Quick Facts: A Fair Tax for Colorado

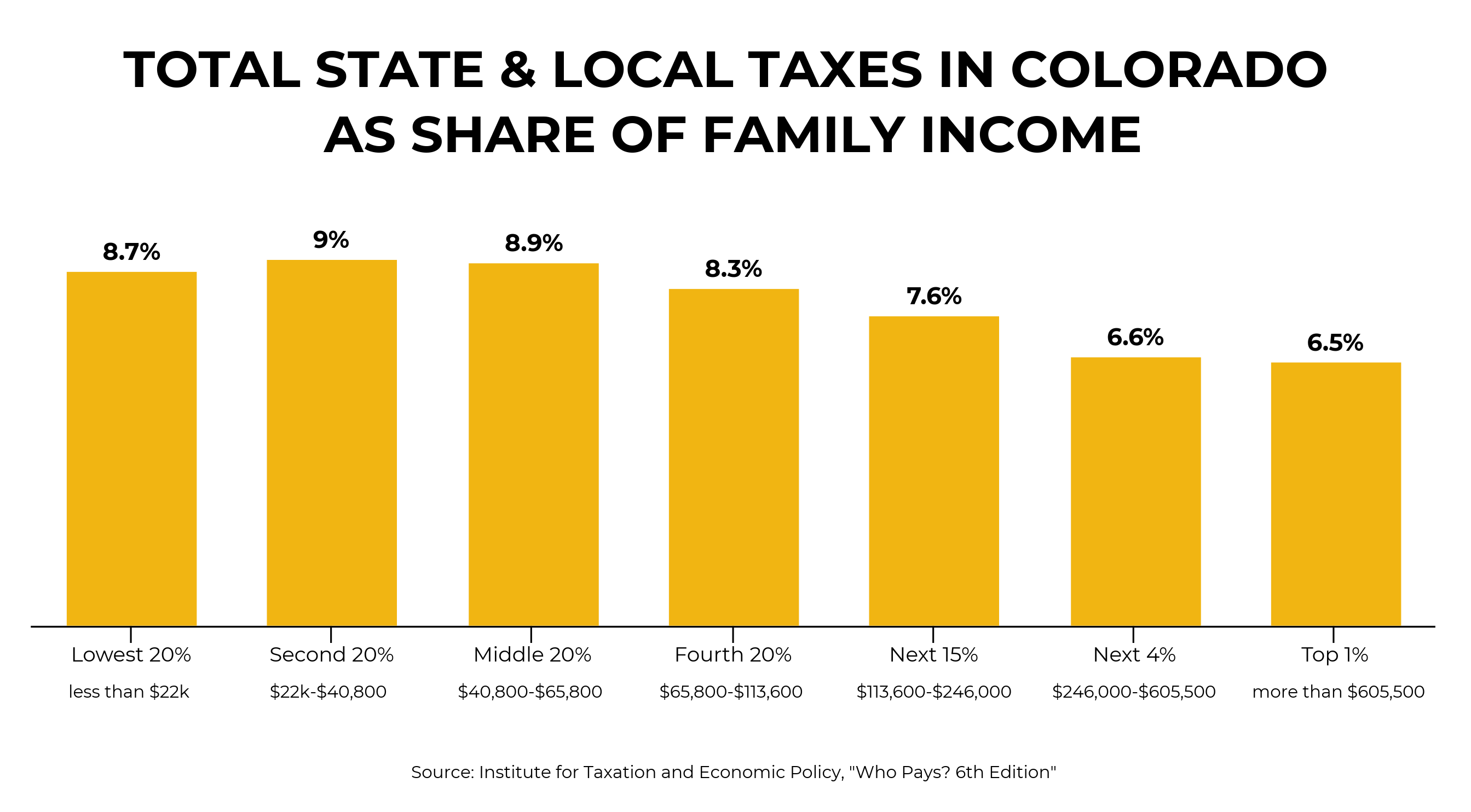

Colorado’s middle class pays more in taxes than the wealthiest 5 percent of Coloradans. To change this, a proposal for a fair tax system is making its way through the titling process and, if it gathers enough signatures, will be on Colorado’s 2020 ballot. To better understand the proposal, we’ve compiled some quick facts below.

Overview of a Colorado Fair Tax

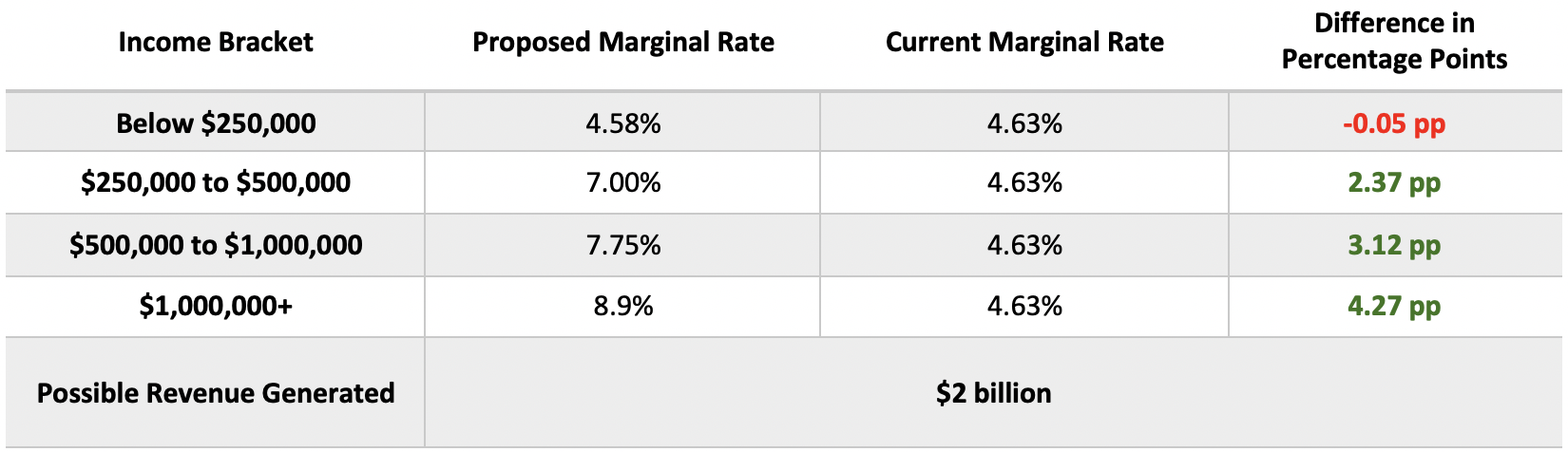

- The measure would reduce the tax rate for income below $250,000 for all Coloradans.

- More than 95 percent of Coloradans would see an overall tax reduction and Colorado would be able to generate significant revenue to invest back into our communities.

- The measure would create three new tax brackets that increase tax rates on marginal income above $250,000. For example, while a millionaire would see a tax cut on their first $250,000, they would see a tax increase on income above $250,000.

Effective Tax Rates on Income

- Under a fair income tax system, portions of a person’s income are taxed at different rates. For example, if a person makes $100,000 annually, the first $50,000 might be taxed at 5 percent, while the remaining $50,000 might be taxed at 8 percent. ($50,000 x 5% + $50,000 x 8% = $6,500)

- The “effective tax rate” is the percentage of an individual’s income paid in taxes overall. The effective tax rate for the above example is 6.5 percent, or $6,500 of $100,000.

- The effective tax rate is the best comparison measure between state income taxes because it measures the true tax rate individuals pay at certain income levels.

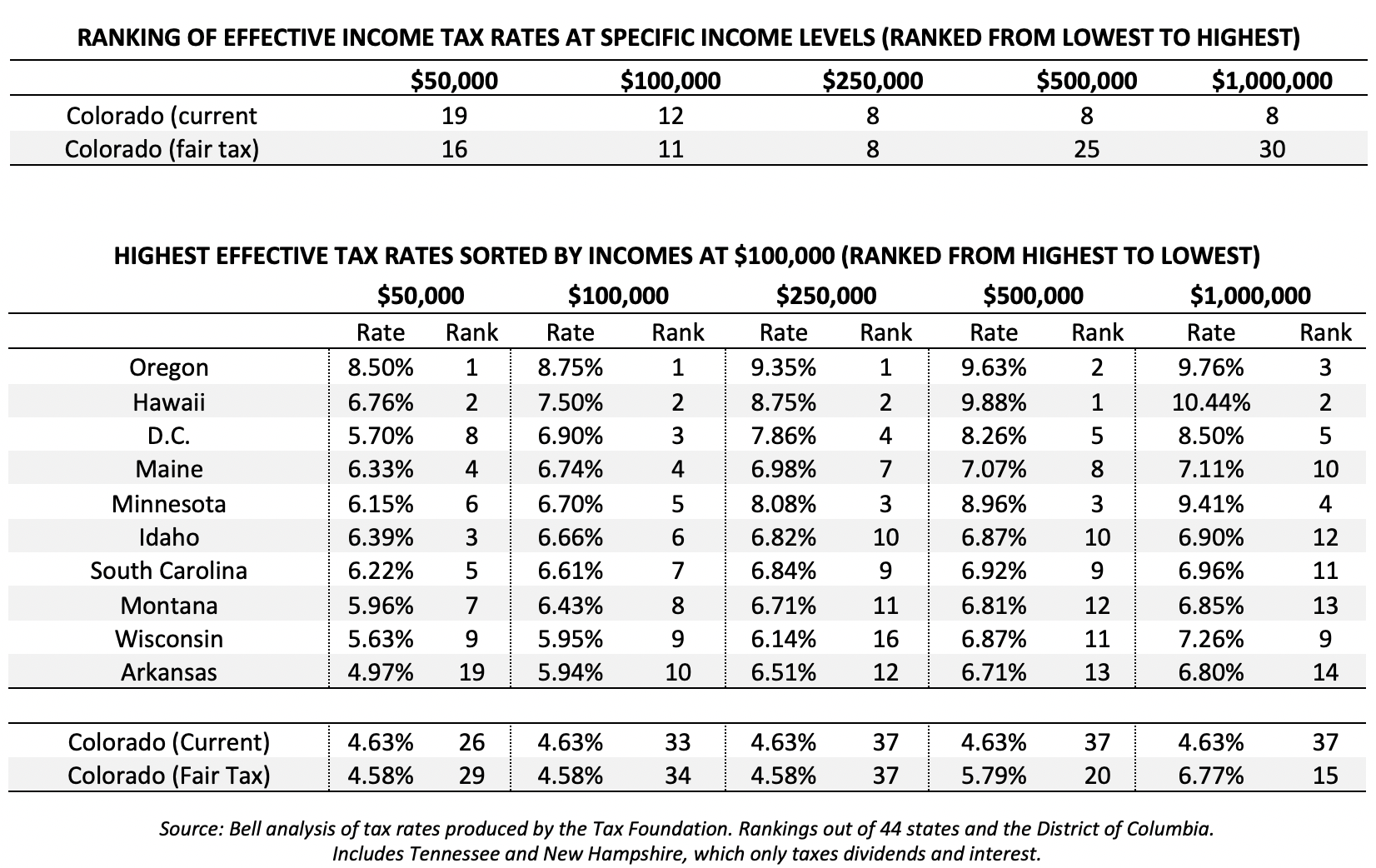

- The proposed fair income tax for the 2020 ballot would decrease the effective tax rate for incomes below $250,000, placing Colorado as one of the lowest effective tax states for incomes at and below that amount. It would rank Colorado higher for incomes at $500,000 and above.

Colorado’s Tax Rankings & Current Inequities

- Colorado currently ranks 45th in the country in state taxes per $1,000 of personal income. Under the proposed fair tax measure, Colorado would move to 39th, still well below the national average. This is below states like Arkansas (7th), New Mexico (9th), Idaho (18th), Kansas (28th), and Utah (29th).

- Colorado currently ranks 33rd in the country in state and local taxes per $1,000 of personal income. Under the proposed measure, Colorado would move to 27th, still below the national average.

- Colorado has a significantly regressive tax structure, where the wealthy pay much less in taxes (by percentage) than Coloradans with lower incomes.

The Wealthy Don’t Move Because of Tax Policy

Research done by Stanford University in 2016 shows over the previous 13 years, millionaires move to a new state less than everyone else: 2.4 percent of millionaires compared to 2.9 percent of the population, generally. The primary reasons millionaires moved, as cited in the research, were family obligations or business needs.

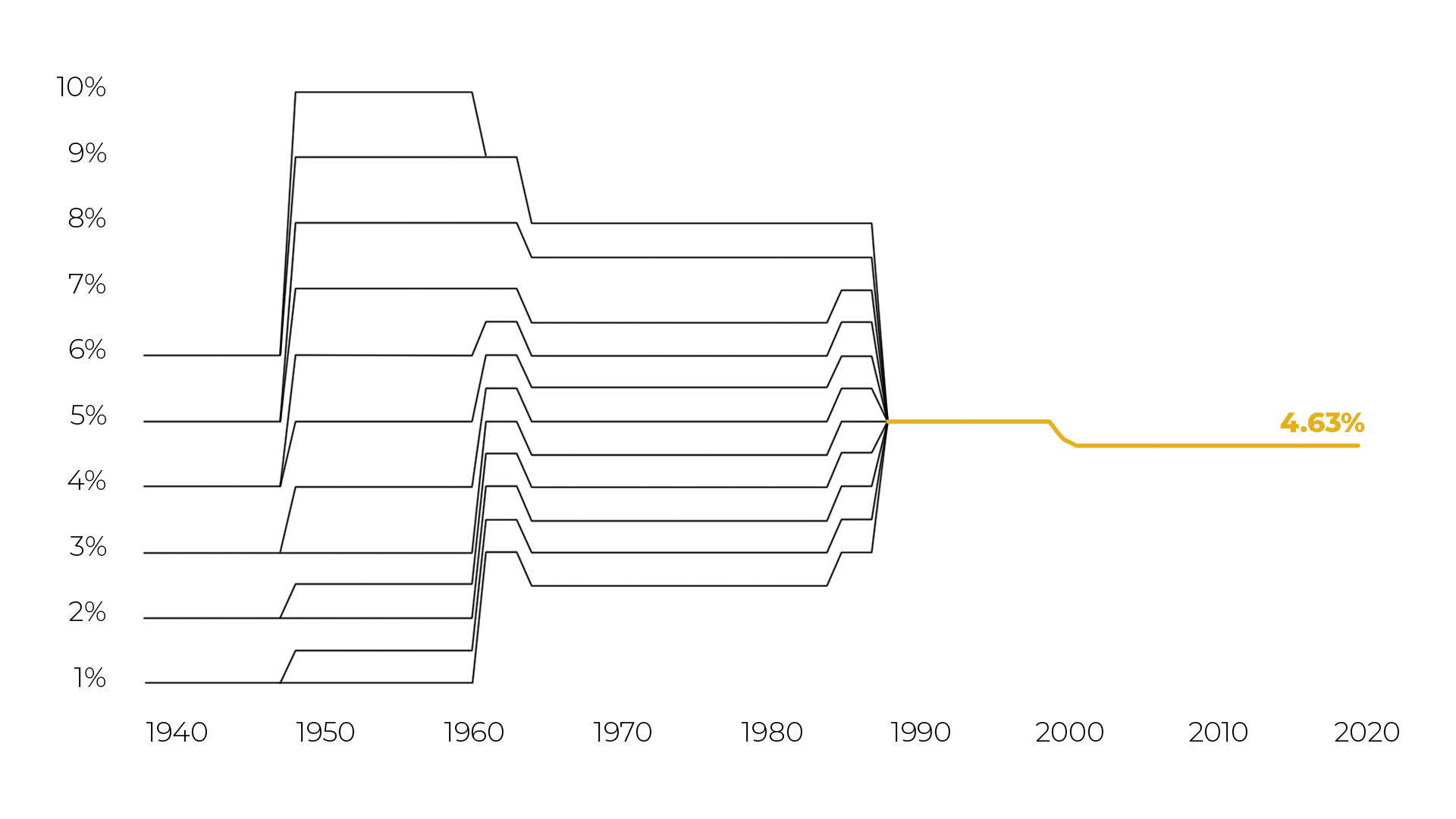

Income Taxes

- Colorado had a graduated income tax until 1987. A flat income tax was enshrined in the Colorado Constitution in 1992.

- When looking at Colorado taxes compared to other states, seven states and Washington D.C. have raised their top marginal tax rate since 2000: California, Washington D.C., Maryland, Minnesota, New York, Oregon, New Jersey, and Connecticut. Of these, Connecticut was the only state that didn’t see annual per capita growth that outpaced neighboring states.

- Only Connecticut and New Jersey saw lower economic growth — measured by change in private sector GDP — than their neighbors. They rest of the states saw significant growth that equaled or far outpaced their neighbors, according to Center on Budget and Policy Priorities.

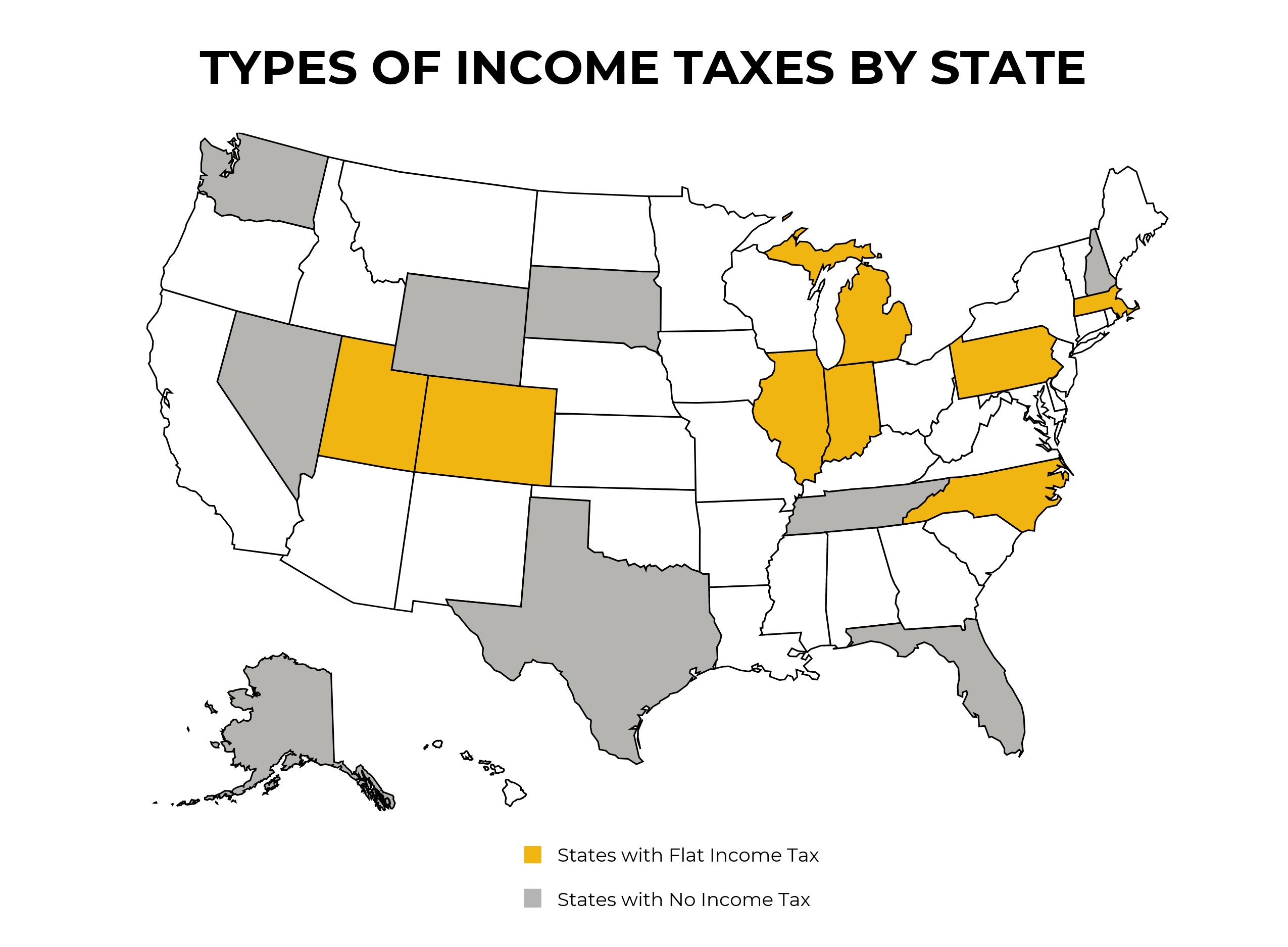

- Colorado is one of only nine states with a flat tax, with another seven states imposing no taxes on earned income.

- Tennessee and New Hampshire are not included in the above states with no income taxes because they tax interest and dividend.

- Colorado’s income tax collections per capita is ranked behind Nebraska, Virginia, and North Carolina.

What Happened to Connecticut?

- Connecticut’s growth was stunted by the overwhelming concentration of the finance industry in the aftermath of the Great Recession. Between 2016 and 2018, the number of hedge funds in Connecticut shrunk by 9 percent and fund liquidations outpaced funds launched in five of the six years prior to 2019.

- Connecticut used almost all the revenue gained from instituting a personal income tax in the 1990s to paying off high pension debt. As a result, Connecticut hasn’t put much revenue from increased tax rates to actual growth-building programs, such as education and transportation.

- Connecticut doesn’t have major cities — no city in the state has more than 150,000 residents — which has caused issues with many young professionals and start-ups flocking to major urban areas, especially given the state’s proximity to New York and Boston.