Initiatives 50 and 108: Don’t Believe the Hype about these Destructive Measures

In recent presentations, members of Colorado Concern and Advance Colorado have urged their networks to endorse Initiatives 50 and 108. To make their case, they offer a highly manipulated picture of Colorado’s property tax landscape – including Denver property tax – and paint two wildly extreme policy proposals as “common sense.”

The reality is that Colorado’s legislative session ended with a landmark bipartisan property tax deal for a reason. After months of careful study, deliberation, and modeling, 92 out of 100 legislators voted to strike a balance between local community funding needs and the need for carefully targeted property tax relief.

That balancing act and the dangers of recklessly slashing property tax rates without considering the impact are notably absent from the 50 and 108 pitch deck. Below are some responses to some of the more alarming statements and claims the backers of these measures are making:

Initiatives 50 and 108 “Eliminate this year’s massive tax hike”

Some ask “why are property taxes going up in Colorado?” Describing the property tax increases that many Coloradans are seeing as a “tax hike” is incredibly misleading. Home values have gone up dramatically in a number of communities, but not all. Unless voters have specifically voted for mill increases, no one has increased property tax rates and mills. The legislature has been reducing assessment rates for the past three legislative sessions. While property tax bills will still go up to differing degrees in many parts of the state, they are going up by far less than they would have without legislative action.

Coloradans’ property tax bills were significantly reduced in 2023 by legislative action, which cut the state assessment rate from 7.06 percent to 6.7 percent and exempting $55,000 of value from each home. In 2024, the legislature continued that reduction. If Initiative 50 or 108 passes, that reduction will not take place and property tax bills will go up. In fact, Initiative 50 does not cut property 2024 tax bills and Initiative 108 only goes into effect for property tax year 2025.

The Measures “allow local districts and the state to retain record-breaking revenue collections”

The measures are quite clear that their purpose is to cut revenues, not allow governments to retain them. Initiative 50 puts a hard 4 percent cap on total statewide property tax revenues, preventing districts from retaining revenues over that cap without a statewide election, regardless of whether local governments revenues actually went up over 4 percent. Initiative 108 drastically reduces local district revenues and requires that state to use its revenue – revenue entirely unrelated to property taxes – to backfill the local cuts. This backfill requirement would directly eat into the existing state budget. Any state revenue growth will be spent toward the backfill or will come in over Colorado’s TABOR revenue limit.

“Both initiatives are designed to ensure sustainable and reasonable property tax growth”

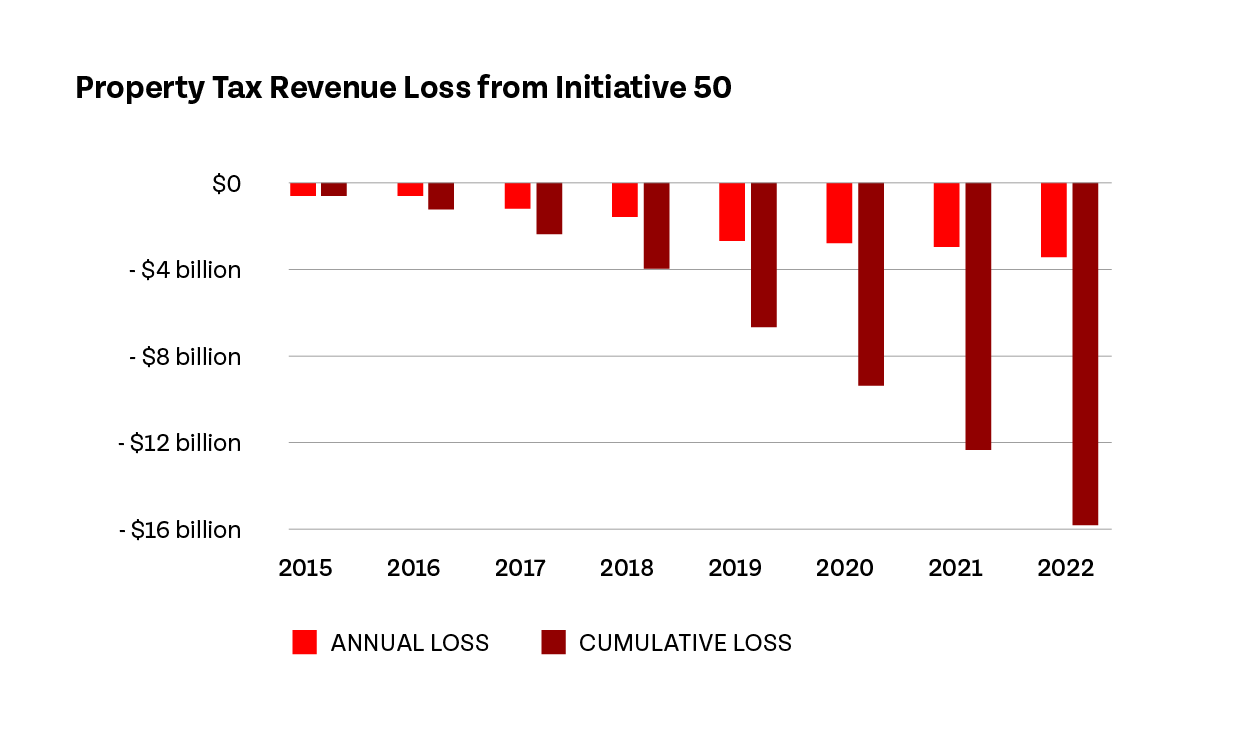

There is nothing “sustainable” about a static 4 percent statewide property tax revenue limit along with a $3 billion property tax cut starting in 2025. The cap does not account for inflation or rising property values. Furthermore, it does not allow communities to recover from value reductions, ratcheting community revenue limits down over time. As the chart below shows, if Colorado had put Initiative 50 in place in 2015, there would be a cumulative $16 billion loss in the districts’ allowable revenue capacity – that’s more than one year of our statewide property tax revenue.

These measures are a “a balanced approach”

This claim is made throughout the presentation. “Balanced” with what? Unlike SB24-233, which balanced the need for property tax relief with the local community and school funding needs, Initiatives 50 and 108 are a slash and burn approach to property taxes.

“Legislators struck a deal that will send property taxes soaring”

The legislature has been reducing assessment rates for the past three legislative sessions with the goal of significantly blunting the impact that a home value spike in May of 2022 would have had on 2023 and 2024 property tax bills. While property tax bills will still go up to differing degrees in many parts of the state, they are going up by far less than they would have without legislative action. Residential assessment rates are now lower moving forward and property values are projected to increase very minimally in 2024. Moreover, caps on community revenues will ensure that future value spikes do not translate into the property tax bill increases Coloradans saw in this assessment cycle.

“Between 2010 and 2022, cumulative property tax bills in Colorado jumped by 80%”

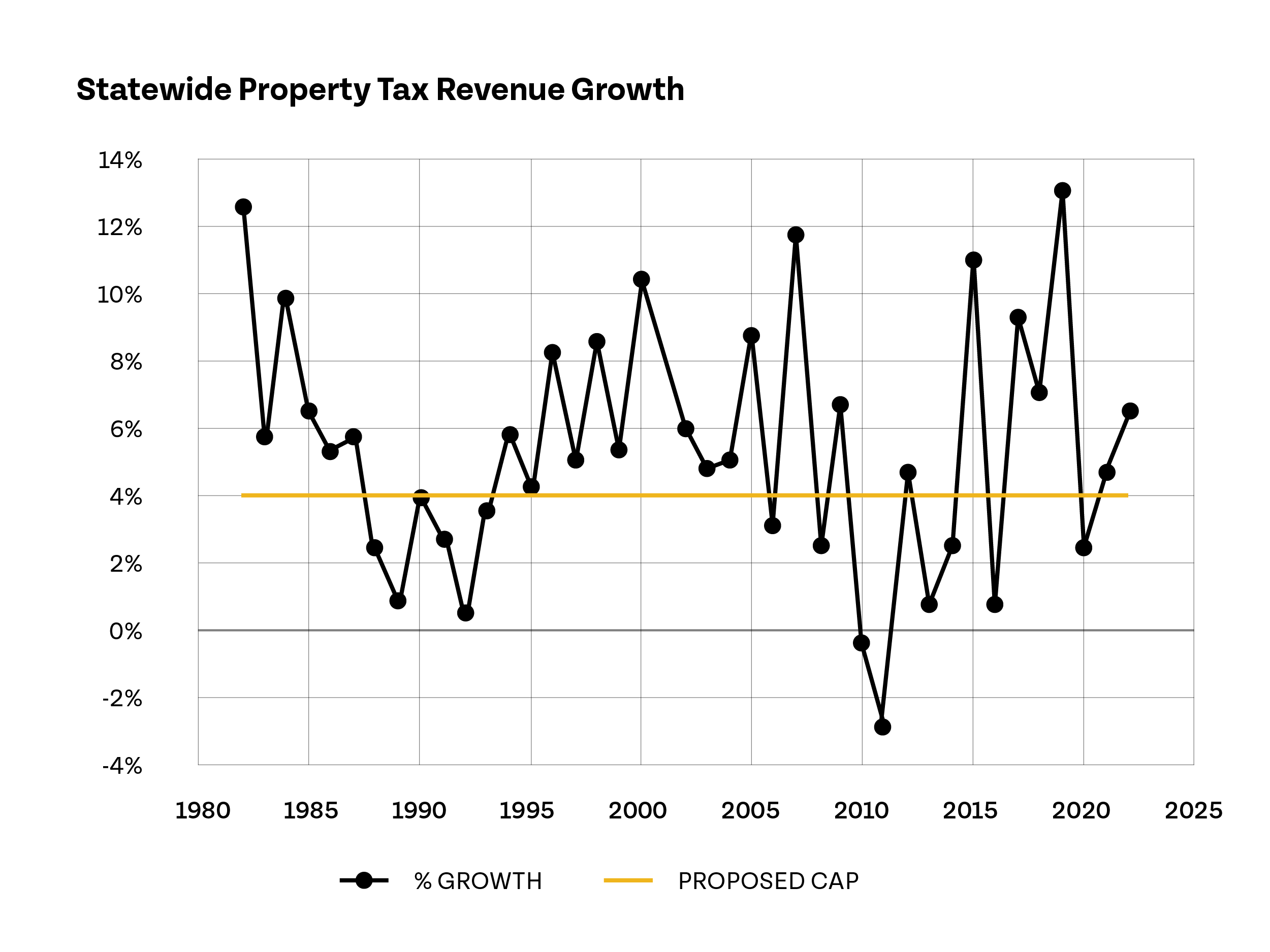

Using this period of time to measure growth in values or property tax bills is incredibly misleading. In the midst of the Great Recession was the lowest point in Colorado’s property market in decades. The chart below shows that the state lost nearly 4 percent in property tax revenue during that assessment cycle. The property tax bill “jump” in the time that followed was a time of massive recovery for values and community budgets. Importantly, with the state’s Gallagher Amendment still in place, commercial properties bore the brunt of that increase, not homeowners.

“Cumulative property tax bills grew at a pace that is approximately faster than 62% than median household incomes”

Cumulative property tax bills reflect property values growth in a wide range of property types, including commercial and luxury residential. Comparing growth in median household income to property value growth unrelated to median household income is a red herring.

“The Local Districts have doubled their budgets in just over a decade”

This is a grossly inaccurate claim. There are 4,600 local districts across our state and no two districts are the same. These local districts include school districts, counties, municipalities, and special metro districts. Some of these local districts rely solely on property tax revenues while others use a mix of other revenue streams. These budgets grow not just because of increases in property values, but also due to voter approved mill increases or approval of new sales tax revenue.

Another significant contributor to increased budgets is new construction. Every new home and every new commercial building brings new property tax revenue. Over a 10-year period, this amounts to a significant amount of revenue that isn’t added taxes but simply the result of a growing population. Finally, this statement does not account for the impacts of inflation or the recent influx of COVID-relief dollars from the federal and state government.

“It actually does not decrease residential property taxes. The current effective rate increase from 6.3 to 6.7”

This is misleading. The effective rate depends on the value of a home. The legislature reduced the assessment rate for the 2023 and 2024 tax years to 6.7 percent and exempted the first $55,000 of value. The current effective rate for a $700,000 home is 6.17 percent. In 2025, the effect assessment rate will go down to 6.4 percent. Starting in 2026, the effective assessment rate will vary. The owner of a $700,000 home in Denver will pay a effective assessment rate of 6.57 percent.

SB24-233 “… creates a two tier tax system on homeowners, imposing a tax the rich scheme on anyone who owns a home worth more than $700,000”

There is no two-tier Colorado property tax system for homeowners in SB24-233. The landmark measure reduces every home’s value in the state by 10 percent of the first $700,000. Every homeowner will benefit from this exemption as well as the reduction in the assessment rate.

Prop 108 “allows local districts and the state to keep record breaking revenue tax collections. It’s good for homeowners and firefighters”

Prop 108 very clearly robs Peter to pay Paul. It cuts local property taxes and makes the state backfill those cuts. Neither level of government gets to “keep record breaking tax collections.”

“The local backfill requirement [in Initiative 108] is flexible”

There is nothing flexible about the statutory language in Initiative 108. The backfill requirement very clearly states: “No later than April 15th of each year, the state treasurer shall issue a warrant, to be paid year yearly from the General Fund to reimburse local districts for lost revenue as a result of passage of this measure.”

“If the legislature wants to keep the money over the 4% cap, all it has to do is ask the voters”

A major flaw in Initiative 50 is the lack of clarity around who “the Government” is. Property taxes are local district taxes and there are over 4,600 districts. Tallying revenue from every single local district and asking voters to approve an allowable increase every two years will be a complex task. Moreover, it puts legislators at the state Capitol in between local community decisions.

“Thirty-nine states have some kind of limitation on property taxes”

Yes, 39 states, including Colorado, have some kind of limitation on property taxes. The types of limits vary by kind and impact. No state, however, has a limit like Initiative 50 which would be the ONLY limit on statewide property tax revenues in the country.