About That “Taxman” Podcast…

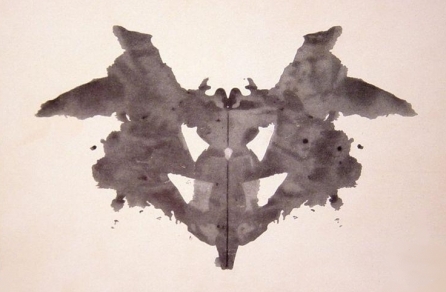

The Taxman podcast by CPR is a Rorschach test: For those who know about TABOR’s perils, it affirms their opposition, and to those who support it, the piece serves to strengthen their view of anti-tax activists as crusaders against a sneaky government disassociated from its citizens.

The Taxman podcast by CPR is a Rorschach test: For those who know about TABOR’s perils, it affirms their opposition, and to those who support it, the piece serves to strengthen their view of anti-tax activists as crusaders against a sneaky government disassociated from its citizens.

For those new to the topic, I worry the novel series leaves some room for the listener to believe TABOR’s effects have worn off and Doug Bruce was soundly defeated. While telling the story of TABOR through the history of its bizarre author serves as a great hook, there is a deeper narrative to be told — one of a state that has attracted unrivaled wealth and growth, but is unable to ensure everyone reaps the benefits of that prosperity.

In the final episode, one CPR reporter sums up 25 years of TABOR by asserting Colorado’s state government has come up with all kinds of ways around TABOR and the state’s economy is booming.

Related: Facts — Fiscal Policy

That summation is only partly true. Although the state’s economy is truly booming, what’s glossed over is how a great many Coloradans feel economically stuck. That might be because Colorado’s General Fund spending, as a percentage of our state’s total personal income, is just above what it was during the 2002-2003 recession. It may be because spiking education costs, limited access to funds to help pay for early child care, and a lack of resources for new infrastructure are bleeding family budgets.

The Taxman podcast exaggerates just how much our state has “gotten around” TABOR. In actuality, only two major things have happened.

In 2005, voters passed Referendum C, giving us a five-year timeout from TABOR’s revenue cap and eliminating the ratchet driving our budget downward. We emerged from that timeout having more money to spend — between FY 2005-2006 and FY 2016-2017, Colorado retained $16.7 billion more than it would’ve had Ref C not passed — on vital services such as K-12 education, higher education, and health care, but we didn’t change the basic structure causing the lack of investment. In fact, looking at our General Fund spending when adjusted for population and inflation, we are only a little further ahead of where we were right before the Great Recession.

Related: Colorado’s Fiscal Challenges in 14 Charts

The second thing: Some local communities have “debruced,” meaning they can keep revenue that exceeds TABOR’s limits. However, what’s equally as important at the local level is how TABOR interacts with the Gallagher amendment and limits communities’ ability to fund schools and public safety functions. When local communities can’t or won’t go to the ballot for mill levy increases to fund local schools, the state must pick up the tab. This only encroaches on other priorities in the state budget.

These impacts at the local level have balkanized Colorado. Some communities are doing great and others aren’t. When it comes time to vote on statewide tax measures, there are uneven views of our quality of life. As this goes on, this will begin to tear at our statewide identity and our resolve to create a better future together.

While the Taxman podcast spends a little time talking about how TABOR is packed with a number of other implications, the listener walks away with the primary impression TABOR is ultimately about Coloradans approving taxes. And that’s how TABOR’s proponents want it advertised.

But TABOR includes provisions its faithful proponents don’t talk about nearly as loudly. For instance, TABOR expressly prohibits graduated tax rates. In this way, it protects Colorado’s wealthier citizens at the expense of everyone else. It’s just one more hurdle on the path to selling revenue increases to Coloradans who want to see tax fairness in whatever tax proposal comes their way.

Related: Highlights from Beyond the Boom: Telling the Story of Economic Mobility in Colorado

Ultimately, we need to raise taxes in our state. Plenty of voices will say we’re “throwing money at the problem,” but just because it’s a cliché doesn’t mean it’s not true. Money, it turns out, is the answer to this particular problem. Why? Because right now we don’t have enough to fund the things we need. And no, we cannot just shift resources from one bucket to another — something vital, no matter how you cut it, will always draw the short straw — and each year will be a bad version of Groundhog Day where we are forced to pick winners and losers in our state’s budget. All Coloradans end up the losers when we don’t invest in ourselves, our communities, and the services we need to get ahead and stay ahead. More revenue helps us solve this problem.

Seventeen years ago, our legislature reduced our tax rates and because of TABOR, it will be far harder to raise them back up than it was to lower them.

And that’s the biggest problem with TABOR: It makes everything so much harder, including the conversation about the amendment itself. That’s why I applaud CPR for producing the Taxman podcast; they made a hard subject a little easier to grasp. The next step now is working harder to tunnel deeper and break out of a prison created by a man who believed in a bizarre and selfish world where everyone plays by their own rules and looks out only for themselves.