Lasting Damage: COVID-19’s Toll on Colorado’s Strapped State Budget

Lasting Damage: COVID-19’s Damage to Colorado’s Already Strapped State Budget

The last few months have been devastating for the prospects for the investments we make in our communities, Colorado’s economic infrastructure, and our children’s future. In a state already limited in the financial resources we can provide to schools, transportation, and community investments, the economic consequences of COVID-19 have the potential to set Colorado back decades.

For legislators working on the budget, the last month has been an exercise in making choices between only bad choices. Do you cut funds for aging Coloradans to avoid draconian cuts to K-12 education? Do you cut programs that have proven effective to ensure Coloradan’s have basic forms of health care?

In this detailed blog, we outline the economic conditions that are providing Colorado’s with false choices and the likely cuts that will lead to lost opportunities for Coloradans, exacerbate existing inequities, increase future inequities, and lead to future costs far greater than the costs of prevention.

Before turning to these areas, it is important to state there are current options available to avoid these deep cuts to Colorado communities:

- Congress and the White House can pass an additional stimulus to direct more federal funding to state and local governments, keeping programs from being cut and workers in cities, counties, and the state from being laid off

- There are important legal questions about how to explore the emergency tax provision within Colorado’s Constitution. The tax requires a supermajority vote in the state legislature. An emergency tax on the wealthiest Coloradans would allow Colorado to continue to make strong investments in our communities that will be vital to recovery

- A proposed ballot initiative to cut taxes on 95 percent of Coloradans while creating new tax brackets for the wealthiest 5 percent could raise funding at the state-level and prevent some of the more drastic cuts that would otherwise be required.

But there are no guarantees any of the above options will come to pass. In the meantime, we are facing an economic catastrophe that eclipses even the depths of the Great Recession.

The Economic Costs to Colorado from COVID-19

COVID-19 has affected all aspects of Colorado’s economy. A few key indicators give a sense of the scope of the economic consequence within Colorado:

- The General Fund budget is projected to be $3.3 billion lower than the budget set for FY 2019-20 and the projected budget for FY 2020-21, the equivalent of about a 25 percent drop in the General Fund. During the depths of the Great Recession, the largest single fiscal year drop for the General Fund — from FY 2009-10 to FY 2010-11 — was $517 million, a 7 percent drop in revenue at that time.

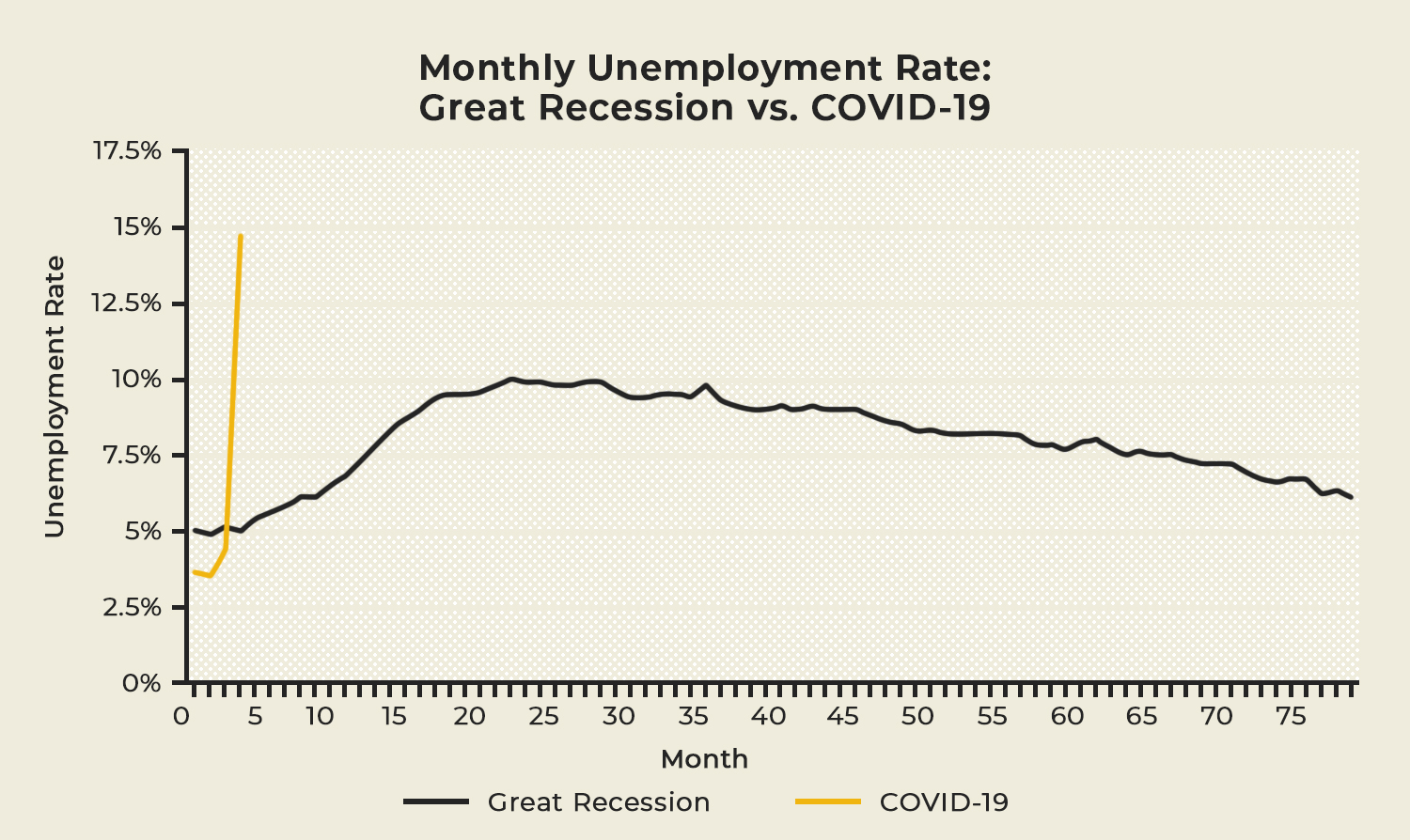

- Unemployment has risen faster than nearly any point and is reaching levels only seen during the Great Depression. As the below graph shows, the national unemployment rate has reached 14.7 percent unemployment in just two months, compared to the approximately 23 months it took the country to hit peak unemployment — 10 percent — during the Great Recession.

- At the beginning of FY 2019-20, the Unemployment Insurance Trust Fund (UITF), the state fund that provides funding for unemployment claims, had a positive balance of $1.1 billion to pay out to unemployed workers. By the end of FY 2020-21, UITF is expected to have a deficit of close to $2 billion, putting stress on insurance premium payments at a time when many businesses will be struggling to keep their doors open.

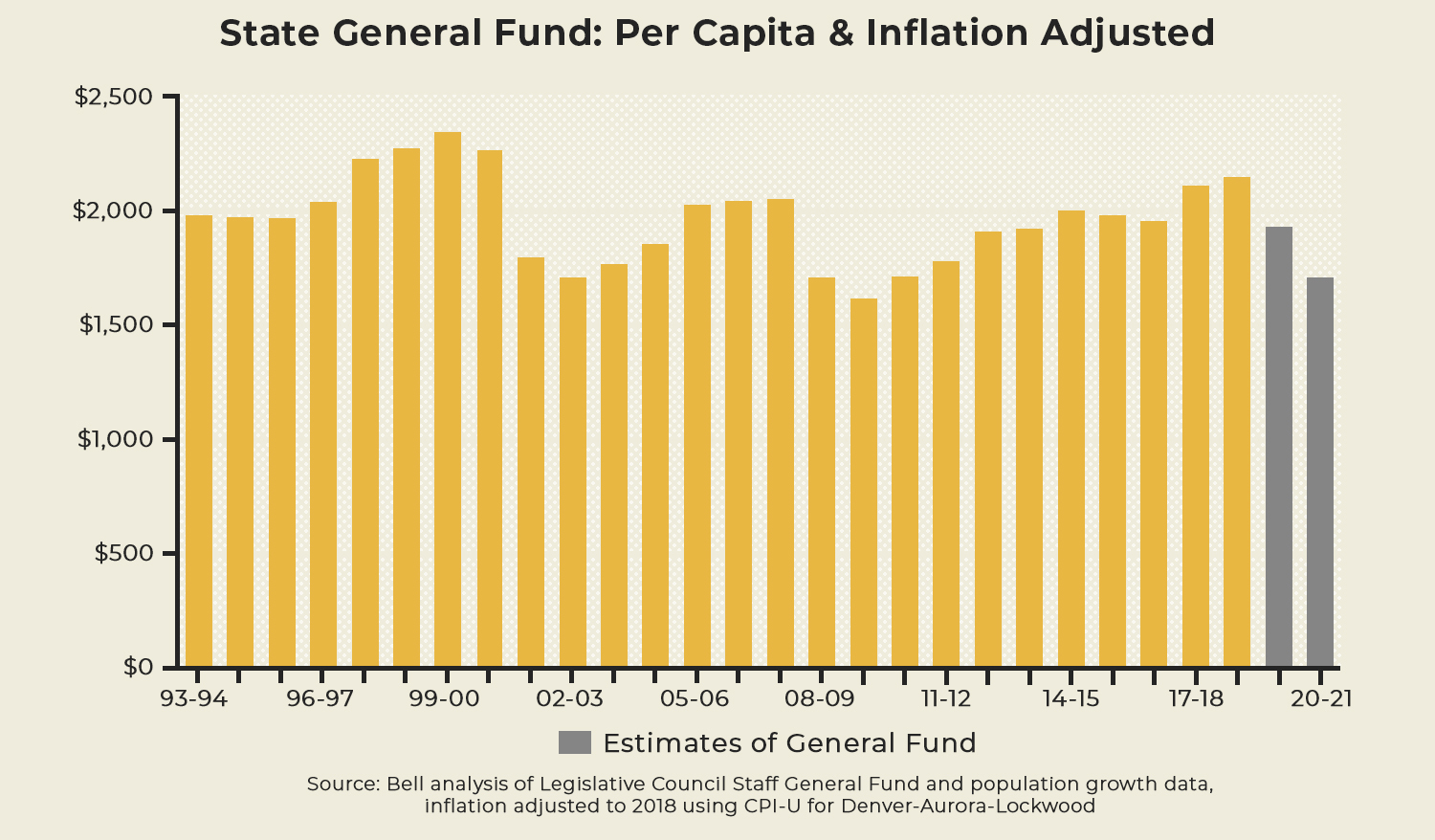

Looking back 30 years, the General Fund forecast projects state spending — on a per capita and inflation-adjusted level — to be lower than every year except the worst year of the Great Recession. Spending levels will be lower than 1992, the year in which the Taxpayer Bill of Rights passed and artificially capped state spending and revenues.

Looking back 30 years, the General Fund forecast projects state spending — on a per capita and inflation-adjusted level — to be lower than every year except the worst year of the Great Recession. Spending levels will be lower than 1992, the year in which the Taxpayer Bill of Rights passed and artificially capped state spending and revenues.

While Colorado receives federal funding for many programs and community investments, the state’s General Fund is the largest single aspect of the state’s budget and is made up of money collected from taxes, including income, corporate, and sales, use, and excise taxes. As of last year, the General Fund made up 37.5 percent of the total state budget. As opposed to federal funding that is passed through the state for specific programs and areas, the General Fund is the largest portion of the budget that can be allocated through legislative discretion.

The projected shortfall through FY 2020-21 is $3.3 billion. That includes nearly $900 million in reduced revenue to the already-passed FY 2019-20 budget and $2.4 billion to the projected FY 2020-21 budget. The expectation is shortfalls will continue into the year after, approaching a total budgetary downward revision from previous projections of $5.5 billion over the next two budget years, according to the Office of State Planning and Budgeting (OSPB).

With reductions of this size, the legislature cannot avoid large and severe budget cuts. It is expected every state agency, every community, and almost every sector of the economy will experience some damage because of the economic downturn. As we learned in the Great Recession, state and local budget cuts only prolong economic struggles, and without an ability to main Colorado’s investments in our schools, communities, and infrastructure, the economic effects of COVID-19 may last much longer than needed.

Local budgets — including counties, municipalities, school districts, and other special districts — throughout the state are going to experience both immediate and long-term shortfalls to their budgets. Local governments cannot administer income taxes in Colorado, which they rely heavily on sales and use taxes and property taxes to fund the critical services in their communities such as schools, police, fire, and transportation.

Sales & Use Taxes

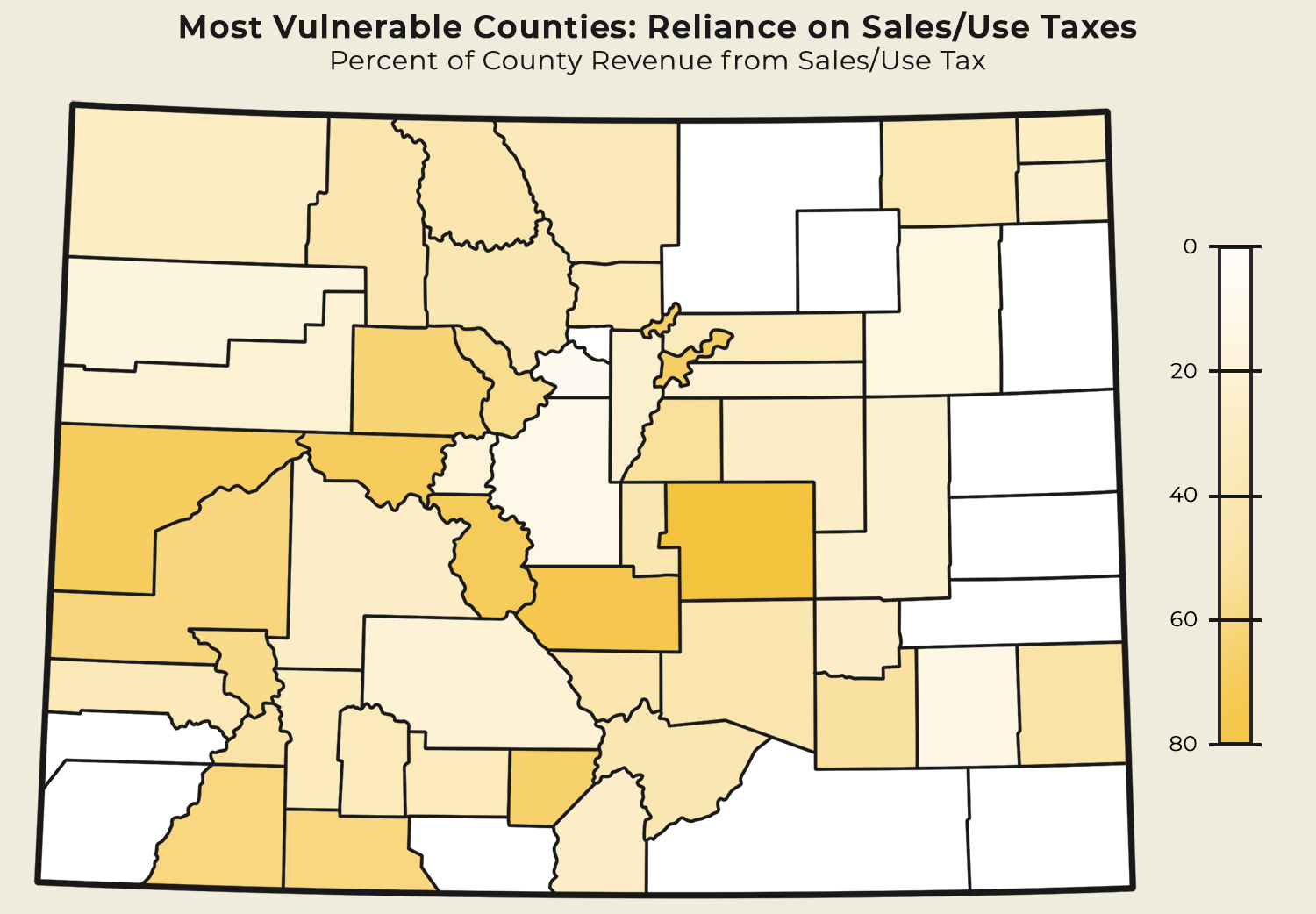

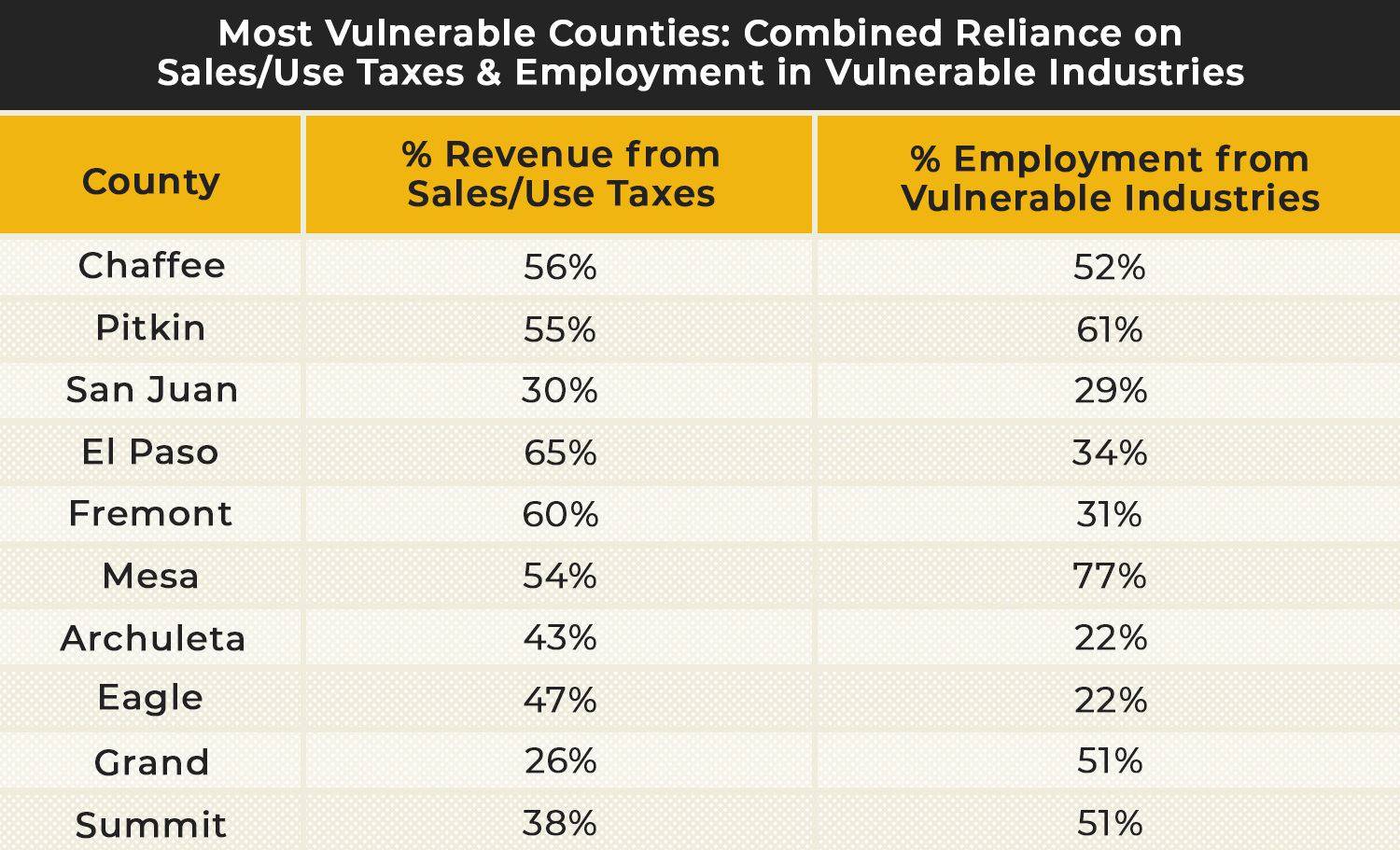

Because of the economic pause needed for health and safety, the loss of sales and use taxes will be immediate. The Bell estimates Colorado cities and counties could lose over $522 million of their budget over the next year if there is a 10 percent reduction in sales tax, and that could increase to over $1 billion if it nears a 20 percent reduction. These effects will not be equal, as there are particular counties and municipalities that are especially vulnerable based upon their reliance on sales taxes and have an economy that is centered around industries that have been extremely hard hit, such as hospitality, retail, leisure, and entertainment. These counties are located throughout Colorado and are likely to be more rural and mountain communities.

Property Taxes

Property taxes are a major source of revenue for schools and for services such as fire, police, and public infrastructure. Because they a typically based upon property assessments made a year or two in the past, they are less likely to rise and fall as fast and relentlessly. Although revenue declines from property taxes are not likely to be immediate, they are likely to come in the next two to three years and could potentially prolong our current crisis.

The economic consequences related to property taxes are further complicated by the Gallagher Amendment. In short, the Gallagher Amendment mandates that residential property taxes can only make up 45 percent of the property tax base, meaning that non-residential property — including commercial, farmland, vacant lots, and mineral claims — make up the other 55 percent.

It is expected non-residential property values will fall over the next few years due to closing of shops, restaurants, and other retail locations throughout the state. If this occurs, the assessments rates for residential property would have to drop to ensure they residential property does not make up more than 45 percent of the state’s property tax base. The state’s Division of Property Taxation estimates the assessment rate for residential properties may need to drop from the current 7.15 percent to 5.88 percent — an almost 18 percent drop and the second largest residential assessment rate decrease since the Gallagher Amendment was adopted.

This could have devastating consequences for communities that have a larger share of residential properties within their county, which is primarily rural communities in Colorado. With a smaller property tax base, localities would either must cut their budgets or increase property taxes.

Property taxes are driver of money for K-12 education. In fact, 51.2 percent of property taxes across the state go to local K-12 education. The Division of Property Taxation estimates total lost revenue to school districts is $491 million, an amount that would cause great harm to school districts. Given the state is typically counted on to backfill education revenue to local districts, and the state is facing severe deficits, the cuts may even have to be larger for longer. Nearly 23 percent of property taxes go to county governments and more than 20 percent go to special districts. That means on top of the lost money to schools that will result from the drop in property tax revenue, county governments and special districts — which include fire districts, ambulance districts, and other important services — will see enormous hits too.

What's Known About Possible State Budget Cuts

As the legislature returns, proposed cuts adopted by the Joint Budget Committee (JBC) will be finalized for the full legislature, and they will become actual cuts. For the past three weeks, the JBC, which makes budget recommendations to the General Assembly, has been meeting to do what no one has done before: make cuts to our state’s budget on a scale close to 25 percent of our state General Fund.

A plethora of documents and analyses have been produced, but because Colorado’s budget is already limited in size and the majority of funding goes to education, health care, human services, and higher education, there was little choice but to make cuts to vital economic and community investments. Unless more funding is made available through the federal government or raised at a state-level, these cuts will have immediate and long-lasting consequences.

The decisions JBC has been forced to make will cost hundreds of thousands of Coloradans economic opportunity for years to come. More than a decade of progress has been erased in many areas over the course of the past several weeks. The worst cuts will lead to systemic opportunity failures because the foundations of our institutions themselves are being damaged. In the case of both K-12 and higher education, the costs of these cuts are compounded on systems that never fully recovered from the Great Recession, and raise serious concerns around our ability to rebuild these systems so that they can be vehicles of opportunity for all. Past cuts to these areas were only very gradually and incompletely restored.

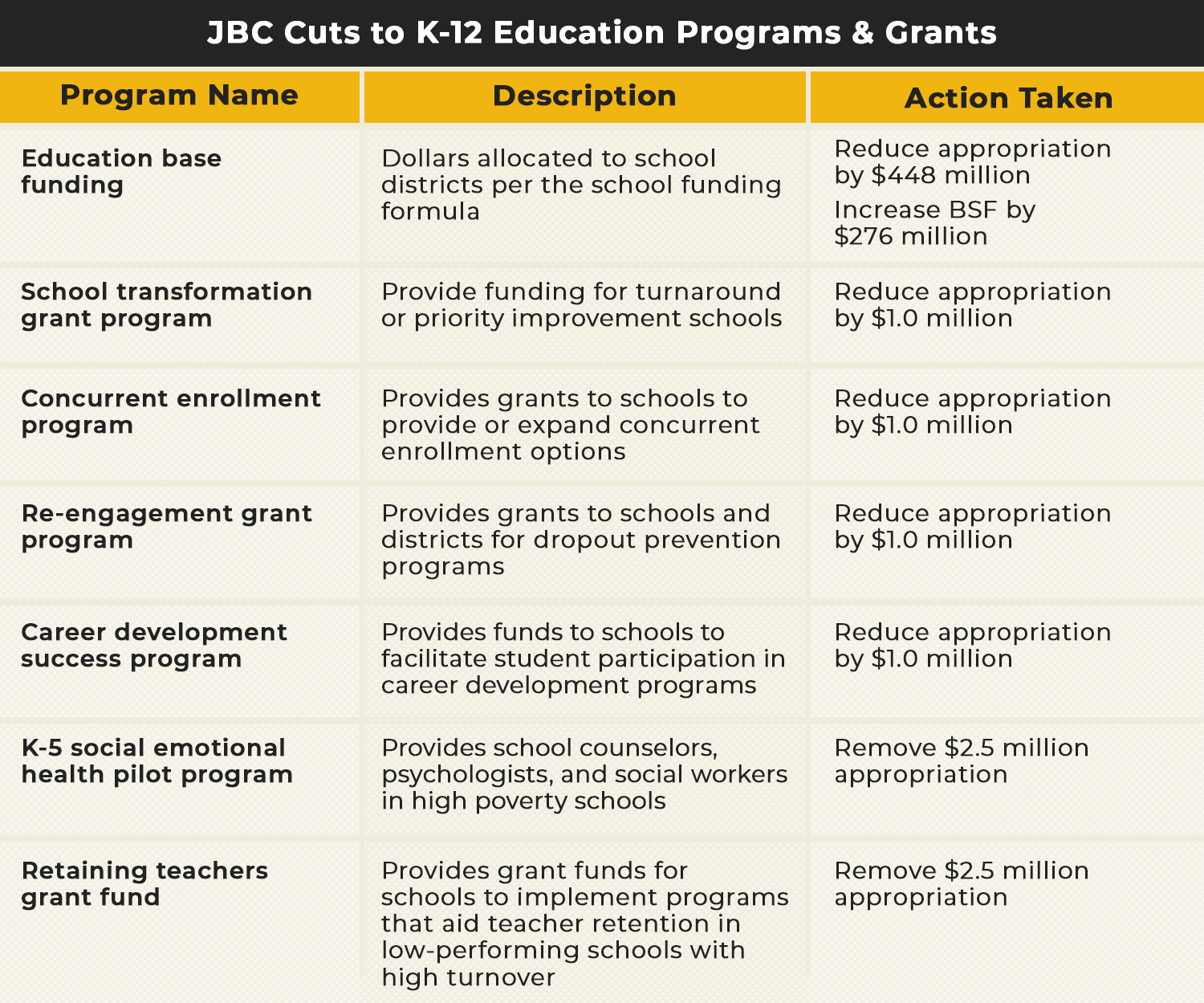

K-12 Education: What’s been done?

The cuts that have already been made have cost districts, teachers, and students all over the state evidence-based programs we know have lasting impacts on the economic mobility of all Coloradans. The most dramatic cuts to education came at the end of the JBC’s budget process, with a $724 million cut to education base funding. This includes a $448 million reduction to the current appropriation, and a roughly $276 million increase in the budget stabilization factor. To prioritize equity alterations to the school funding formula (more on that below) are still on the table through the School Finance Act when the General Assembly returns. Already, we have seen cuts to pilot programs, special projects, and grants for school building improvements. This table provides a summary of some of the significant cuts the JBC has already made that impact Colorado’s most vulnerable student populations. Most of the programs outlined below are targeted at reducing inequities in student outcomes and increasing the likelihood of degree attainment.

K-12 Education: What’s Left?

Colorado already ranks low, compared to other states, in per-pupil-funding. In 2017, Colorado ranked 37th in per-pupil spending compared to other states. Colorado has underfunded public education for years through the budget stabilization factor (BSF), which allows the legislature to not fully fund education as would be required by the state constitution. The JBC just raised the BSF with their cut to education base funding, up to a total of $1.3 billion, further driving down per-pupil spending. The BSF applies equally to all districts as a percent, but because districts are jointly funded by local revenue and state revenue, an equal reduction in the percent of state revenue can have large impacts in some districts and negligible impacts in other districts (i.e. those that generate more dollars though local property taxes).

K-12 Education: What Can Be Considered?

To avoid devastating cuts to the most vulnerable districts, the General Assembly can make adjustments to the school funding formula, a contentious issue in the best of times. There are three main areas where the General Assembly could make adjustments to:

- The “size factor” provides additional dollars to small districts to help compensate for the lack of economies of scale that larger districts have.

- The “at-risk factor” provides additional dollars to districts based on their population of students eligible for free or reduced-price lunch to better support these students.

- The “cost of living factor” provides additional dollars to districts to compensate for higher costs of living.

To help prioritize equity, JBC staff hopes adjustments to the formula will focus on reductions to the cost of living factor. The additional merit of cuts here is districts with higher costs of living are more likely to be able to offset cuts through mill levy overrides compared to other districts.

Higher Education: What’s Been Done?

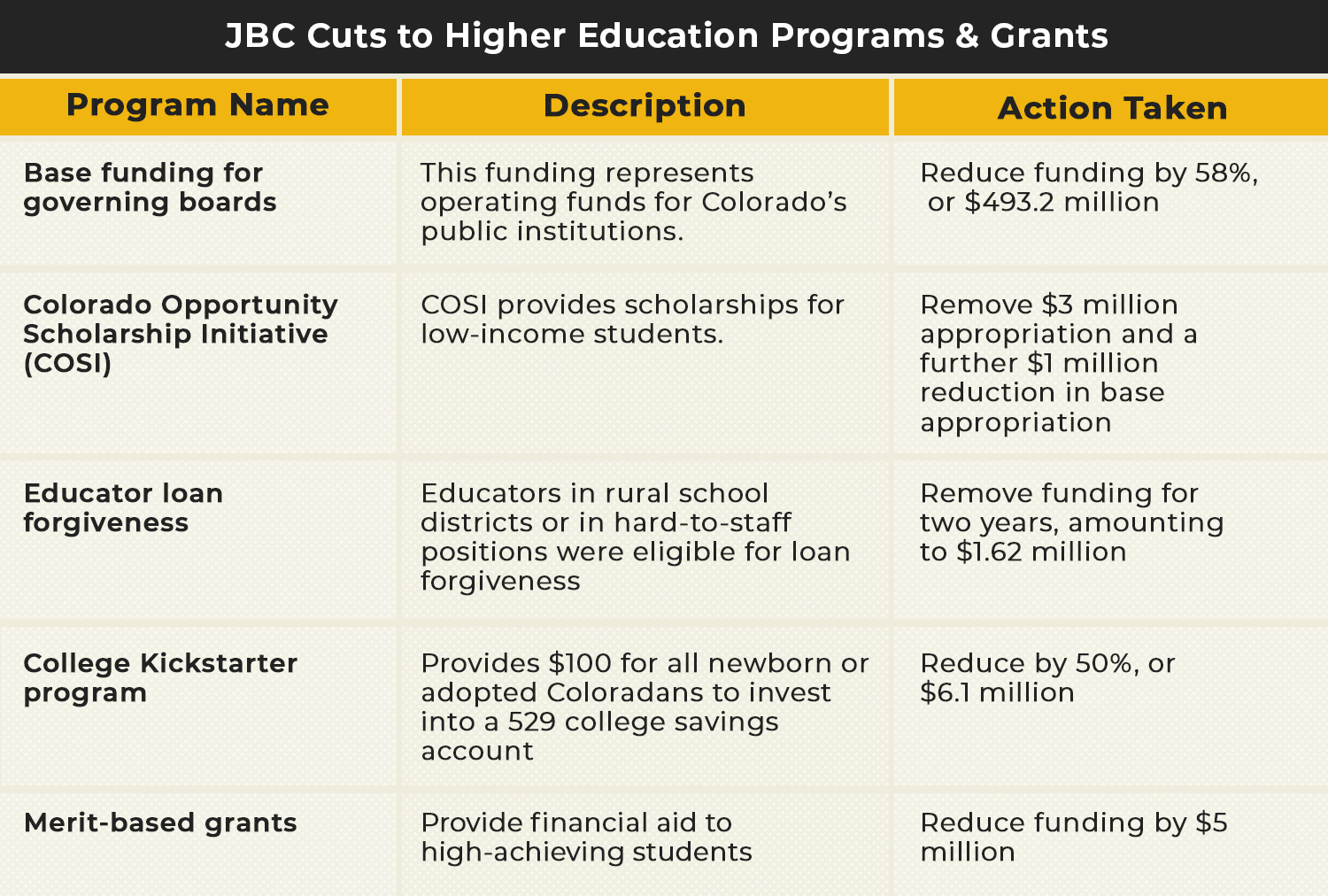

At this point, higher education has been thoroughly addressed, with cuts to governing board budgets representing some of the largest and most staggering cuts the JBC has made. This table presents a summary of some of the most significant cuts to higher education.

Like K-12 education, our institutions of higher education have fared poorly since the last recession. Dramatic cuts to higher education are common during times of recession because of flexibilities in this part of the budget. Moreover, during a typical recession, institutions of higher education can rely upon tuition revenue from increased enrollment to offset cuts from the state. Additionally, during the last recession the federal stimulus bill, the American Recovery and Rehabilitation Act, further offset some of the state cuts to higher education. Since then, the level of state investment has failed to return to pre-recession levels when accounting for population growth and inflation.

Compared to other states, Colorado ranked 45th in terms of state investment to higher education. On May 19, 2020, the JBC voted to reduce the state appropriation to institutions of higher education by 58 percent or a level amount of $493.4 million. This cut lowers state fiscal support for higher education to $106.55 per capita. If other states were to hold their levels of state investment constant this would leave Colorado ranking 49th in per capita higher education funding.

While CARES Act dollars will offset some of the cuts (in both public K-12 and higher education) in the coming year, Colorado will likely inch further toward the bottom of the pack in our state investment to both K-12 and higher education. This is for two reasons:

- CARES Act dollars cannot currently be used to directly backfill revenue losses. While there are efforts to get more federal dollars, and more flexible guidelines on how these dollars can be used, at the moment CARES Act funds can only go to COVID-19-related expenses. This makes it difficult to say exactly how much cash institutions will be operating with next year.

- CARES Act dollars are a one-time influx of cash into our institutions of higher education, akin to the American Recovery and Rehabilitation Act. Since the state cuts in 2009, higher education has slowly regained lost ground. However, we are still far from where we were before the Great Recession in terms of per capita spending on higher education from state investment. K-12 education has been underfunded through the BSF by hundreds of millions of dollars a year since the recession as well. Despite hopes that these base funding cuts are a one-time occurrence there is a concern that institutions will be permanently affected by a slow recovery. The compounding effects of the Great Recession and the COVID-19 recession could amount to more than two decades of underfunding higher education in Colorado.

Further aggravating these cuts are two issues. First, institutions, at this time, have limited avenues for recuperating those lost revenues since enrollments are unlikely to increase during the fall due to COVID-19 associated risks of attending in-person classes. Second, higher education institutions will likely need additional resources as we transition into a recovery stage. Given the economic shift catalyzed by COVID-19 there will be a greater need to train and prepare workers for new high-demand jobs. Our institutions of higher education will play a critical role in revitalizing the economy, and we have left them very vulnerable.

Not only will these cuts harm future outcomes for Coloradans of all ages, we know the brunt of these cuts will be inequitably borne by our most vulnerable communities. Across K-12 education, higher education, and in health and human services, it is our rural communities, low-income communities, and communities of color that are most likely to be negatively impacted by cuts.

K-12 Education

The JBC has tried to preserve dollars for the most vulnerable students but is also negotiating the challenge that due to the recession more students are going to be eligible for free or reduced-price lunch with the rise of unemployment. This means education would be more expensive if the state’s funding formula were to remain unadjusted.

Due to the significant role local revenue plays in funding, cuts will be deeply felt in localities that rely more on state funding to backfill local revenue shortfalls. This inevitably plays a disproportionately heavy toll on rural districts where funding shortfalls and a lack of economy of scale combine. This will not only be felt with across the board cuts through school finance, but through some of the programmatic cuts that have already been made.

Beyond existing cuts there are additional school finance options available to the General Assembly, by reducing pupil counts in three specific areas.

- Full-day kindergarten could be eliminated and return to the half-day kindergarten only.

- The Colorado Preschool Program could be reduced to serve fewer students.

- The Accelerating College Through Concurrent Enrollment (ASCENT) program could be reduced to serve fewer students.

These three programs represent key solutions to equity barriers in our society. Ultimately, decisions made by the General Assembly in a few weeks will determine how deep the inequities created by our cuts to K-12 education are.

Higher Education

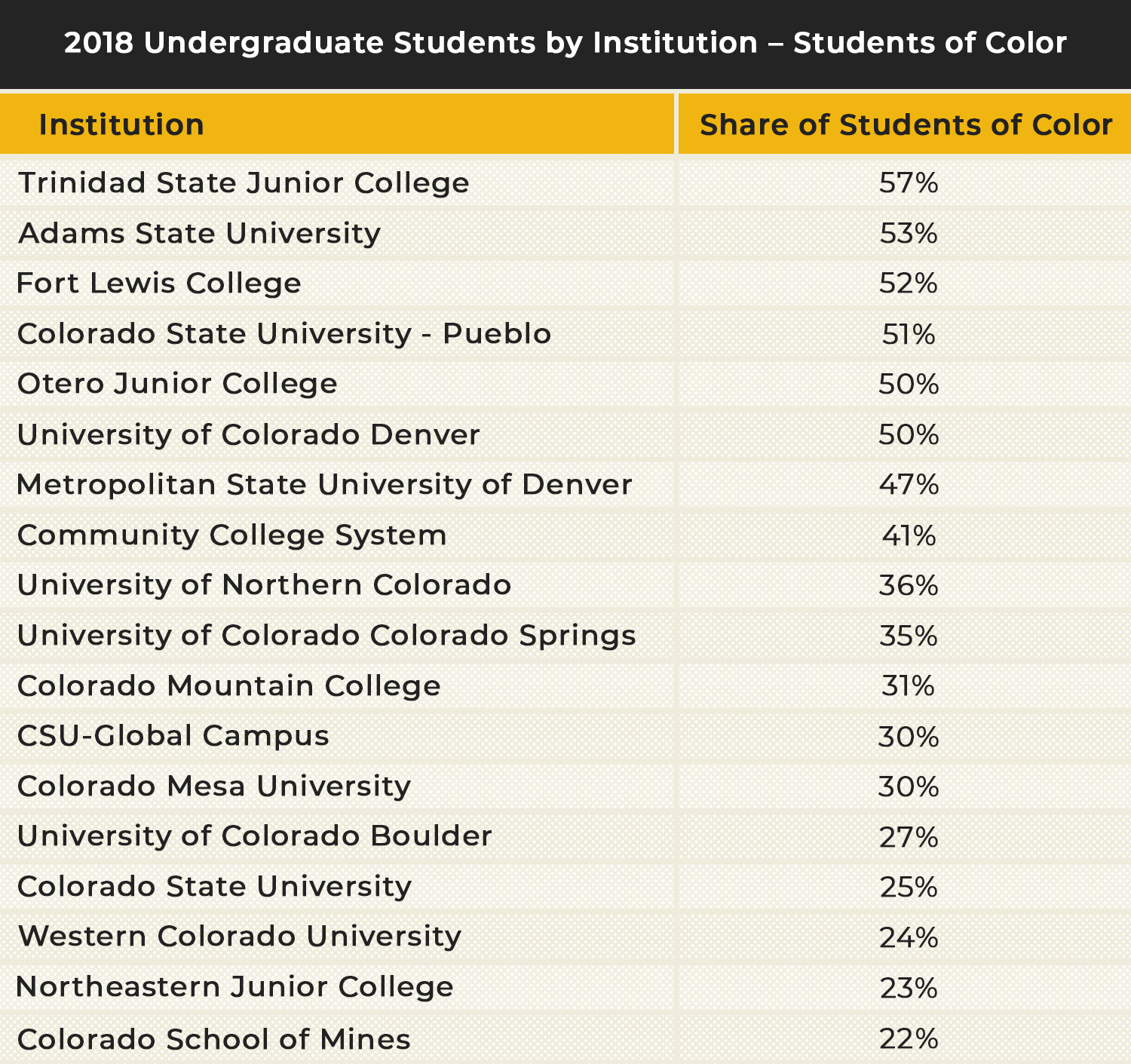

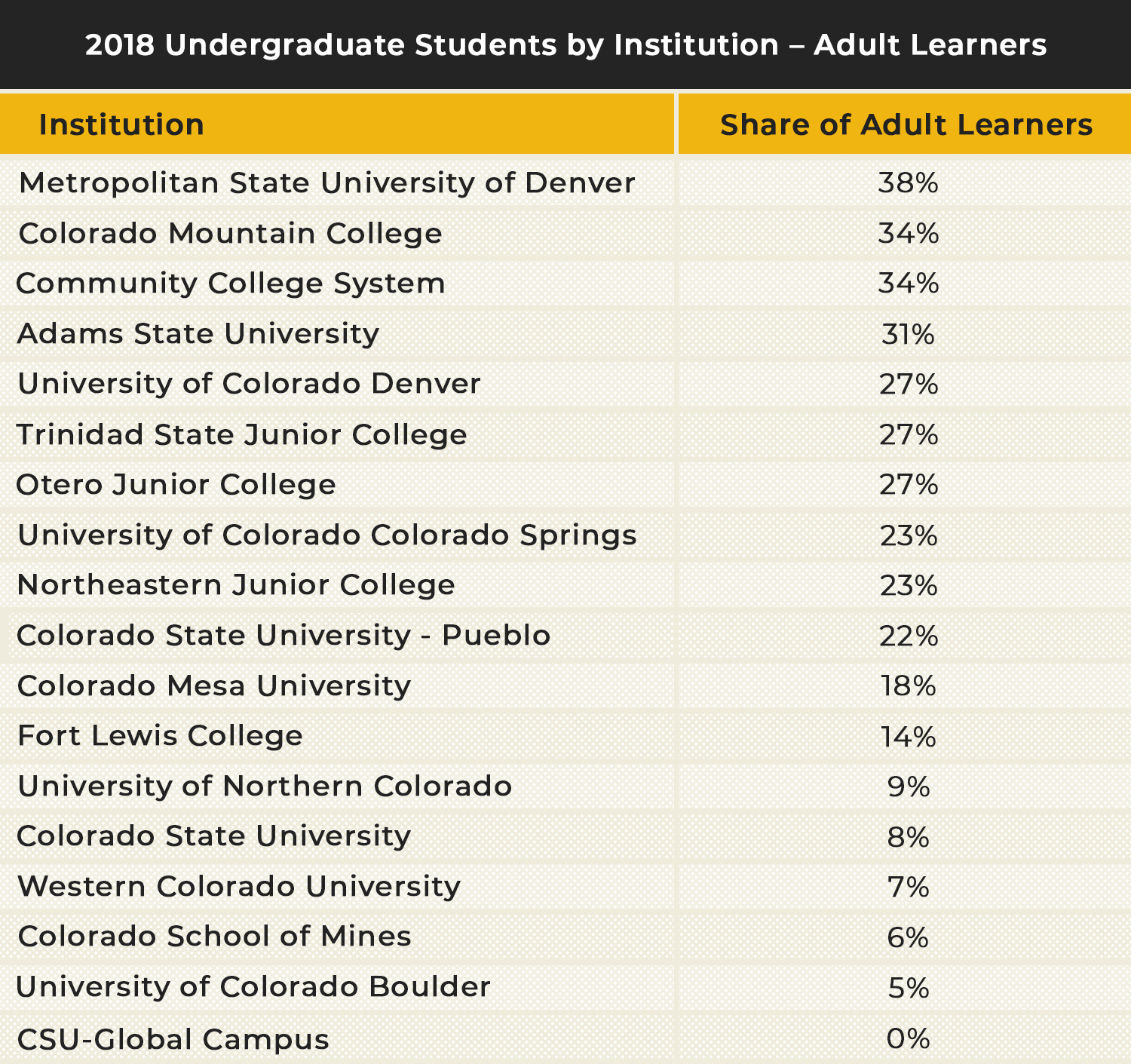

While some higher education institutions can safely weather this storm, some of our most vulnerable institutions may be unable to survive this funding cut. Some of these institutions are also more likely to serve adult learners, part-time students, and students of color. Further, our vulnerable institutions are also receiving fewer CARES dollars because CARES funding doesn’t consider part-time students or undocumented students. This means that our most vulnerable populations are bearing the brunt of these cuts. These cuts are particularly concerning in our rural institutions of higher education. Potentially, whole regions of Colorado could be left without access to a university, depending on their ability to withstand these cuts.

JBC staff has identified Adams State University, University of Northern Colorado, and Western Colorado University as particularly vulnerable during this time due to a higher reliance on state funds at these institutions. Even accounting for the direct funding from the CARES act, a mere 10 percent reduction from the General Fund would have resulted in a 2.8 percent reduction of total revenue for Adams State, and 2.5 percent for Western State. While University of Northern Colorado would only see a 0.6 percent reduction in their total revenue under this scenario, their vulnerabilities arise from tuition reductions and other factors. The cuts enacted, therefore pose serious long-term risks to the viability of these institutions given the uncertainty of fall enrollment and the size of the JBC’s cut.

Critically, institutions serve diverse populations or act as key regional points of access to higher education. Adams State University, for instance, has the second highest share of students of color in the state. University of Northern Colorado and Western Colorado University have smaller shares of students of color. However, these institutions are in more rural areas and are key parts of their communities.

Another critical demographic that stands out are adult learners. We know these learners need unique supports to access institutions of higher education. Further, these are the very students institutions will need to support in order to help individuals retrain for future jobs. Again, Adams State University stands out for serving these students, but so does the Community College System. These factors should be kept in mind in future budget conversations to ensure that the budget decisions being made will help rather than hinder Colorado’s economic recovery.

A combination of federal funds and state investment will be necessary to support these institutions. These investments will be critical to strengthening Colorado’s economy, preparing our workforce for the future of work, and ensuring no Coloradan gets left behind.

Health & Human Services

Across the Departments of Public Health and Environment, Health Care Policy and Financing, and Human Services, a range of state-supported programs are provided through community organizations. Regardless of location, many of these programs are already stretched thin. However, universal challenges are often felt more acutely in rural areas, where resources and providers are limited.

A few examples of cuts that have been approved by the JBC which will disproportionately impact rural communities include:

- Reduction in funding for family resource centers (approximately $500,000): Located in communities across the state, Family Resource Centers provide a centralized location for Coloradans to access a variety of services like child care and housing. Though important in all corners of Colorado, Family Resource in rural communities are noted to be an especially important touchpoint for those in need of support.

- Reduction in family planning services (approximately $700,000): Serving approximately 55,000 Coloradans through a network of federally qualified health centers, nonprofits, and local public health agencies, these funds provide low-income clients with comprehensive family planning services. The rural clinics providing these services have fewer staff members than those in urban communities, and as a result, funding cuts that result in personnel reductions will be disproportionately felt in these communities and could result in limiting hours and services.

- Community provider rate reductions ($25 million): It’s well noted pre-COVID reimbursement rates for a number of essential community services were already low. Approved rate reductions by the JBC will further impact how, and whether, Coloradans receive health care, dental care, and behavioral health services. However, once again, in rural areas, where provider networks are already limited, these reductions will likely have disproportionate impacts on access to services in non-Front Range communities.

Lost Prevention & Increased Future Costs

Many state-funded programs have both short and long-term benefits, providing for immediate needs while simultaneously offering services that support individuals and families far into the future. These long-term benefits often lead to a decreased need for expensive, acute services — resulting in future savings for both families and the state. However, to realize these benefits, initial investments are needed. Unfortunately, Colorado’s massive budget shortfall has placed many of these preventative programs up for reduction.

Each of the preventative programs discussed by members of the JBC are important in their own right, offering essential benefits that support Coloradans’ health and well-being. However, often these different efforts work in tandem, strengthening and supporting each other. As a result, the individual cuts to each program will be further magnified by the simultaneous reduction in many other preventative efforts.

Several of the more notable cuts to preventative programs are in the following areas.

Departments across the state rely upon community organizations to provide essential services. Reimbursed by the state at established rates for their work, these organizations provide a range of services — including home- and community-based services, child care, health services, and behavioral health care. With many preventative aspects, these services are important in providing a base level of support for individuals to remain meaningfully engaged in their communities.

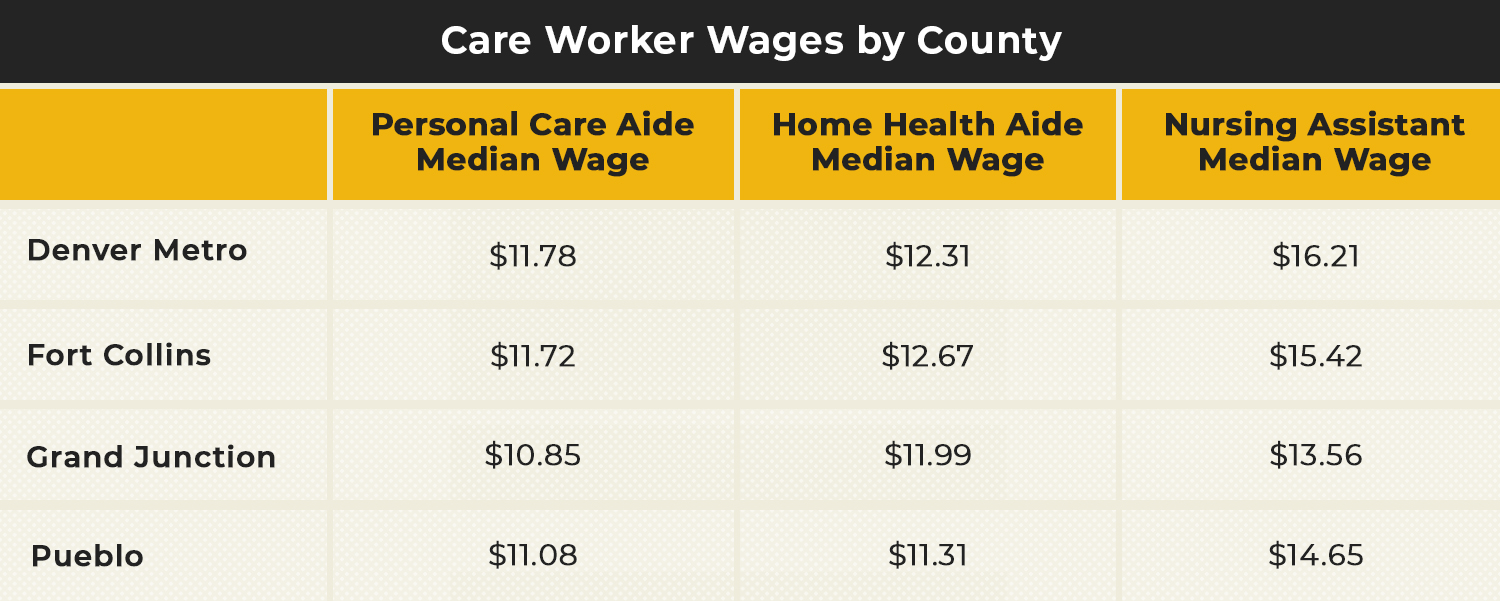

Before COVID, it was widely acknowledged that many community provider rates were low — so low the state has had difficulty attracting enough providers to offer services. Whether in relation to dental care, behavioral health, or home health services the lack of adequate community providers has long-term impacts that affect access to service and overall well-being. Additionally, it’s important to note low reimbursement rates are connected to low wages, like those for direct care professionals who support our state’s older adults.

Reductions in over $175 million in programs including the Senior Homestead Exemption, Senior Dental Program, and Older Coloradans Cash Fund, which supports the states 16 Area Agencies on Aging (AAA).

Colorado is one of the fastest aging states in the country. To support our changing demographics, Colorado has taken meaningful steps to offer preventative services that keep older adults healthy and in their homes and communities — something that’s both a preference for many older adults and a less expensive option than more intensive, out-of-home placements. As detailed in the Bell’s recently released Aging Agenda, which was informed by dozens of community stakeholders and over two years of research, Colorado has a number of innovative, comprehensive supports for the state’s older adults that are evidence-based and in high demand.

Despite the growing need for many of these preventative services, JBC members had the difficult decision and voted to:

- Eliminate the Homestead Exemption, a program that relieves some of the tax burden for older homeowners, for one year;

- Reduce $1 million in funding for the Senior Dental Program, which served over 3,000 low-income older adults in FY 2018-2019

- In total, reduce the Older Coloradans Cash Fund by $15 million. Money in the Older Coloradans Cash Fund is used to support the state’s AAAs, which offer a range of tailored community-based services for older adults and unpaid caregivers. Services include transportation assistance, Meals on Wheels, and respite.

Reductions of over $12 million in behavioral health services, including for those in rural, underserved, and community settings

Over the past several years, Colorado’s made important progress in developing a more extensive range of options for those with behavioral health needs. This includes creating a task force and passing recommended legislation to support those with opioid use disorders and expanding evidence-based programs for those with co-occurring substance use and mental health disorders. These additions supplement and extend the already existent services and supports offered through community mental health centers and crisis service systems. Especially in a time of deep economic uncertainty, these supports are more essential than ever and can both prevent the need for more extensive services and, especially in crisis situations, prevent the loss of life.

Because such deep cuts across departments are needed, and because so many of these programs are new, JBC members voted to reduce funding to the following behavioral health programs:

- Eliminate $3.1 million in funding for new CIRCLE programs, which is an evidence-based residential treatment program for those with co-occurring substance use and mental health disorders, in Mesa and Larimer counties

- Reduction in $1 million for Assertive Community Treatment, an evidence-based model that provides treatment in the community for those with mental illnesses

- Eliminate $5.5 million in funding for a substance use disorder grant program designed to support underserved communities

Eliminate a $225 million state payment to PERA for FY 2020-21.

The Public Employee Retirement Association (PERA) has experienced and ongoing unfunded debt to public sector retirees. The legislature recently agreed on a deal to decrease this debt through a mix of state and employee contributions and automatic provisions that were meant to stabilize the fund. However, one of the big aspects of the agreement was temporarily eliminated as a part of the budget cuts. At the start of every fiscal year, on July 1, the state is obligated to contribute $225 million to PERA. With that contribution eliminated for the next fiscal year, the pension will now face an extra $990 million in long-term debt.

Colorado Can Still Avoid this Shipwreck

As stated early, these drastic cuts can be avoided.

- Congress and the White House can pass an additional stimulus to direct more federal funding to state and local governments, keeping programs from being cut and workers in cities, counties, and the state from being laid off

- There are important legal questions about how to explore the emergency tax provision within Colorado’s Constitution. The tax requires a supermajority vote in the state legislature. An emergency tax on the wealthiest Coloradans would allow Colorado to continue to make strong investments in our communities that will be vital to recovery

- A proposed ballot initiative to cut taxes on 95 percent of Coloradans while creating new tax brackets for the wealthiest 5 percent could raise funding at a state-level and prevent some of the more drastic cuts that would otherwise be required.

The time to act is now, otherwise we jeopardize Colorado’s ability to recover from this unprecedented pandemic.