Low Fees Essential to Secure Savings Success

Everyone agrees America faces a retirement crisis. Working families and people of all ages are not saving enough for their later years. The best way to save for retirement is to put away a little out of each paycheck throughout your working life.

Everyone agrees America faces a retirement crisis. Working families and people of all ages are not saving enough for their later years. The best way to save for retirement is to put away a little out of each paycheck throughout your working life.

But 45 percent of private sector workers in Colorado in their prime working years — aged 25 to 64 or 753,000 workers — do not have access to any type of retirement savings plan at work. They are unable to take advantage of the best and easiest way to save for their retirement.

One of the advantages of the Secure Savings Plan currently being debated by the Colorado General Assembly (HB17-1290) is it would provide private sector workers with access to a workplace plan at very low fees. Total fees would be capped at 1 percent for the first five years the plan is in operation and at 0.75 percent beginning in year six and beyond. Analyses conducted for similar plans in California and Oregon show over the long term, these plans can operate with total fees of about 0.5 percent. Reducing fees paid by workers, particularly low-wage workers, means they will amass more funds for retirement.

Our research shows most of the workers who would benefit from this plan work in small businesses and, for the most part, earn relatively low wages. Research on the fees charged by 401(k) plans in the market shows plans serving these types of workers pay the highest fees.

A 2014 study on the total fees charged by 401(k) plans conducted by BrightScope and the Investment Company Institute found the smallest plans, as measured by number of participants or amount of assets, had the highest fees. It found plans with less than $1 million in assets had the highest median fees at 1.48 percent and a range of fees from 2.66 percent on the high end to 0.68 percent on the low end. While it does not sound like a lot, paying 0.5 to 1 percent more in fees, when compounded over 20 to 30 years, significantly reduces the amount of money workers have in retirement.

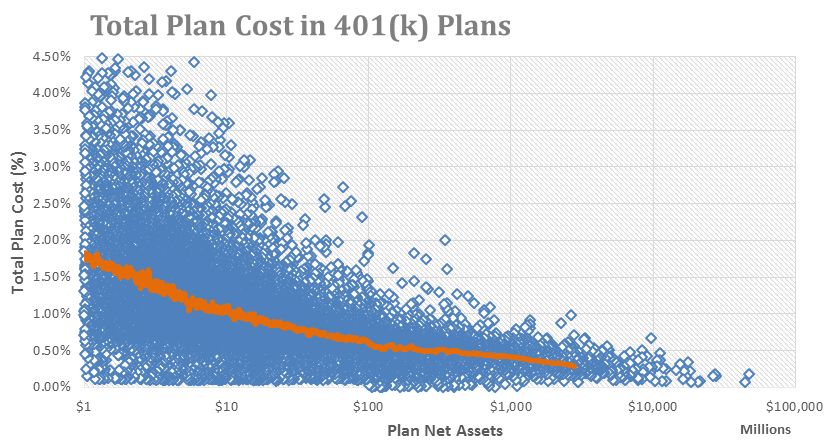

The figure below shows the distribution of 401(k) fees grouped according to the amount of net assets in the plan. The solid line shows the median fees.

“The sheer number of plans paying north of 2 percent a year was shocking to us,” said Ryan Alfred, CEO of BrightScope. “To make matters worse, this chart cuts off at $1 million in plan assets, so there are likely many, many more plans above 2 percent that don’t disclose the level of information we need to evaluate them.”

“The sheer number of plans paying north of 2 percent a year was shocking to us,” said Ryan Alfred, CEO of BrightScope. “To make matters worse, this chart cuts off at $1 million in plan assets, so there are likely many, many more plans above 2 percent that don’t disclose the level of information we need to evaluate them.”

Another firm, Employee Fiduciary, Inc., analyzed the total fees charged on 121 401(k) plans with less than $2 million in plan assets. They found the average assets in the plans totaled $677,332 and the total fees averaged 2.22 percent.

In a blog post, Eric Droblyen, CEO of Employee Fiduciary, Inc observed, “Generally, brand name insurance and payroll company 401(k) providers are the most expensive, while lesser-known, ‘open architecture’ providers are the least expensive.”

The fees that would be charged on the Secure Savings Plan are much lower than what small employers with low-wage workers currently pay in the market place. These are the very employers least likely to offer workplace retirement savings plans in Colorado and the ones whose workers would benefit the most from the Secure Savings Plan.