Could Automatic Enrollment Help Colorado’s Retirement Crisis?

Everyone agrees: Americans need to save more for retirement. A recent report by the Federal Reserve shows even among people in their 50s and 60s, 1 in 8 has no retirement savings. Is that because even when employers match contributions, many workers with access to workplace retirement plans still don’t participate in them? Possibly. That’s where automatic enrollment comes in, as mounting evidence shows it can help workers overcome this barrier.

What is Automatic Enrollment?

When confronted with complex decisions, behavioral economics tells us the natural human reaction is to procrastinate and put off choosing. When combined with concerns about being able to afford contributions and uncertainty over the best investment options, many workers never get around to signing up for their retirement plan at work.

Under automatic enrollment, workers are placed in a plan at a set contribution rate, generally 3 percent to 5 percent of their earnings. Automatic enrollment turns the tables, putting the natural tendency to delay decision making in favor of saving.

Workers can opt out if they want, but they often tend to stay enrolled. Data from Vanguard, the large mutual fund company, which administers over 10,800 plans covering 4.9 million workers, shows automatic enrollment significantly boosts worker participation in plans.

Who Does Automatic Enrollment Help?

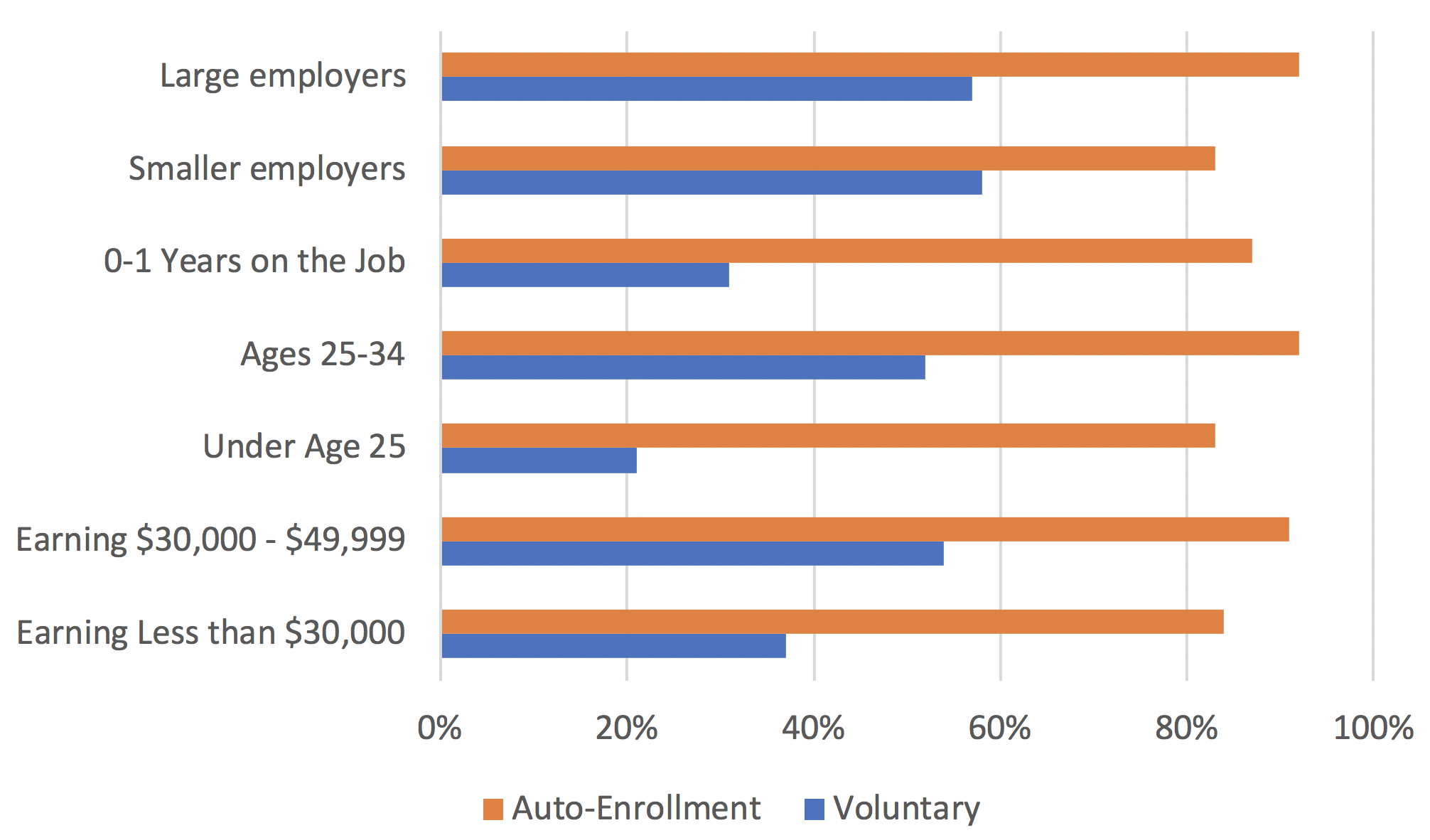

Generally, workers who are older, higher paid, longer tenured, and employed in larger firms are more likely to participate in a plan. But as the graph below shows, more workers overall participate in retirement plans with automatic enrollment rather than voluntary enrollment. Specifically, workers earning less than $30,000 and those earning between $30,000 and $49,999 are about twice as likely to participate in a retirement plan under automatic enrollment compared to a voluntary plan. The same holds true for young workers and those with short tenures. The share of workers participating in a retirement plan in small firms was 43 percentage points higher in those with automatic enrollment compared to those with voluntary plans.

Automatic Enrollment Boosts Participation Across the Board

Source: How American Saves 2018 and How America Saves 2018, Small Business Edition, Vanguard

Source: How American Saves 2018 and How America Saves 2018, Small Business Edition, Vanguard

Oregon, one of six states that enacted a workplace plan for workers without access to an employer-sponsored retirement plan, reports 74 percent of all employees in its initial rollout opted to remain in the plan after being automatically enrolled. Many of these workers are lower paid and work for smaller businesses.

The biggest obstacle workers face in saving for retirement is many don’t have a workplace retirement plan. Nationally, about 4 in 10 workers don’t have access to a retirement savings plan at work. In Colorado, about 45 percent of private sector workers aged 25 to 64 don’t have a workplace plan. Yet, AARP points out workers are 15 times more likely to save for retirement if they have a payroll deduction plan at work.

That’s why passing the Colorado Secure Savings Plan to ensure all workers have access to workplace retirement savings plans tops our list of policy solutions. It would ensure all Colorado workers have access to a workplace retirement plan with automatic enrollment.

Until we can enact the Colorado Secure Savings Plan, all employers that offer workplace retirement savings plans should automatically enroll their workers. This will help workers build a nest egg for retirement and begin to chip away at our retirement savings deficit.