2018 Legislative Session Report Card

Grading the 2018 Legislative Session

Grading the 2018 Legislative Session

This year was a critical one for Colorado’s legislature. There seemed to be real momentum on finding solutions to alleviate rising costs and stagnant wages, as both have hit a well-documented stumbling block for economic mobility in our state. As tricky questions arose about how technology and evolving employer-employee relationships will shape the economy, this legislative session had the room to prepare and plan for our future.

Related: Bell President Scott Wasserman Reflects on the 2018 Legislative Session

Colorado’s General Assembly had plenty of tools to address these issues, but at the heart of our political paralysis is a fierce debate over the role government should play to help Coloradans overcome adverse forces. Because of that divide, we consistently saw good ideas come out of the Democrat-controlled state House only to have the Republican-controlled state Senate halt them from passage. Even some bipartisan proposals that would’ve helped bring economic mobility to every Coloradan were killed.

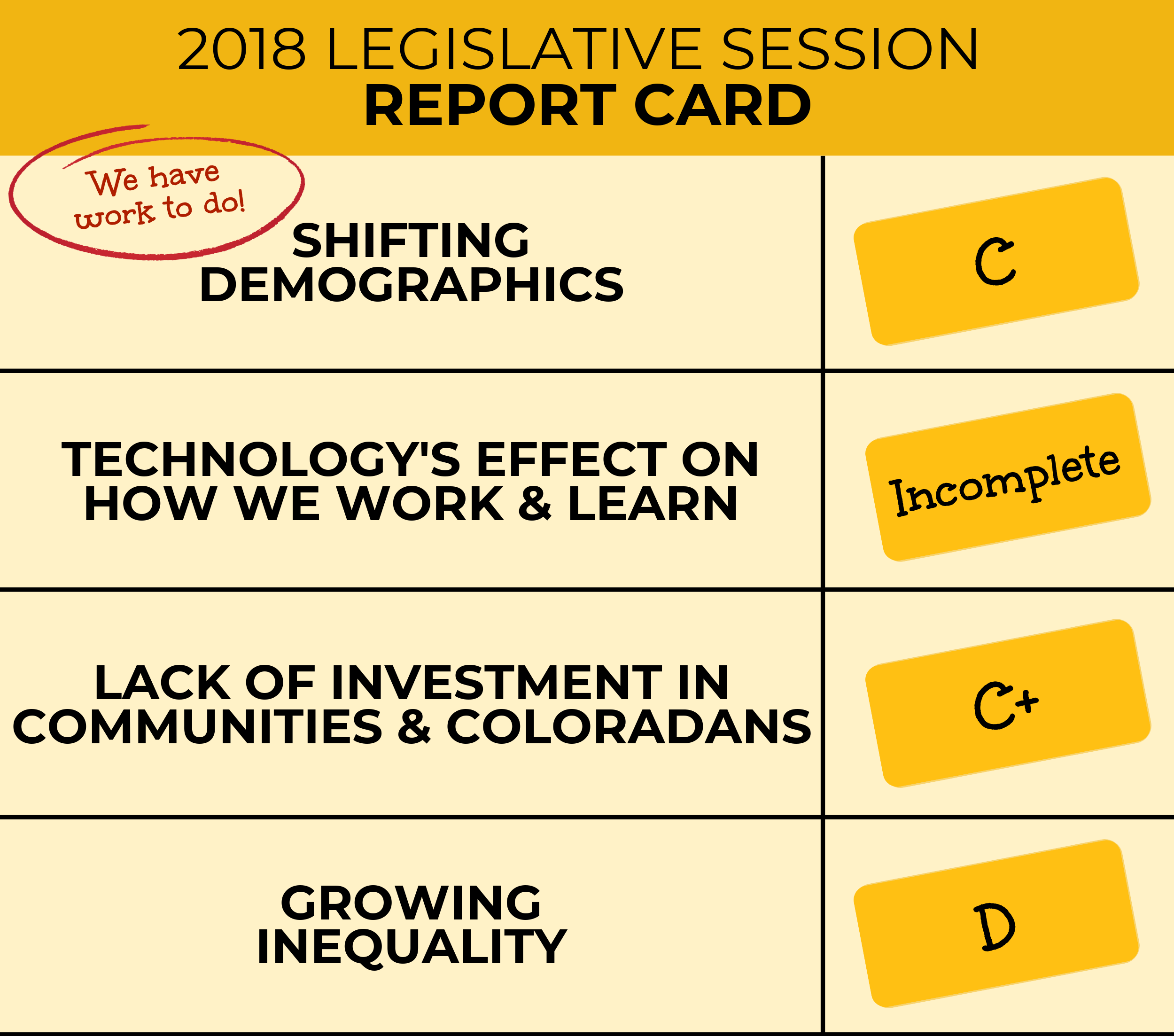

The four forces the Bell Policy Center identifies in our Guide to Economic Mobility all played a major role in legislation that came before the General Assembly. Below you can see how well we think the legislature did during the 2018 legislative session to address the issues too many Coloradans face when it comes to getting into — and staying in — the middle class.

Shifting Demographics: C

FAMLI Fails, Families Lose: Rep. Faith Winter’s proposal (HB18-001) that would have provided paid family and medical leave insurance for all Colorado workers was killed in state Senate, leaving millions of Coloradans at the mercy of their employer to take time off to care for themselves or their loved ones. A statewide family and medical leave insurance program, like the family and medical leave insurance (FAMLI) program, would’ve allowed leave for a variety of reasons, including caring for aging adults, an essential need as Colorado’s population continues to grow older.

FAMLI Fails, Families Lose: Rep. Faith Winter’s proposal (HB18-001) that would have provided paid family and medical leave insurance for all Colorado workers was killed in state Senate, leaving millions of Coloradans at the mercy of their employer to take time off to care for themselves or their loved ones. A statewide family and medical leave insurance program, like the family and medical leave insurance (FAMLI) program, would’ve allowed leave for a variety of reasons, including caring for aging adults, an essential need as Colorado’s population continues to grow older.

Kicking the Can on Retirement: There is no disagreement on the state’s looming retirement crisis, yet the Senate rejected a bill (HB18-1298) to study the major proposals put forth by both proponents and opponents on this issue. The Colorado Secure Savings Plan, championed by Reps. Pettersen and Bridges and Sens. Donovan and Todd, was an opportunity to find practical solutions for hardworking Coloradans. Without options, Colorado’s retirement problem will continue — and we’ll start to see the consequences as our population ages. State and local budgets will be on the hook for services as more Coloradans hit retirement with little or no savings to lean on.

Early Childhood Education Funding Sacked: A bill (HB18-1232) to implement a new school funding formula would’ve directed more resources to schools with a large number of English language learners, and ultimately provided universal, state-supported preschool for 4- and 5-year-old students, but it died in the House. The formula was developed and supported by almost all of the state school superintendents and would’ve only gone into effect if the voters passed a ballot measure to increase school funding. This bill recognized the need to better prepare our workers of the future, many of whom will be Hispanic, and the effect high-quality early childhood education has on closing educational attainment gaps later in life. All is not lost, though: This formula can be resurrected in later sessions if additional school funding is found.

Technology’s Effect on How We Work & Learn: INCOMPLETE

Proposed Bill Would’ve Hurt Workers of Tomorrow: The Bell opposed a bill (SB18-171) that would have allowed businesses to classify workers as “non employees,” saving employers on payroll taxes, unemployment benefit taxes, and health care expenses, but sacrificing the protections and rights of “non employees.” As more and more workers become independent contractors — both by choice and by business mandate — we need a system that provides workers with benefits, as well as the freedoms that come from freelancing and gig economy work. This area is changing quickly thanks to the expanding gig economy and other alternative work arrangements. Thanks to the work of a broad coalition, the proposal was tabled for this year. We need to take time to craft a comprehensive approach to this workforce evolution.

Unfortunately for Coloradans, there’s not much else to grade on because not much of the 2018 legislative session was spent having a proactive discussion on possible policies to address our new economy. As we noted above, little consideration was given to portable benefits like paid leave and retirement plans. While these policies certainly address Colorado’s shifting demographics, they play a major role in how we prepare for the future of work. We need more discussion and action over the next few months to meet the demands of our new economy and shape our response to a changing workforce.

Lack of Investment in Communities & Coloradans: C+

Roads vs. Schools, Everything Else: Legislators ultimately settled on a deal (SB18-001) to appropriate funding from the state’s General Fund toward transportation needs, but resisted pressure to fully fund the amount of bonding originally proposed by Republicans, who insist on no new tax revenue to fund this critical service. We appreciate the leadership that came from the House, driving a hard bargain to safeguard the many services that would’ve been threatened by over-obligating future General Fund dollars. It’s now up to voters to approve a new, sustainable revenue stream to ensure Colorado doesn’t continue to pit our needs for better roads against every other critical service our state provides.  No More Tax Cuts… For Now: At a time when our investments in communities and Coloradans are near record lows — compared to our otherwise booming economy — reducing the state income tax rate further (SB18-061 and HB18-1203) would’ve made it harder to fund education, child care, and postsecondary education. Lawmakers made the right choice when they decided to “stop digging,” avoiding deeper cuts to Colorado’s already-low state income tax rates.

No More Tax Cuts… For Now: At a time when our investments in communities and Coloradans are near record lows — compared to our otherwise booming economy — reducing the state income tax rate further (SB18-061 and HB18-1203) would’ve made it harder to fund education, child care, and postsecondary education. Lawmakers made the right choice when they decided to “stop digging,” avoiding deeper cuts to Colorado’s already-low state income tax rates.

Affordable Housing Measure Passes: Legislation (SB18-007) was adopted to rename and reauthorize affordable housing tax credits for five years. An additional $150 million in credits will go toward underwriting the cost of affordable housing construction, which is an effective method to encourage developers to build these units.

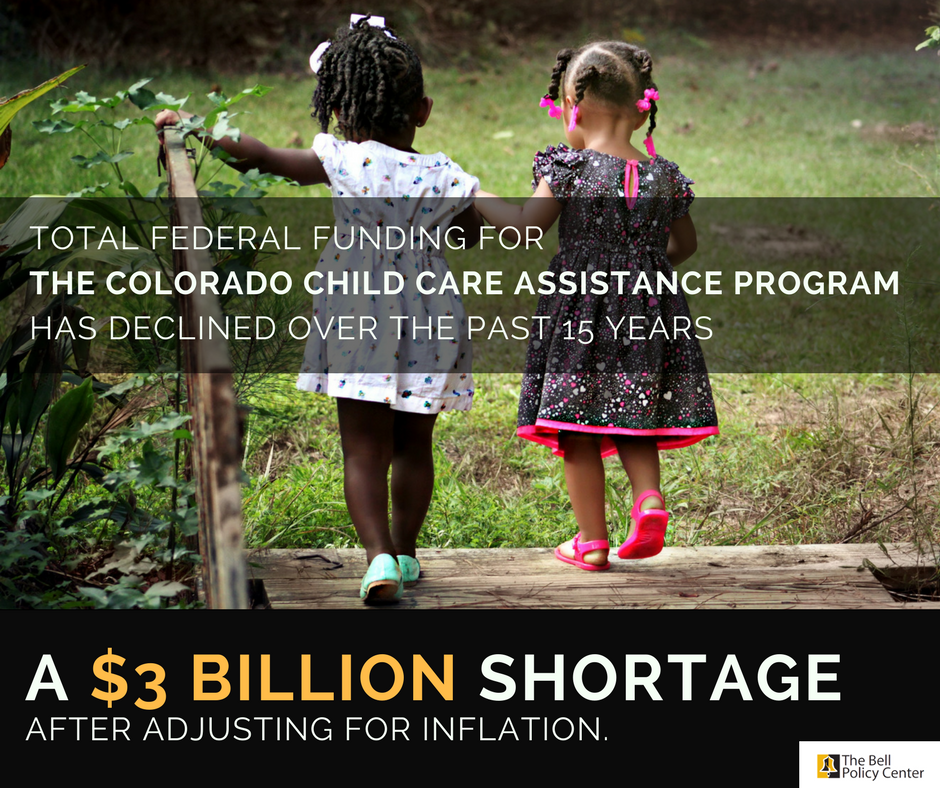

CCCAP Gets an Update: The Colorado Child Care Assistance Program (CCCAP) benefited from legislation (HB18-1335) to set a statewide minimum eligibility limit and direct an overall income eligibility limit be set by rule, with an emphasis on the federal maximum. CCCAP will also receive an additional $12 million in funding. With these changes, more Colorado families will get coverage under CCCAP, and the potential to reduce the cliff effect increases.

Some Relief on Child Care Costs: If passed as originally proposed, Speaker Duran’s bill (HB18-1208) to increase child care tax credits would’ve expanded eligibility to more middle-income families and offered a larger credit. With child care costs rising faster than incomes, this scaled-back version still lessens the squeeze on Colorado families.

While the legislative session did result in some reduction of the costs families struggle with, our state’s fiscal limitations make substantial relief an impossibility. Even with significantly more revenue coming in this year, the choices legislators needed to make were painful. The debate around transportation is the perfect example of how deep the hole we’re trying to escape truly is. Legislators agreed to appropriate $500M this year, $150M next year, and $50M per year for the next 20 years for bonding. As historic as those decisions are, two things remain true: It’s not enough to meet our total transportation needs; and without a dedicated revenue stream, those dollars will come at the expense of our schools, public colleges, child care, and so many other already-underfunded priorities that affect the average Coloradan’s household budget.

Growing Inequality: D

Bipartisan Effort Not Enough for Health Care Bill: Despite bipartisan sponsorship from Reps. Roberts and Catlin and Sens. Donovan and Coram, a bill (HB18-1384) to evaluate health care coverage options (including a Medicaid buy-in alternative) was defeated in the state Senate in the 2018 legislative session. Coloradans, especially those in rural communities, face a lack of choice in insurance options and skyrocketing health costs; this bill would’ve honed in on a solution to mitigate both.

A Win Against Work Requirements: Medicaid work requirements and lifetime limits on Medicaid (SB18-214) were voted down in the bill’s first hearing in Colorado’s Republican-controlled Senate. As we’ve said before, these onerous restrictions only seek to vilify Medicaid recipients, but supporters claim work requirements promote self-sufficiency. If that’s really their goal, our research finds public dollars would be best spent supporting informal and formal caregiving, job training, and affordable housing, just to offer a few examples.

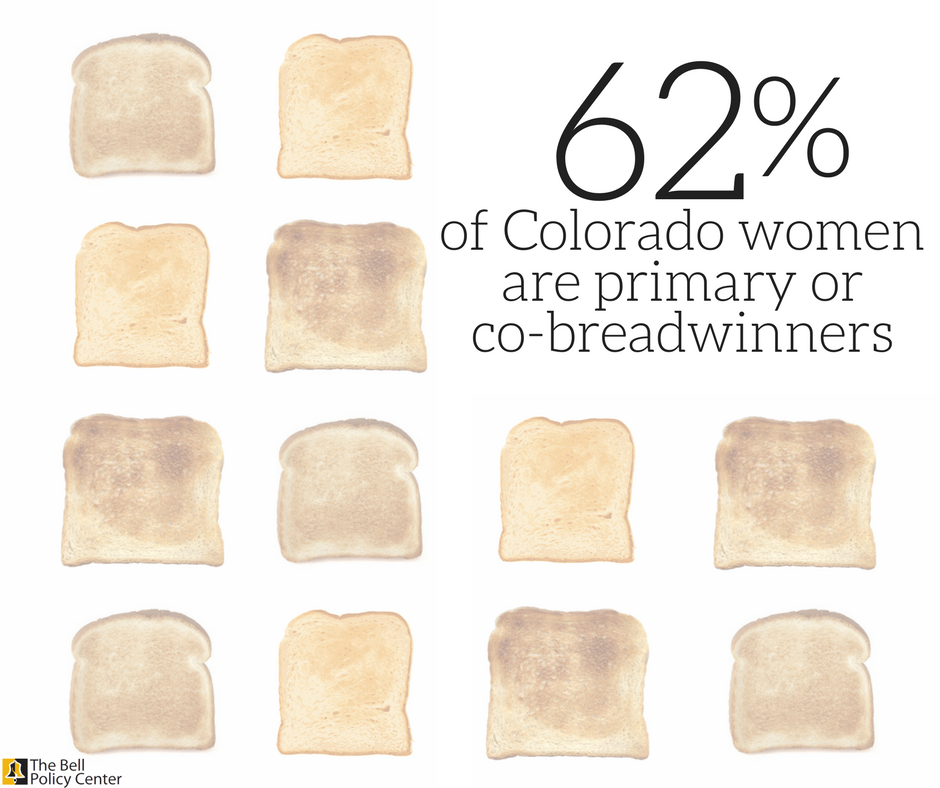

Pay Equity? Not This Year: Studies show Colorado’s middle class families are increasingly comprised of two professional adults, but the gender pay gap continues to curb women’s earnings… and their chances of building a middle class life for themselves and their families. Two bills (HB18-1377 and HB18-1378) this legislative session sought to correct the imbalance in pay between men and women, but both were killed in the state Senate.

Few Safeguards for Student Borrowers: As the federal government neglects its duty to crack down on the unfair, deceptive, and malicious business practices of student loan servicing companies, that responsibility is now relegated to states. Despite Attorney General Cynthia Coffman’s support, the state Senate defeated a bill (HB18-1415) aimed at regulating student loan servicers, handing a win to predatory bad actors in Colorado. With student loan debt increasing across the state — it’s the second largest source of debt behind mortgage debt, up 349 percent since 2000 — students and their families should be able to depend on their elected leaders to stop the predatory economy from taking advantage of them and their wallets.

Debt Collector Overreach Stopped: As originally introduced, this bill (HB18-1057) would’ve given private debt collectors access to consumer information from the state government and allowed them to charge the same fee the state does when collecting debt on behalf of public entities. Together with the Financial Equity Coalition, the Bell turned lemons into lemonade, taking the information overreach out of the bill and capping the fee the state can pass onto to debtors in a win for consumers.

No Local Control on Minimum Wage: In a state that supposedly values local control, the Senate killed legislation (HB18-1368) allowing local governments to set their own minimum wages above the state’s to better address the needs of their communities. This leaves hourly workers in many Colorado cities further behind as they try to enter the middle class with a paycheck that doesn’t accurately reflect the costs of where they live.