Progressive Income Tax: How It Works

Taxes are a certainty in life. It’s important to understand how they are structured and what they say about the priorities and values of the government putting them in place. One key area to consider is distribution of income taxes. Most states use a progressive income tax system, where tax rates increase along with one’s level of income. With conversations about taxing upper-income individuals heating up across the country, many people are surprised to learn a progressive income tax system isn’t even an option in Colorado.

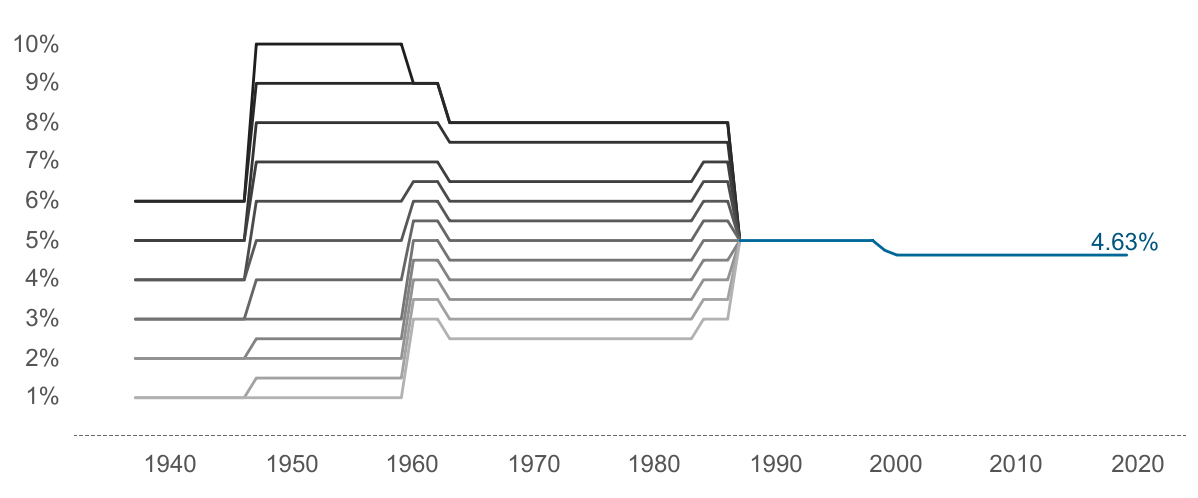

It wasn’t always this way. Colorado had a progressive — or “graduated” — income tax for decades. While Colorado’s rates shifted throughout the years, it was always a progressive system in which the wealthy paid a higher percentage of their income than those at the lower end of the income ladder. That changed in 1987 when a flat tax was instituted by the state legislature, taxing all income at the same rate. This model was enshrined in the Colorado Constitution in 1992 with the passage of the Taxpayer Bill of Rights (TABOR) and the flat tax system continues to this day. The graphic below illustrates the history of Colorado’s income tax rates.

Let’s step back and decode how income tax rates work. Marginal tax rates are both basic parts of how income taxes function and are also confusing and easily misunderstood. All rates are put into “brackets” and all income — no matter one’s total income — is taxed within that bracket.

For example, if a progressive income tax is structured so there’s a 5 percent tax on earnings up to $450,000 and a 8 percent tax above $450,000, then the first $150,000 an individual earns is taxed at the same rate regardless of whether that person makes $50,000 a year or $500,000 a year. It’s only after income crosses that threshold — $450,001 in this in this example — the rate changes, and only for the money within that bracket. For the person making $500,000 a year, only the money between $450,000 and $500,000 will be taxed at that rate of 8 percent, not the entire $500,000.

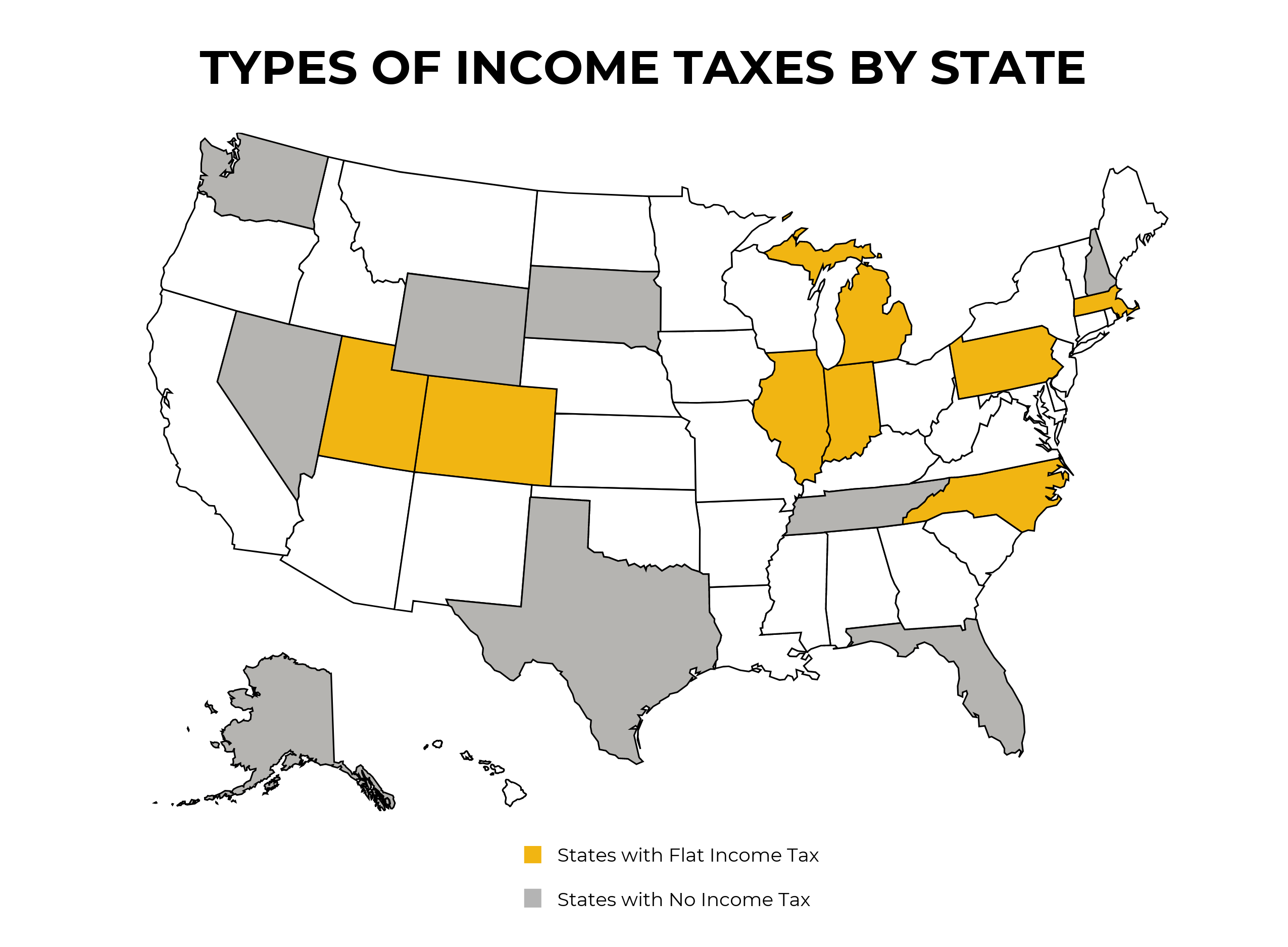

Most states tax income in the way described above — through a progressive income tax. However, there are 17 states that have different systems for income taxes. Eight states, including Colorado, have a flat tax. Nine states have no income tax and use other taxation, such as increased sales taxes and/or property taxes, to plug funding holes that would otherwise come from income tax.

A flat tax means every dollar of income is taxed at the exact same rate. For Colorado, that means all income is taxed at 4.63 percent. The idea of a flat tax is if everyone pays the same percentage of their income, then it’s fair for everyone. However, that idea can be misguided.

When all people throughout a state pay the same percentage, it impacts low- and middle-income families much more than upper-income families. If a family is living paycheck to paycheck and struggling to make ends meet, that percentage of income tax would have more ramifications for a family with a lower income than for one with hundreds of thousands of dollars in excess income. Even though the rates are the same, a tax of 4.63 percent would be much more noticeable for a family making $35,000 annually ($1,620.50) than one making $1 million ($46,300). Even still, there is more to consider, as an income tax is not levied in a vacuum.

An important part of tax systems throughout the United States — on a federal level, state level, and local level — is how different types of taxes interact with each other. For example, sales and property taxes are regressive, meaning low- and middle-income families are burdened by that tax more than upper-income families. This is because families who are just getting by use much of their income on buying goods and their wealth is mainly through the owning of property, as opposed to other tools like stocks, dividends, and other non-material goods.

Most states use these types of regressive taxes to make up a large part of their tax base. At the same time, many of these states try to balance out the use of regressive taxes with an income tax that falls more on wealthier families, therefore making the system as a whole more fair.

According to the Institute for Taxation and Economic Policy (ITEP), of the 10 most regressive states — in terms of taxation systems — nine of them either have no income tax or a flat tax. In total, 45 states, including Colorado, have regressive tax systems. When you include all state and local taxes, only five states and Washington D.C. have overall progressive tax systems that ensure the lowest 20 percent of income earners pay less in taxes as a percentage of income than the top 1 percent of income earners. Additionally, these states and D.C. all have a progressive income tax.

As ITEP states plainly in its Who Pays? report: “States with the most equitable state and local tax systems derive, on average, more than one-third of their tax revenue from income taxes, which is above the national average of 27 percent. These states promote progressivity through the structure of their income taxes, including their rates (higher marginal rates for higher-income taxpayers), deductions, exemptions, and use of targeted refundable credits.”

Ensuring income taxes are structured in a progressive way is crucial to making a full tax system equitable and fair. It’s also useful to look at the utility of a progressive income tax in how it can help stem the growth of income inequality in the United States over the past few decades. Colorado has not been immune to this trend, as we have documented. Progressive income taxation is a way to combat the problem of income inequality, by ensuring those at the upper end of the income scale pay their fair share for services we all use. A progressive income tax at the state level helps curb inequality in a way that is beneficial for society.

Finally, economists have looked at a progressive income tax from an economic theory standpoint. Many of those economists have concluded a progressive income tax is good in and of itself because of taxing those at the top of the income ladder higher than those at the bottom. Much of this is because those at the lower end of the income spectrum tend to put all their income toward services within the broader economy (think electricity bills or groceries), as opposed to putting money in savings accounts or similar places. This has a positive effect on broader economic activity, so when done right, a progressive income tax actually helps stimulate the economy.

As discussed, Colorado uses a flat tax for income. Colorado’s legislature put this in place in 1987, and it was constitutionally enshrined as a part of TABOR in 1992. As a result, a graduated income tax is currently prohibited in Colorado.

To put the importance of the income tax in Colorado in perspective, as of FY 2019-2020, individual income tax revenues made up nearly two-thirds — 65.7 percent to be exact — of Colorado’s General Fund revenue. Of all the money that makes up the full state budget — including federal funds, cash funds, and the General Fund — the individual income tax made up 23 percent, compared to the national average of 27 percent. What this shows is income tax is incredibly important to funding government services in Colorado, but we place more of the funding burden on regressive taxes than most other states. Making sure we use income taxes effectively and equitably makes our government a fairer place.

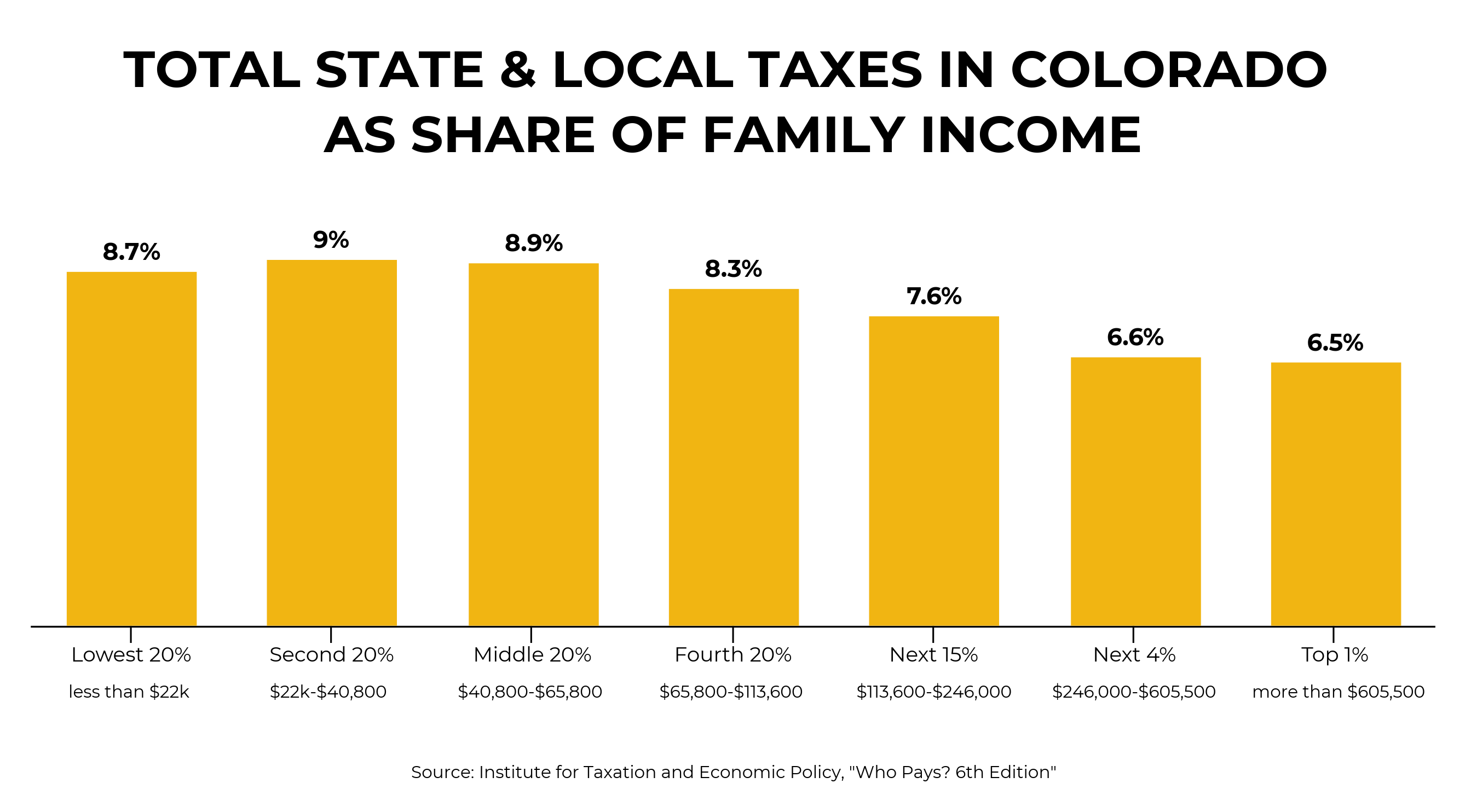

The graph below (recreated from ITEP data) shows the tax burden in Colorado falls more on those at the lower end of the income ladder than those at the top. Much of that fact is driven by the use of sales taxes and other regressive consumption taxes. Because Colorado utilizes a flat tax on earned income, it does not come close to balancing out the regressive nature of the sales tax.

Much of that fact is driven by the use of sales taxes and other regressive consumption taxes. Because Colorado utilizes a flat tax on earned income, it does not come close to balancing out the regressive nature of the sales tax.

This state has seen massive growth, especially on the Front Range, and that growth appears likely to continue. With growth comes the need for increased public services and new infrastructure. The question: How do we continue to provide adequate funding and revenue to the state? If our state has to come up with some new revenue, it will either have to be within the current system, which falls disproportionately on low- and middle-income Coloradans, or from a new system that will tilt the tax obligations more toward the upper class. This is a choice all states must make.

Can Colorado Put a Progressive Income Tax System in Place?

Colorado’s flat tax is enshrined in our state constitution. That means to implement a progressive income tax, there would need to be a ballot measure approved by the voters of the state. The specific ballot measure could take on many different forms, but it would need to either repeal the specific constitutional provision or put a new amendment in our state constitution.

As Colorado’s economy continues to grow, the state should assess whether our tax system is working for all Coloradans. What worked for our state more than 30 years ago, may not be best for our state into 2020 and beyond. Making our system more progressive to help those who have been left behind would be a good starting point for this vital conversation.