The Predatory Lending Landscape

Predatory Lending Landscape

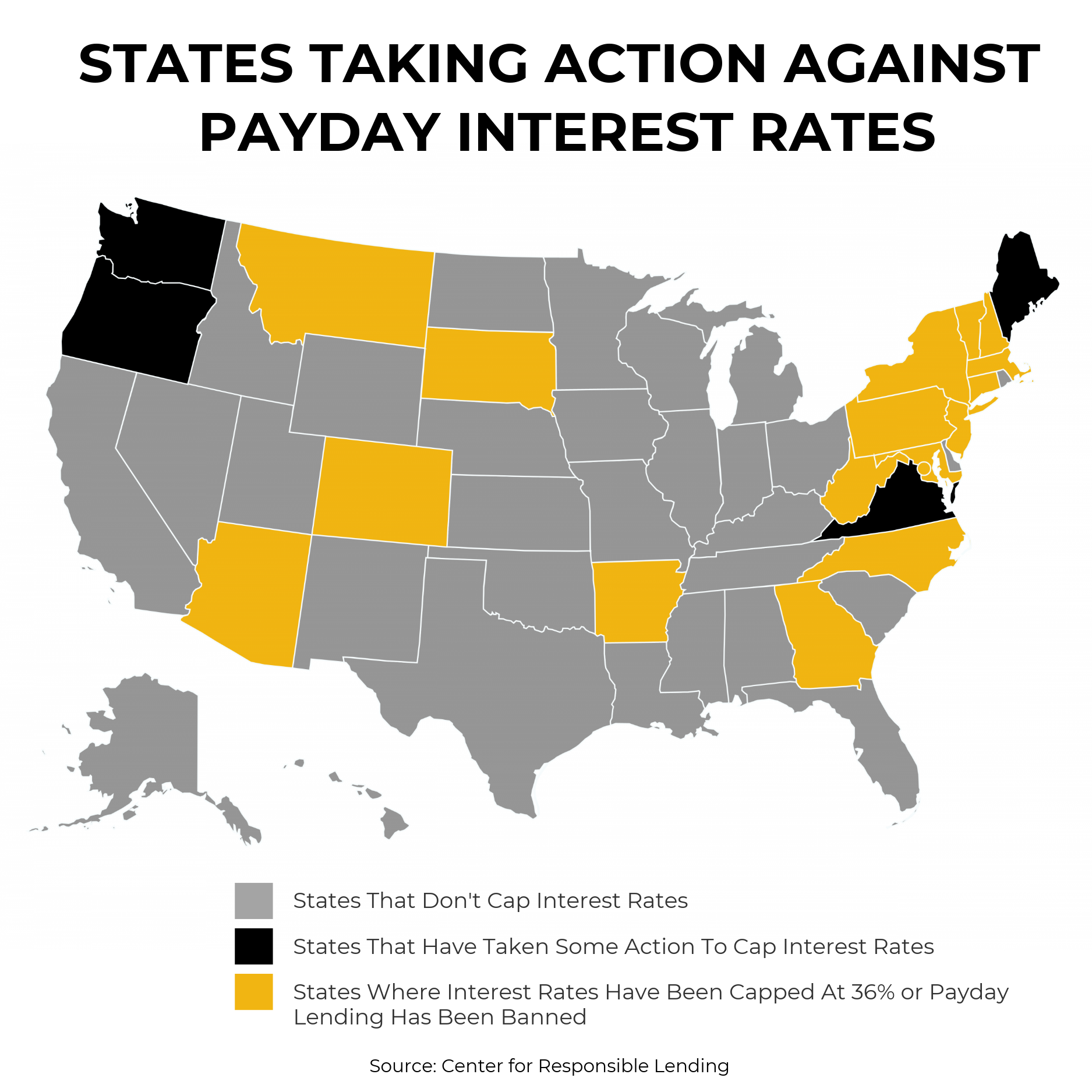

Following the passage of Proposition 111, effectively capping interest rates and fees on payday loans at 36 percent, Colorado is embarking on a new era. Our state has joined the ranks of 16 other states and the District of Columbia with either rate caps or complete bans designed to stop people from entering a debt trap through payday loan products. As more states prohibit shockingly high interest rates, consumers are saving money, finding better solutions to limited cash flow, and are avoiding long-term financial pitfalls like bankruptcy. While Colorado has made significant progress, it’s imperative to not let our guard down in this new environment.

The lending industry is made up of several different types of products, some that are sought after because of their ease of access. These particular products are known as payday loans, repaid in one lump sum; small-installment loans, repaid over time; and supervised loans, which are consumer loans with higher standards of regulation and an annual APR of more than 12 percent. Payday loans are short-term, high-cost loans, typically $500 or less, while allowing lenders access to the borrowers bank account. Small-installment loans are designed to allow more time to repay the loan in installments, also with higher interest and fees, and generally are used to consolidate debt or help build credit.

Because these loans can be unsecured, they are more appealing to borrowers with bad credit or low incomes. Again, because these loans are typically small-dollar loans — up to $1,000 — and don’t rely on a physical asset to guarantee repayment, they appeal to borrowers who need quick cash. Since regulations on payday loans have been tightening, lenders have been turning to high-cost installment loans.

At least 32 of the 39 states where payday lenders operate are vulnerable to high-cost, small-installment lending. Colorado, California, and Texas are all among high-risk states. Lenders take advantage of the seeming affordability of these loans by charging high interest rates and fees. As such, the proliferation of small-installment loans and other high-cost lending products is a point of concern.

The rate cap of 36 percent isn’t just an arbitrary number: It dates back more than 100 years for being the right balance that allows lenders to still make a profit while providing borrowers access to affordable loan products. While the usury cap for many states is set at 36 percent, many states allow fees and charges on top of interest, which brings APRs on small-dollar loan products well above 36 percent.

With this new cap on payday loans, Colorado has much more protective laws, comparable with several other states. Current small-dollar lending in Colorado is as such:

- Payday loans are allowed up to $500 and are capped at 36 percent APR, including fees.

- Small-installment loans are allowed up to $1,000 and can be as high as 160 percent, including fees.

- Supervised loans from zero to $1,000 are capped at 36 percent, 21 percent on loans $1,001 to $3,000, and 15 percent for loans over $3,000.

Colorado is now in the same league as states like North Carolina and New York that have strict lending laws.

North Carolina has also capped payday lending rates at 36 percent, with installment loans of $500 capped at 16 percent and loans of $2,000 capped at 31 percent. North Carolina was the first state to significantly reform payday lending laws in 2006, and borrowers there have seen notable improvements. More than twice as many former borrowers say the absence of payday lenders has had a positive effect and they are better off without them. Furthermore, New York is one of the most protective states with criminal law setting the overall usury cap at 25 percent, the civil usury cap at 16 percent, and outright banning payday loans.

Another example is in Ohio, where payday rates used to exceed 600 percent until recently. In 2008, Ohio legislators capped the maximum APR for short-term loans at 28 percent. This didn’t deter lenders, as they found loopholes in state law to reclassify their practice. Despite the capped interest rate, Ohioans were subjected to the nation’s highest payday lending APR of 591 percent. To put this into context, a five-month $300 loan would incur $680 in fees.

The Ohio Fairness in Lending Act in 2018 is a repeat effort of the 2008 legislation with stronger regulations that has produced some of the safest and low-cost lending products in the nation, allowing up to 28 percent APR and a maximum monthly fee of 10 percent. This bipartisan effort is expected to save borrowers $75 million a year and comes with other significant safeguards. The law sets up protections against illegal online lending, mandates that lenders be licensed to operate, and allows state regulators to supervise lenders, monitor the market over time, and publish annual reports.

On the other side of the spectrum, Texas and California are among states that have more lax lending landscapes. Regarding payday loans, rates and fees in Texas can go up to 661 percent. Payday and auto lenders have found a loophole allowing them to charge up to $110 in fees on a $500 loan, whereas a borrower in Nebraska (where fees and APR can still go up to 404 percent) would only pay $75.

California’s payday rate cap is 460 percent, and the laws protecting against predatory lending do nothing to address fees and rates. Rather, they include prohibitions to actions by the lender, like neglecting to consider the financial capacity for the borrower to repay the loan. As such, California law governs lenders with broad, vague strokes that open the door for predatory practices. Given this environment, borrowers in California are faced with less-than-ideal alternative products, like those offered under a new pilot program that would increase the maximum dollar amounts on small-dollar loans from $2,500 to $7,500, yet still have interest and fees that exceed 50 percent. Governor Brown cited, “I am reluctantly signing Assembly Bill 237 because the alternative is worse… I remain concerned that increasing the cap on these loans without stricter regulatory oversight may create unintended consequences.”

Colorado has taken significant steps to become a state with strong consumer protection laws in regards to lending practices. Recently, passage of Proposition 111 has resulted in more stringent laws that combat the pattern many borrowers fall into. A rate cap of 36 percent means borrowers are better positioned to repay the loan within reasonable time limits and without having to take out additional loans or fall behind on other vital payments.

Compared to states like California, Colorado’s consumer protections are much stricter. Lenders hoping to operate in our state must understand Coloradans believe in fairness and equity for borrowers. Alternative products will undoubtedly become more available as the landscape clears, but these principles must remain, ensuring no borrowers are taken advantage of and put in a cycle of debt.