costs.

- In order to pay for current UI claims, Colorado will have to borrow from the federal government. While these loans are interest free until December 31st, based upon current opposition in the Republican-held Senate, these loans will start to accrue interest after that point. As demonstrated in the graph above, this borrowing with interest will extend Colorado’s insolvency for possibly a decade if we do not make SB20-207’s long-term reforms.

- If Colorado has not paid back federal loans within two years, the federal unemployment tax for businesses in Colorado doubles and increases by that same amount for every year the loans have not been repaid. By 2027, Colorado businesses could be paying five times their current federal unemployment insurance taxes as well as a solvency surcharge that would be needed just to pay off existing loans.

- Insolvency could also lead to calls for reduced benefits, reduced eligibility, and an inability to invest in strong programs such as training. Colorado could be approaching a situation in which businesses are paying high rates to a less effective program.

Ensures Workers Have the Right to Return to a Healthy Workplace

Unfortunately, returning to work may not be an option for some Coloradans, as COVID-19 has wreaked havoc within their families, requiring them to care for a family member or a child who can no longer attend school. The risks of COVID-19 may also require many Coloradans to stay home and make them unavailable to return to work.

SB20-207 would further clarify the allowable reasons for quitting or not returning to a job during a public health emergency, while still receiving UI. These additional reasons will include situations where an individual needs to care for a sick or quarantined family member or for a child whose school is closed due to a public health emergency. It also ensures “vulnerable individuals” can stay on UI while they are unable to work. The expansion of “good cause” will allow these Coloradans the opportunity to stay on UI while they try to recover themselves.

Assistance in Helping Businesses to Maintain Employees & Incentivizing Acceptance of Work

It’s promising many Colorado businesses are beginning to reopen and take the needed steps to restart the economy. As our state takes these steps, many employees may see reduced hours, perhaps reduced pay, or a need to take different jobs. SB20-207 helps with these potential problems:

- Expands the Work Share Program, which allows employers to use UI benefits to compensate employees for lost hours rather than having to lay off employees.

- Incentivizes individuals to Work and Accept Employment Opportunities by raising the earnings disregard from 25 percent to 50 percent of an individual’s weekly benefit amount for both full and partial unemployment.

SB20-207 is a Smart Compromise

Colorado can not afford to further damage our economy by putting workers at risk, risking long-term insolvency to our Unemployment Insurance Trust Fund, and burdening businesses in the short term. SB20-207 makes needed compromises and long-term reforms at the same time.