Colorado Paid Leave: Learning From Massachusetts & Washington

paid leave

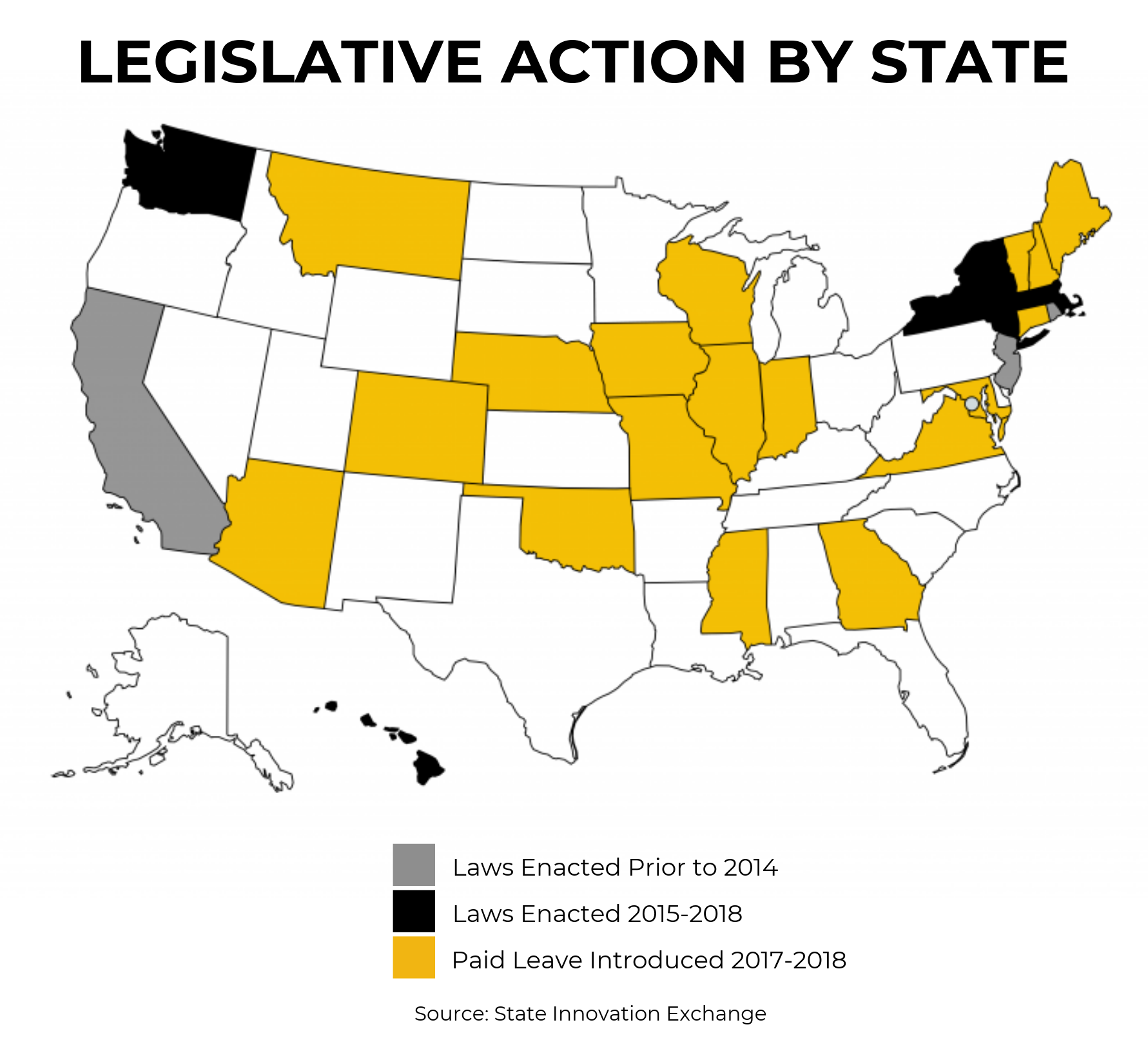

The United States is the only developed nation in the world without some form of paid leave. However, some states are innovating while national efforts stall. Despite proposed bills in the legislature, a Colorado paid leave plan has been stymied by the state Senate, while six states and Washington D.C. already have laws on the books. With a new legislature in 2019 — comprised of many who championed this issue during their campaigns and/or previous legislative sessions — there is a real opportunity for Colorado to join the states that have helped workers navigate life’s unexpected challenges.

Establishing paid family and medical leave has benefits that go beyond a families’ financial bottom line. Increased breastfeeding rates, improved child development, and improved child mortality happen when parents have the ability to take sufficient time off to bond with their young children. With Colorado’s demographics steadily aging, it is also important to include paid leave for those who need to care for loved ones. As Colorado ages, this issue will only become more acute.

To better understand how Colorado can make progress in this area, it’s helpful to look at states that have succeeded. When comparing Colorado to states that have implemented paid leave plans, our state’s lack of temporary disability insurance fund (TDI) stands out. Many of the states with paid leave programs use TDI as the mechanism for administration and implementation of paid leave benefits. While two states — Massachusetts and Washington — don’t have TDI, both recently establish paid family and medical leave. Instead, these two states established a fund paid into by workers, allowing them to access the funds during their leave. Let’s look closer at each state’s systems and use their examples to create one that works for us.

- Both states have an opt-out system — meaning all employees are automatically enrolled. Workers who are self-employed or public sector who aren’t automatically covered can opt in.

- Both states have a shared responsibility between the worker and the employer. This means both pay into a state fund that can be used for medical leave, but workers cover the full cost of family leave through payroll deductions.

- Both states ensure workers can return to their job after taking paid leave.

- Both states allow employers to apply for approval of an alternative plan, if that plan has equivalent benefits for employees.

- Both states have exemptions for small businesses: In Washington, employers with fewer than 50 workers don’t have to pay the employer portion, and in Massachusetts the same applies for employers with fewer than 25 workers.

- The total premium in Washington for both paid medical and paid family leave is 0.4 percent of wages, whereas the total premium is 0.63 percent of wages in Massachusetts. While slightly different, both are a very small percentage of wages.

- Both states emphasize the portability of their programs, meaning the social insurance of paid family and medical leave isn’t tied to a job, but the individual who will have the benefit no matter where he or she works.

- In Massachusetts, some public employees, mostly municipal workers, aren’t automatically covered, but can opt in. All public employees in Washington are covered.

- Massachusetts created a new state department, the Department of Family and Medical Leave, and the premiums paid by employers and workers and benefits paid to workers will be in the Family and Employment Security Trust Fund. In Washington, the program is administered through the existing Employment Security Department.

- Workers in Washington receive 90 percent of their weekly wage up to 50 percent of the statewide average weekly wage, and then 50 percent of their weekly wage above that statewide average. In Massachusetts, it’s 80 percent of the weekly wage up to 50 percent of the statewide average weekly wage, and 50 percent of the weekly wage above that statewide average.

- In Washington, the maximum weekly benefit is $1,000 per week, adjusted annually after the first year to 90 percent of the statewide average weekly wage, but in Massachusetts it’s $850 per week initially. It’s then adjusted annually after the first year to 64 percent of the statewide average weekly wage.

- Massachusetts workers can take up to 20 weeks for their own health need in a benefit year, but in Washington it’s 12 weeks in a 52-week period.

- Washington set up a small business assistance grant program for employers who have 50 employees to 150 employees. These grants will help employers to maintain their margins, efficiency, and productivity, while giving workers the allowance of paid family and medical leave.

These differences are important and leave room to make paid family and medical leave legislation unique to Colorado. It’s possible to construct a policy that’s accessible and affordable for all workers — not just employees. It’s possible to do so in a way that doesn’t cause significant burden on employers. Colorado is already falling behind and the longer we wait, costs will continue to build up for everyone across the state.

WASHINGTON vs MASSACHUSETTS

A COMPARISON ON PAID LEAVE

In both Washington and Massachusetts, family leave can be used for:

- bonding with an infant;

- within first year placement for foster children;

- care for family member with serious health condition;

- certain military family needs.

Medical leave can be used for worker’s own serious health condition.

In Washington:

- Workers (45 percent) and employers (55 percent) share cost of medical leave.

- Workers cover full cost of family leave.

- Employers with fewer than 50 employees are exempt from paying the employer match for medical leave.

- The law caps premiums for both family and medical leave, set at less than 1 percent of payroll.

In Massachussetts:

- Workers (40 percent) and employers (60 percent) share cost of medical leave.

- Workers cover full cost of family leave.

- Self-employed workers pay the full cost of family leave, though certain self-employed workers may be covered automatically.

- Employers with fewer than 25 employees are exempt from paying the employer match for medical leave as long as less than half of their workforce is comprised of self-employed individuals.

- Same as Washington on premium cap.

In Washington:

- All workers, including public sector employees

- The self-employed can opt-in

- Federal employers and employees, federally recognized tribes and sole-proprietors are exempt

In Massachussetts:

- Workers covered by state unemployment law except some public employees, like municipal employees

- Self-employed and public employees who aren’t automatically covered can opt-in

Yes in Massachusetts, but Washington workers must meet specific criteria similar to FMLA.

In Washington:

- Workers receive 90 percent of the average weekly wage up to 50 percent of the statewide average weekly wage. The maximum weekly benefit is $1,000 per week, to be adjusted annually to 90 percent of the statewide average weekly wage in the future.

In Massachussets:

- Workers receive 80 percent of the average weekly wage up to 50 percent of the statewide average weekly wage. The maximum weekly benefit is $850 per week, to be adjusted annually to 64 percent of the statewide average weekly wage in the future.

In both Washington and Massachusetts:

- A state fund run by a state department

- Employers can apply for an exemption and approval for voluntary plans that provide equivalent benefits as those through the state

In Washington:

- 12 weeks for medical or family leave in a 52-week period

- Ability to take additional weeks in limited situations

- Workers face a seven-day unpaid waiting period before accessing the benefit, unless the leave is for bonding

In Massachussets:

- 20 weeks for medical leave in a benefit year

- Workers face a seven-day unpaid waiting period before accessing the benefit

In Washington:

- Companies with fewer than 150 employees can opt into employer premiums and apply for assistance grants.

- Grants of up to $3,000 are available and can be issued 10 times per year to a single employer.

- Grants of $1,000 are available to businesses that experience significant wage-related costs due to an employee taking leave under the program.

- Doesn’t apply to employers covered by a Collective Bargaining Agreement in effect prior to October 19, 2017, as employees are covered by that agreement until it expires, reopens, or is renegotiated. An employer and union cannot agree to waive the requirements of paid family medical leave.

- Employers must continue to honor employee accrual of benefits (i.e., vacation, sick leave, seniority, and bonuses) and contribute to employer-sponsored health insurance during an employee’s period of family/medical leave.

- Employers must adhere to all preexisting laws, company policies, and/or collective bargaining agreements providing greater leave benefits, though employers with greater leave benefits may apply for an exemption from the program.

- Special coverage requirements created for family child care providers and personal care attendants.

The federal paid family and medical leave pilot program provides tax credits to businesses that offer paid family and medical leave. To qualify, employees cannot make more than $72,000 a year. The employees must be allowed at least two weeks of paid family and medical leave per year for all qualified employees under FMLA, and part-time qualified employees must be allowed a proportionate amount of paid family and medical leave. Finally, the policy must provide at least 50 percent of employee wages during leave. Leave paid by state or local government doesn’t apply.